Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

Commodity markets are often viewed as unpredictable, driven by weather, geopolitics, and sudden supply shocks. While those forces certainly matter, they are not the whole story. Beneath the headlines, many commodity markets follow recurring seasonal rhythms that repeat with surprising consistency over time. One of the most effective ways traders have learned to harness these patterns is through seasonal futures spreads. Rather than betting on outright price direction, spreads focus on the relative movement between two related futures contracts, allowing traders to express a seasonal view while reducing exposure to broad market volatility.

What Are Seasonal Futures Spreads?

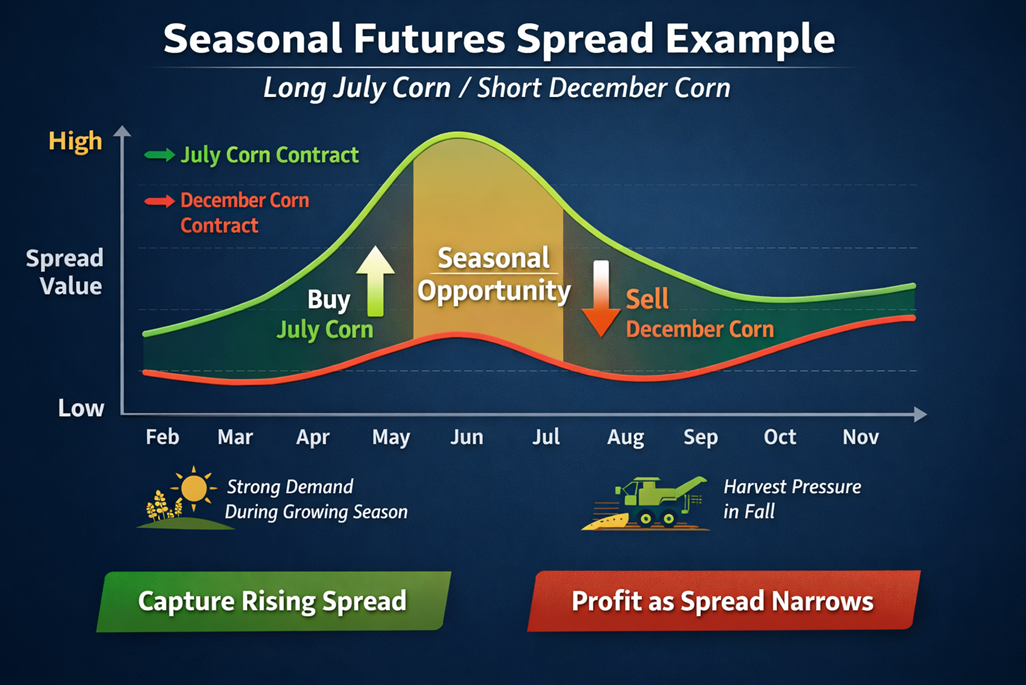

A futures spread involves simultaneously buying one futures contract and selling another within the same commodity. The contracts may differ by delivery month, location, or grade, but they are tied to the same underlying market. Seasonal spreads exploit the fact that different delivery months tend to behave differently at specific times of the year. These tendencies are not random; they emerge from the physical realities of commodity production, storage, transportation, and consumption. Instead of asking whether a commodity will rise or fall, spread traders ask a more precise question:

- How does one part of the curve typically behave relative to another during this time of year?

