The 2025 Q4 earnings season is in full swing, with results from the big banks this week kicking the period into a much higher gear. Another period of positivity is expected, supported by a favorable earnings estimate revisions trend for the S&P 500.

And concerning next week’s docket, several reports, including those from Netflix NFLX, Intel INTC, and Johnson & Johnson JNJ should be on investors’ radars.

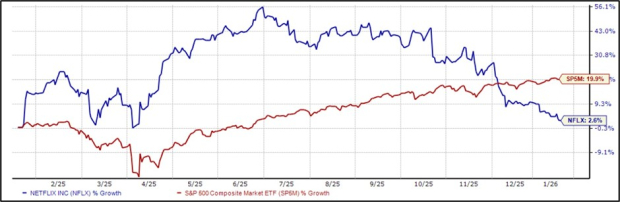

Netflix Shares Struggle Post-Split

Streaming titan Netflix is scheduled to report its quarterly results on next Tuesday after the market’s close. Shares have mightily struggled post-split, though some of the weakness can likely be attributed to profit-taking after a huge run.

Image Source: Zacks Investment Research

Earnings and revenue expectations have primarily remained flat over the last few months, with current estimates alluding to 27% EPS growth on 17% higher sales. The company’s profitability has improved nicely amid operational efficiencies, with margins moving higher over the last few periods.

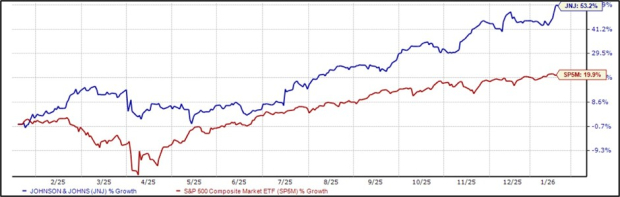

JNJ to See Outsized Sales Growth

Consumer staples favorite Johnson & Johnson has seen its shares go on a huge run over the last year, up more than 53%. The company has also continued to be a strong earnings performer, exceeding both our consensus EPS and revenue estimates in six consecutive releases.

Image Source: Zacks Investment Research

Like NFLX, expectations have largely remained stagnant over the last few months, with JNJ expected to see 22% EPS growth on 7% higher sales. The 7% YoY forecasted sales growth rate is quite sizable for JNJ given its already-established nature, reflecting the highest rate since 2023.

JNJ reports next Wednesday, January 21st, before the market opens.

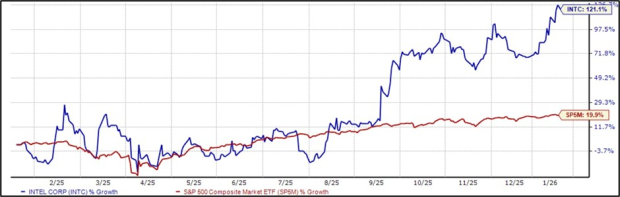

Intel Shares Soar

Intel shares have been the hottest of the bunch, up more than 140% over the last year on the back of a big turnaround in sentiment and favorable business developments. EPS and revenue expectations haven’t budged much, like those above, with INTC forecasted to see a 30% pullback in earnings on 6% lower sales.

Image Source: Zacks Investment Research

Keep an eye out for talk surrounding AI PCs in the release, an area that’s been a focus for Intel as of late.

Bottom Line

With the 2025 Q4 earnings season kicking into a much higher gear next week, there are several reports investors should keep on their radars, including those from Netflix NFLX, Intel INTC, and Johnson & Johnson JNJ.

While EPS and sales expectations haven’t budged much for all three, the stability is still a positive takeaway. Given NFLX and JNJ’s consumer-facing nature, the results can also give us somewhat of a feel on the state of demand overall. INTC’s story largely revolves a comeback, with the company putting a focus on AI PCs.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)