Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 73%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Watch List Favorites

This week the Newsletter contains 19 stocks and ETFs across 8 sectors. 2 of the stocks on the Watch List are detailed below:

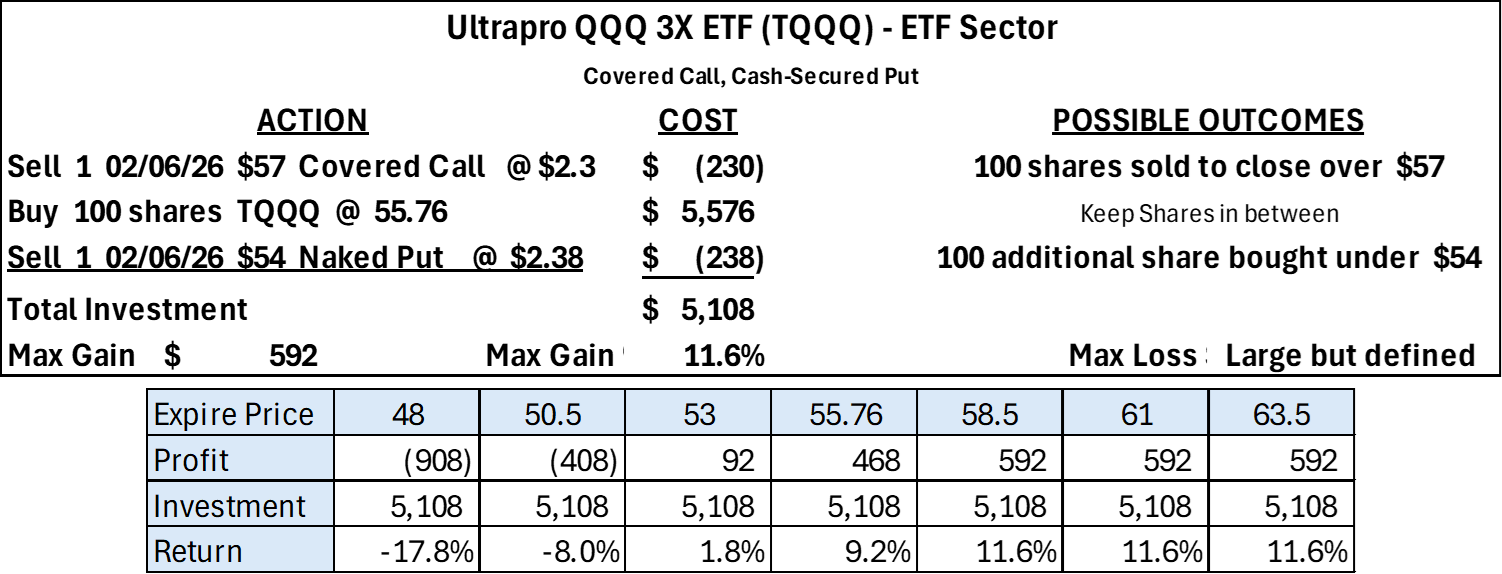

Ultrapro QQQ 3x ETF (TQQQ)

- The investment seeks daily investment results, before fees and expenses, that correspond to three times (3x) the daily performance of the NASDAQ-100 Index®. The fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the Daily Target.

ProShares UltraPro QQQ is consolidating near the upper end of its advance, pressing against a descending trendline after a strong multi-month uptrend. Price is holding above a tight cluster of rising short- and intermediate-term moving averages, keeping the trend intact. This action suggests digestion rather than distribution, with a clean break above trendline resistance needed to signal the next upside leg.

Joby Aviation, Inc., (JOBY)

- Joby Aviation, Inc., a vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service in the United States and Dubai. The company intends to build an aerial ridesharing service, as well as developing an app-based platform that will enable consumers to book rides. J

Joby Aviation Inc has broken above the downward-sloping trendline, marking a notable shift in short-term structure. The breakout is being supported by a tight cluster of rising moving averages beneath price, reinforcing the $14.50–$15.00 area as near-term support and improving the technical backdrop as long as this zone holds.

Watch List Overview

Watch list candidates are chosen for their stable price behavior, defined support, and liquid option markets, making them well suited for a long-stock, dual-option selling strategy. Their orderly movement allows the stock to serve as a reliable anchor while both the call and put premiums expand the profit range and reduce dependence on short-term direction.

Past Performance

Each week the Newsletter contains around 20 stocks / ETF's on the Watch List to be opened the following Monday for expiration 4 Fridays later. Since the expiration cycle on May 23, the average stock gain on the Watch List has outperformed the S&P 500 26 of 32 weeks.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)