Where Seasonal Patterns Come From

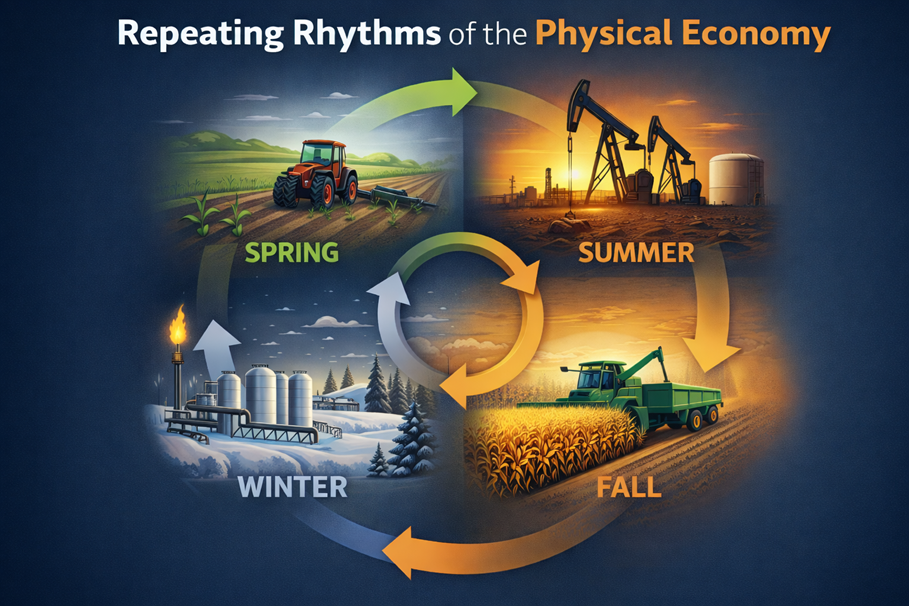

Seasonality in commodities is rooted in real-world supply and demand cycles.

- Agricultural markets follow planting, growing, and harvest schedules that repeat annually.

- Energy markets reflect seasonal demand for heating, cooling, and transportation.

- Livestock markets are influenced by breeding cycles, feed availability, and slaughter timing.

- Metals markets often show seasonal inventory and fabrication trends tied to industrial activity.

Because these forces recur year after year, they leave measurable footprints in historical price relationships between futures contracts.

Why Spreads Are Well-Suited for Seasonality

Seasonal patterns tend to show up more reliably in spreads than in outright futures prices. Outright prices are influenced by macro forces such as inflation expectations, currency movements, and global risk sentiment. These factors can overwhelm seasonal tendencies in any given year. Spreads, by contrast, isolate relative value within the same market:

- Broad price shocks often affect both legs similarly.

- Volatility is typically lower than outright futures.

- Margin requirements are often reduced compared to flat price positions.

This makes spreads a natural vehicle for expressing seasonality while controlling risk.

The Role of the Futures Curve

Seasonal behavior is closely tied to the shape of the futures curve—whether it is in contango or backwardation. As inventories build or draw down through the year, nearby and deferred contracts respond differently. Seasonal spreads often reflect:

- Tightness or abundance in near-term supply,

- Storage economics,

- Anticipated shifts in availability or demand.

By trading the relationship between months, spread traders align themselves with how the market typically adjusts to these evolving conditions.

Why Seasonality Persists

One might assume that widely known seasonal patterns would disappear as traders exploit them. In practice, many persist for decades. The reason is simple: seasonality is driven by physical constraints, not opinions. Crops still grow on the same schedule. Heating demand still rises in winter. Storage still costs money. These realities do not change just because traders are aware of them. As long as production, consumption, and logistics follow recurring cycles, seasonal tendencies continue to reassert themselves.

The Importance of Historical Testing

Not all seasonal spreads are created equal. Some patterns appear strong over short samples but break down over longer periods. Successful seasonal spread trading depends on:

- Extended historical datasets (often 10–20 years or more),

- Testing multiple entry and exit windows,

- Evaluating win rates, average returns, and drawdowns,

- Filtering out patterns that only worked during unusual regimes.

Seasonality is not about prediction—it is about probability.

Risk Management Still Matters

Seasonal tendencies improve odds, but they do not eliminate risk. Weather anomalies, policy changes, and unexpected supply disruptions can temporarily override historical norms. This is why many traders combine seasonality with:

- Position sizing discipline,

- Time-based exits,

- Volatility awareness,

- And confirmation from broader market context.

Seasonality works best as a framework, not a standalone signal.

Bottom Line

Seasonal futures spreads work because they are grounded in the repeating rhythms of the physical economy. By focusing on relative value rather than outright direction, they allow traders to express these tendencies with greater consistency and lower volatility.

The edge does not come from forecasting the next headline—it comes from aligning with the structural forces that quietly shape commodity markets year after year.

Closing Note

For traders interested in applying this long-horizon, data-driven approach in practice, the Smart Spreads Newsletter focuses on identifying and tracking high-probability seasonal futures spreads using extended historical datasets and rigorous testing. In addition to seasonality, the newsletter incorporates a broad set of technical and fundamental indicators—such as Commitment of Traders, Relative Strength and Positioning, Carry Yield, Relative Strength, Hedge Fund Position Estimates, CTA Momentum, and market context—to provide an additional filtering layer, helping ensure that seasonal opportunities align with current market dynamics before capital is committed.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gmail.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)