Precious metals were the best-performing sector of the commodities asset class in Q4 2025 and over the entire year. As the sector is now in 2026, the trends for gold, silver, platinum, and palladium remain bullish.

The precious metals sector led the asset class higher with a 30.27% Q4 gain. The composite of gold, silver, platinum, and palladium futures traded on the CME’s COMEX and NYMEX divisions moved an incredible 103.73% higher in 2025.

In my Q3 Barchart report on precious metals, I concluded with the following:

The trend is always a trader’s or investor’s best friend, and it remains bullish for precious metals in October 2025. GLTR is a product that trades on the NYSE Arca and enables market participants to diversify precious metals exposure. I rate GLTR a hold at the current price level, as even the most aggressive bullish trends rarely move in straight lines. However, any pullback or correction could be a golden buying opportunity.

Precious metals and the GLTR ETF posted impressive gains in Q4 and 2025.

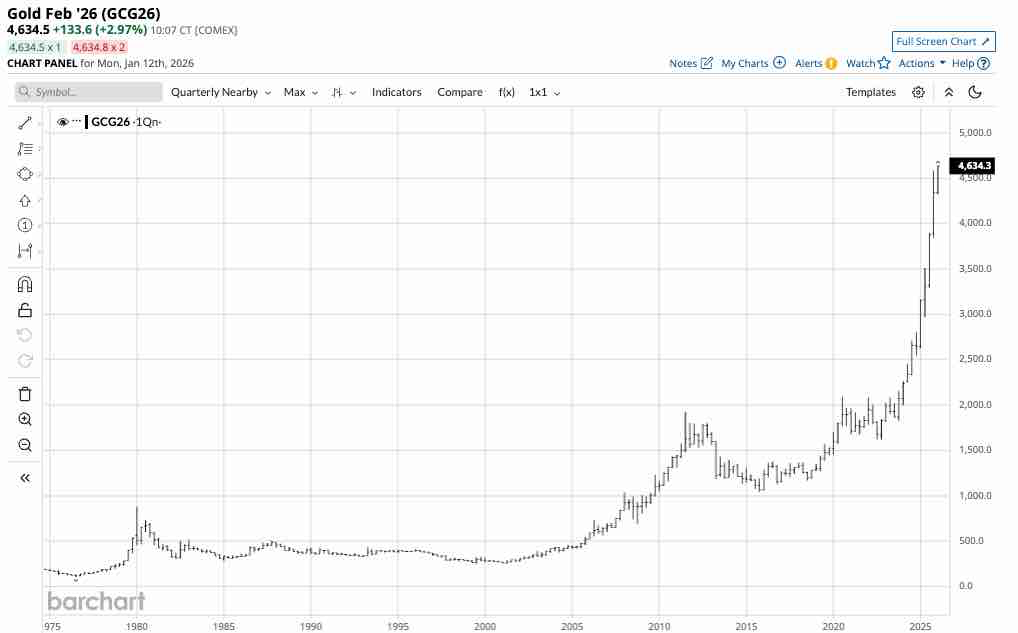

New highs in gold

Gold posted its ninth consecutive new record high in Q4, and rose 13.03% in Q4 2025.

The quarterly chart highlights COMEX gold futures 64.37% gain in 2025. Nearby gold futures settled at $4,341.10 per ounce on December 31, 2025, after reaching a high of $4,584 during 2025’s final month. Gold was higher than the Q4 close in January and posted its tenth consecutive quarterly new high on Monday, January 12, 2026.

