/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

Mark Zuckerberg has just unveiled Meta Compute, a sweeping effort to wire Meta Platforms' (META) future into massive AI infrastructure, purpose-built data centers, and dedicated energy capacity. The plan channels serious capital into compute power that can support more advanced AI products across Facebook, Instagram, WhatsApp, and beyond, signaling that AI infrastructure is now central to Meta’s long-term strategy.

Recent research helps explain why this push is happening now. Gartner expects worldwide IT spending to grow 9.8% in 2026 and exceed $6 trillion for the first time, with a growing slice tied to AI-oriented workloads and cloud infrastructure. In parallel, the data center solutions market is projected to grow at a 19.7% compound annual growth rate (CAGR) from 2025 to 2030, from roughly $448.95 billion to about $1.11 trillion, showing how rapidly compute-hungry infrastructure is scaling.

META stock sits in the spotlight as this spending cycle accelerates, priced around the low $600s and already discounting a major AI opportunity. The key question is simple yet important for anyone watching this name closely: as Meta Platforms doubles down on infrastructure with Meta Compute, should you buy, sell, or hold META stock? Let’s dive in.

The Numbers Behind the Meta Compute Bet

Based in Menlo Park, California, Meta Platforms (META) operates global social, messaging, virtual reality (VR), and artificial intelligence services. Meta Platforms carries roughly $1.6 trillion in equity value, and pays a forward annual dividend of $2.10 for a 0.33% yield.

META shares stood at around $616 on Jan. 14, with a year-to-date (YTD) return of -7% but a 52‑week gain of 4%.

META has a trailing price-to-earnigns (P/E) mutliple of 22 times versus a sector median of 14 times, a forward P/E of 21 times against 16, and a PEG ratio of 1.27 compared with 1.22 for peers, indicating that the market is assigning a clear premium to Meta’s earnings power and expected growth as it leans deeper into AI infrastructure.

Meta Platforms' latest reported results, released on Oct. 29, give important context for whether that confidence is justified. The quarter saw adjusted diluted EPS of $7.25 versus a consensus estimate of $6.61, a positive surprise of nearly 10% once a one‑time non‑cash income tax charge of $15.93 billion is stripped out. This shows that Meta’s core business outperformed earnings expectations, even though the GAAP headline number painted a weaker picture.

The same period produced GAAP EPS of $1.05 compared with expectations of $6.70, a huge miss driven by that tax provision rather than a collapse in operating performance. Meta generated $51.24 billion in revenue versus $49.55 billion expected, up 26% year-over-year (YOY). Adjusted EBITDA reached $31.05 billion with a 60.6% margin, operating margin came in at 40.1%, and free cash flow margin improved to 20.7%, collectively underscoring that the company is still throwing off substantial cash even as it arms itself for the next phase of AI infrastructure growth.

Meta’s AI Nuclear Power Play

Meta is putting real muscle behind Meta Compute by locking in long-term, zero-carbon power for its AI footprint. The company has signed nuclear energy agreements with three partners — Vistra (VST), TerraPower, and Sam Altman-backed Oklo (OKLO) — to supply carbon-free electricity for its AI infrastructure and the Prometheus supercluster now being built in New Albany, Ohio.

These arrangements are designed to deliver a combined 6.6 gigawatts of clean capacity by 2035. The package includes output from existing Vistra nuclear facilities in Ohio and Pennsylvania, planned Natrium reactors from TerraPower, and a dedicated 1.2 gigawatt power campus with Oklo in Pike County, Ohio.

Meta is also reshaping its AI strategy on the software side to better monetize that infrastructure. The company is working on a closed revenue-focused model known internally as Avocado, which may integrate technology from Chinese firms such as Alibaba (BABA) and would sit alongside, rather than fully replace, its open source Llama family.

What Wall Street Is Pricing In for Meta’s AI Push

Wall Street’s expectations for Meta are tightly aligned with the Meta Compute investment story and its broader AI push. The next earnings release is set for Feb. 4, with the current quarter ending December 2025 carrying an average EPS estimate of $8.29 versus $8.02 last year, marking a projected growth rate of about 3%.

The company also expects next quarter’s revenue to be between $56 billion and $59 billion, reinforcing the view that its ad and AI ecosystems can support heavy Meta Compute and data‑center investments while still growing the top line.

