In Wednesday’s trading, the Dow Jones Industrial Average was down 0.1%. The index’s decline was the smallest on a day when the S&P 500 fell 0.50% and the Nasdaq Composite fell 1%, its worst day since mid-December.

Traders are concerned about ongoing geopolitical tensions, whether in Iran, Greenland, Venezuela, or right here in the U.S. Further, investors were expecting the Supreme Court might make its ruling on tariffs yesterday. That didn’t happen, putting investors on edge.

Today’s another day. Hopefully, it will be a good one.

As for yesterday’s unusual options activity, there were 1,245 calls and puts with Vol/OI (volume-to-open-interest) ratios of 1.24 or higher and expiring in seven days or more.

Of the 1,245, three names jump out at me: Shopify, Starbucks, and Pinterest. All are stocks that I wouldn’t have a problem owning for the long haul.

In the near term, all three offer potential multi-leg options trades.

Shopify (SHOP)

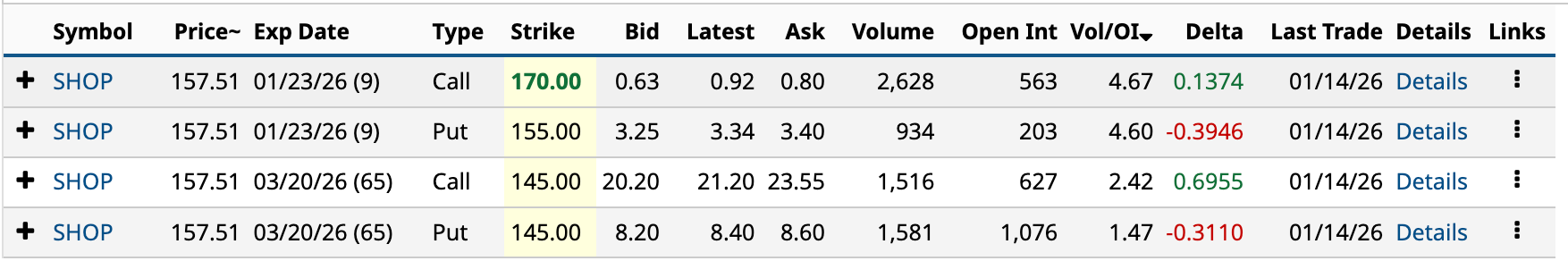

In yesterday’s action, Shopify (SHOP) had four unusually active options with Vol/OI ratios ranging from 1.47 to 4.67. Admittedly, not earth-shattering, but full of possibilities, nonetheless.

Right away, I see two potential multi-leg trades involving the Jan. 23 and March 20 calls and puts.

Right away, I see two potential multi-leg trades involving the Jan. 23 and March 20 calls and puts.

Starting with the Jan. 23 DTE (days to expiration), the $170 call and $155 put form a Long Strangle, which involves buying the $170 call and buying the $155 put. You’re expecting SHOP stock to move significantly in either direction over the next nine days.

Your net debit on this trade is $420 or 2.67% of its $157.61 share price. That’s more than reasonable. That’s your maximum loss on the trade, which occurs if the share price is between $174.20 (upside breakeven) and $150.80 (downside breakeven) at expiration. The probability of this happening is 44.8%.

The expected move over the next nine days is 5.07% or $7.98. You’re more likely to profit from a downside move. The Barchart Technical Opinion is a Buy, which helps, but ideally, you would like a little more runway for your trade to play out successfully. That brings us to the March 20 DTE.

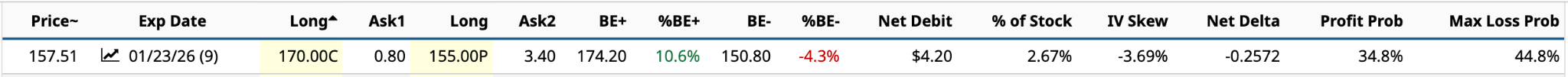

In this example, you’re looking at a Long Straddle, where the strike price for the call and put is the same. Because the $145 call is deep ITM, the net debit is 20.41% of the stock price at $3,215.

So, if the share price on March 20 is above $177.15 (12.5% above the current price) or below $112.85 (28.4% below the current price), you’re making money on the trade.

Based on an expected move of 15.73%, the upper price of $182.29 is above the $177.29 break-even, indicating a profit in this instance. However, the lower price of $132.73 is above the $112.85 breakeven point, which explains the 38.3% probability of profit. With Shopify stock up 38% in the past six months, it’s unlikely to make that big a move to the downside in the next 65 days unless it reports a poor quarter on Feb. 10.