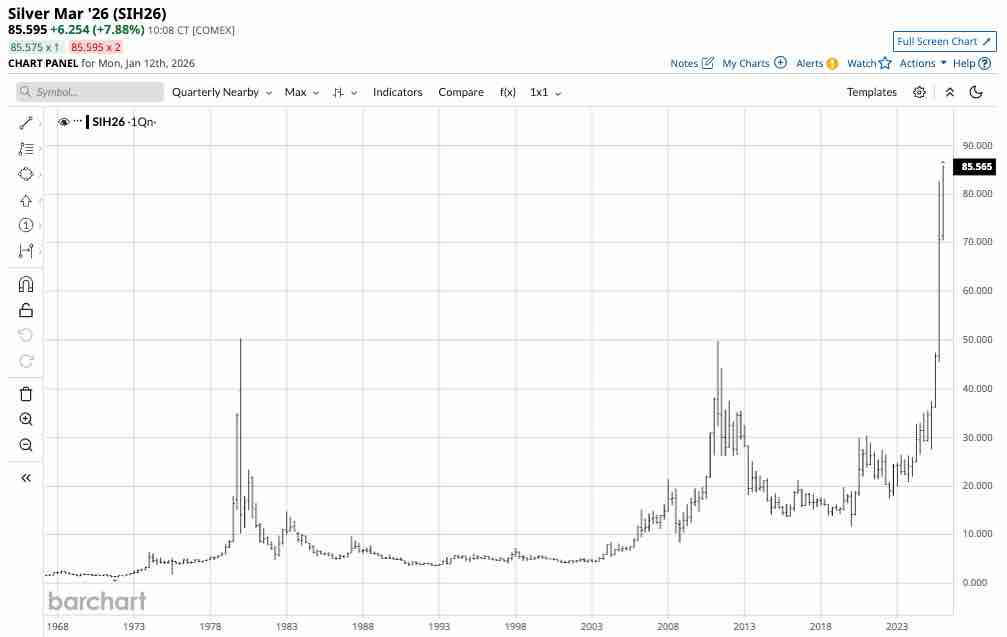

Silver rallies over the 1980 peak

COMEX silver futures reached a new record high in Q4, and rose 51.38% in Q4 2025.

The quarterly chart highlights COMEX silver futures 141.44% gain in 2025. Nearby silver futures settled at $70.603 per ounce on December 31, 2025, after reaching a high of $82.67 during 2025’s final month. Silver was higher than the Q4 close in January. Silver eclipsed the 1980 high of $50.36 per ounce in Q4 2025. Silver rose to a new record high of over $85.80 per ounce on January 12, 2206.

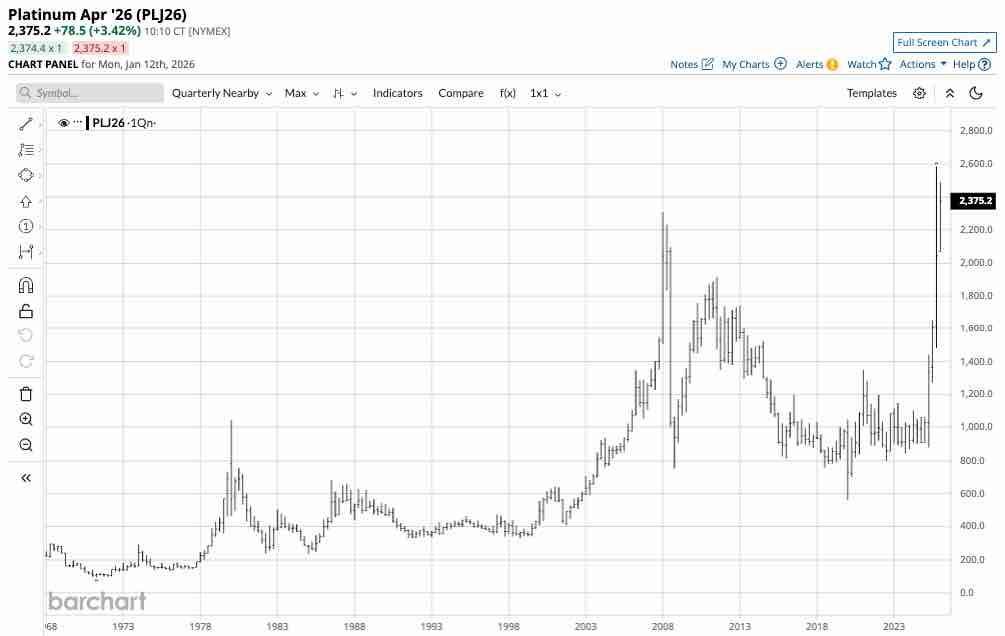

A new record high in platinum futures

NYMEX platinum futures reached a new record high in Q4, and rose 28.39% in Q4 2025.

The quarterly chart highlights NYMEX platinum futures 127.57% gain in 2025. Nearby platinum futures settled at $2,034.50 per ounce on December 31, 2025, after reaching a high of $2,584.50 during 2025’s final month. Platinum was higher than the Q4 close in January. Platinum eclipsed the 2008 high of $2,308.80 per ounce in Q4 2025.