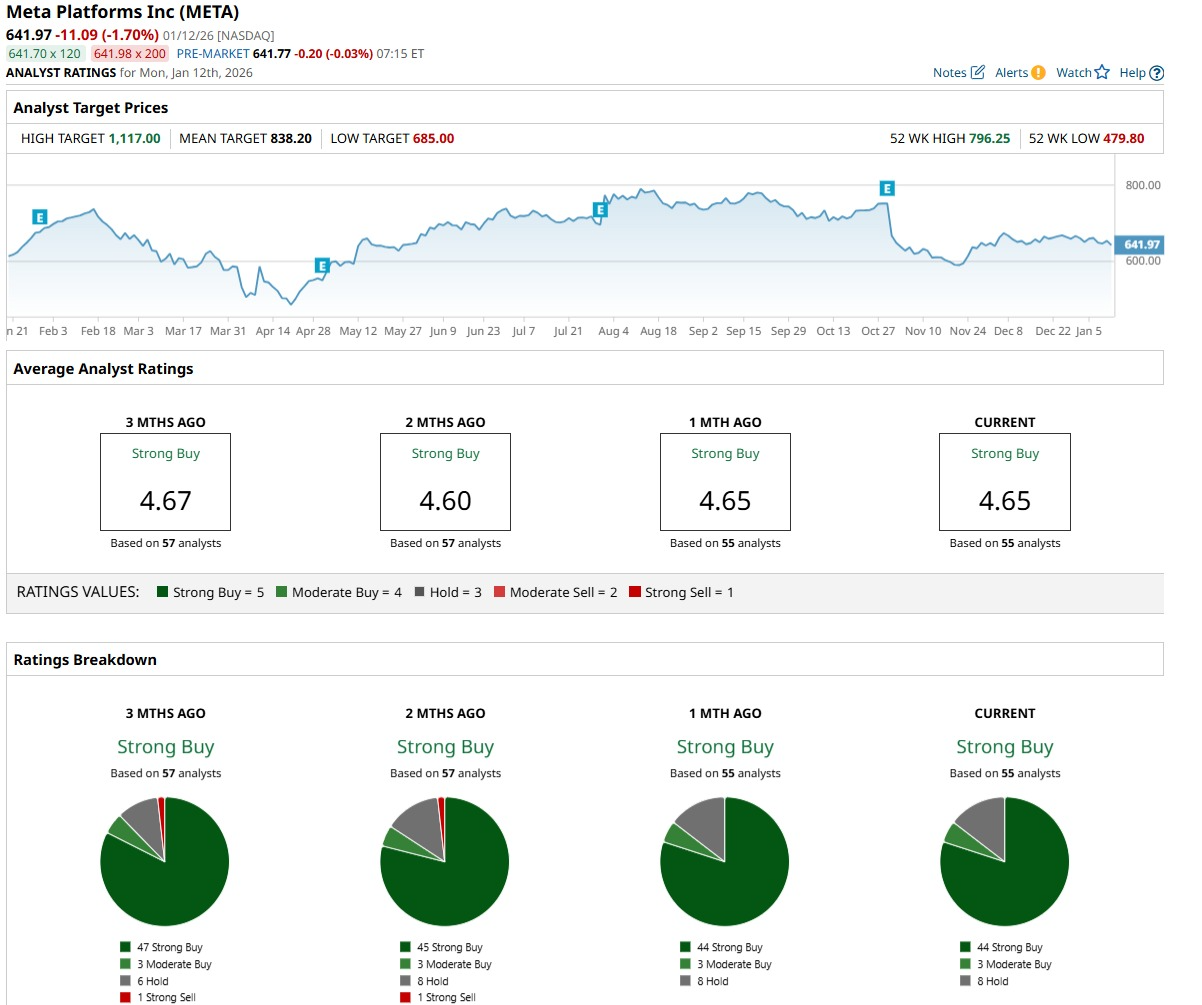

Analyst sentiment is firmly positive. A group of 55 analysts has a consensus rating of “Strong Buy" on META stock. The average price target stands at $838.06, implying potential upside of roughly 36% if projections are met.

The Bottom Line

Putting it all together, META stock still looks like a buy for investors with a multi‑year horizon, and a reasonable hold for those already in the name. The balance of strong earnings growth, clear AI infrastructure strategy through Meta Compute, and roughly 36% implied upside from the average target argues that the next big move is more likely up than down, even if the path is choppy. A shorter‑term trader worried about valuation or AI‑spend headlines may be better off trimming into strength rather than exiting the position outright.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)