Starbucks (SBUX)

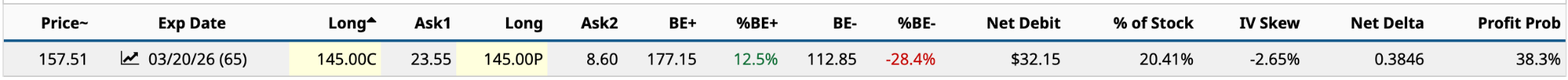

Starbucks (SBUX) had only one unusually active option yesterday, but its Vol/OI ratio of 32.90 was the 20th-highest on Wednesday, with decent volume of 5,100.

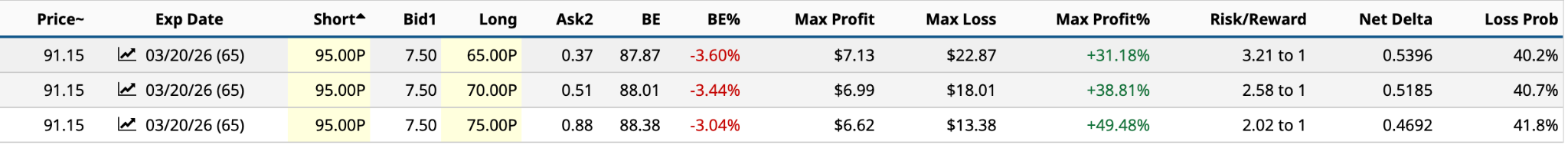

I need at least one more option to complete a multi-leg trade. In this instance, the Bull Put Spread makes sense. A bullish strategy, this involves selling the Feb. 20 $95 put for income and buying a lower-priced put with the same expiration date for downside protection. The possible strike prices appear below.

The bull put spread has a limited loss, just like the long strangle. However, unlike the long strangle, which offers unlimited profit potential, the bull put spread has limited profit potential; therefore, this strategy entails greater relative risk.

The bull put spread has a limited loss, just like the long strangle. However, unlike the long strangle, which offers unlimited profit potential, the bull put spread has limited profit potential; therefore, this strategy entails greater relative risk.

For this reason, I would select the long $75 put because the maximum loss of $1,338 is the lowest, and the risk-to-reward ratio is optimal. Furthermore, the maximum profitability percentage is 49.48%, whereas the loss probability is only slightly higher than the other two strike prices.

Starbucks reports quarterly results on Jan. 28. That will be the difference between success and failure on this trade. While 2026 is expected to be a bounce-back year for the company, most analysts don’t expect much from its Q1 2026 report. That should come in the second half of Starbucks’ fiscal year.

Pinterest (PINS)

Although I remain bullish about Pinterest’s (PINS) future as a less offensive social media app, I’ve recently noticed that many of the images I like link to articles that are significantly out of date, such as from 2020. That said, I’m definitely not the target market — 70% women, 42% Gen Z, etc.

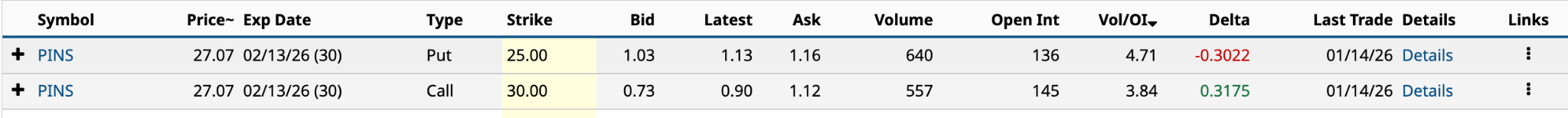

Yesterday, Pinterest had eight unusually active options, but only two are expiring in 30 days, which form a multi-leg trade.

Again, as with Spotify, the Vol/OI ratios weren’t double-digit, but they were healthy enough. Like Spotify, the Feb. 13 call and put fit the bill for a long strangle.

Again, as with Spotify, the Vol/OI ratios weren’t double-digit, but they were healthy enough. Like Spotify, the Feb. 13 call and put fit the bill for a long strangle.

In this instance, you’re buying the $30 call and the $25 put for a net debit of $228. That’s also your maximum loss. The net debit is 8.4% of the share price. A value below 10% is beneficial. The upside breakeven is $32.28; the downside breakeven is $22.72. You profit if the share price at expiration is above or below the breakeven. Your profit probability is around 35%.

Although the Barchart Technical Opinion is Sell, PINS stock is up nearly 4% year-to-date, suggesting that its share price may have bottomed. Further, speculation persists that OpenAI may buy Pinterest in 2026. By doing so, OpenAI eliminates its primary competitor in the shopping space.

I could see that happening. In less than 30 days? Probably not.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)