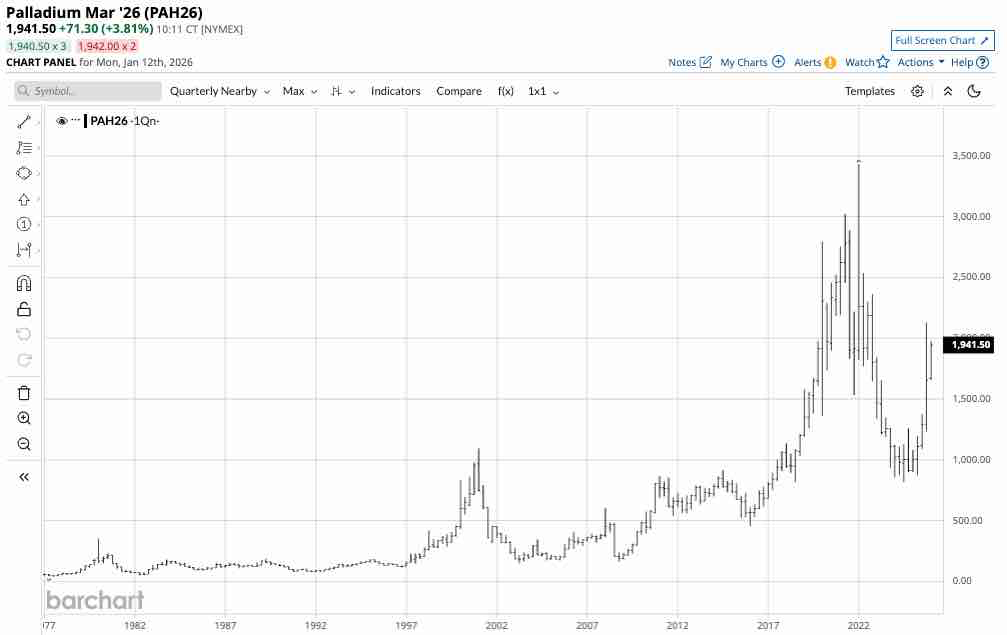

Palladium rallies

NYMEX palladium futures rose 28.27% in Q4 2025.

The quarterly chart highlights NYMEX palladium futures 81.51% gain in 2025. Nearby palladium futures settled at $1,651.40 per ounce on December 31, 2025, after reaching a high of $2,129 during 2025’s final month. Palladium was higher than the Q4 close in January. Platinum eclipsed the 2008 high of $2,308.80 per ounce in Q4 2025. However, it remained below the Q1 2022 record high of $3,425 per ounce.

GLTR reflects the sector- The prospects for 2026

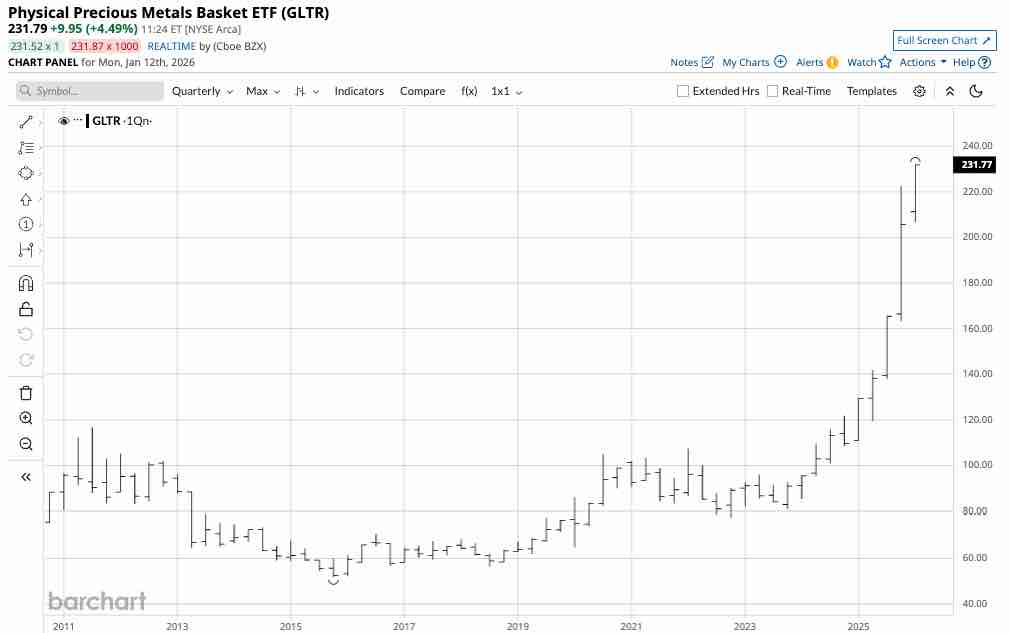

The Physical Precious Metals Basket ETF (GLTR) invests its assets in physical gold, silver, platinum, and palladium. At $231.79 per share on January 12, GLTR had nearly $2.8 billion in assets under management. GLTR trades an average of 147,419 shares per day and charges a 0.60% management fee.

The GLTR ETF rose 24.27% in Q4 2025.

The quarterly chart highlights that GLTR posted an 87.25% gain in 2025. GLTR settled at $205.60 per share on December 31, 2025, after reaching a high of $222.54 during 2025’s final month. GLTR was higher than the Q4 close in January. GLTR rose to a new record high in Q4 2025 and reached an even higher high of over $230 per share in Q1 2026.

As I wrote at the end of Q3 2025, “I rate GLTR a hold at the current price level, as even the most aggressive bullish trends rarely move in straight lines. However, any pullback or correction could be a golden buying opportunity.” I continue to rate GLTR a hold in early 2026. However, the trend is always a trader’s or investor’s best friend, and it remains bullish in January 2026. The higher the price rises, the greater the odds of a correction.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)