Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

One of the most common challenges faced by option income traders isn’t finding premium—it’s managing timing risk. Selling options too aggressively in a single expiration can expose a portfolio to sharp drawdowns, while spreading trades randomly across maturities often leads to uneven results and inconsistent income. A simple structural solution to this problem is the 4-week ladder. Rather than concentrating exposure in one expiration or constantly resetting positions based on short-term market noise, a laddered approach distributes trades evenly across time. The result is a more stable income rhythm and reduced dependence on getting any single entry “exactly right.”

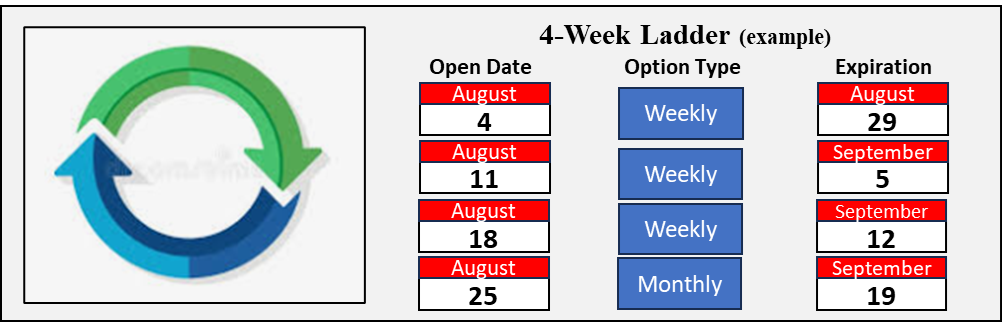

What Is a 4-Week Ladder?

A 4-week ladder is a time-diversified framework in which option positions are staggered across four overlapping expiration cycles. Instead of entering all trades at once, new positions are added on a regular schedule—typically weekly—while older positions roll off naturally as they expire. At any given time, a fully built ladder includes:

- One position nearing expiration,

- One in mid-cycle,

- One earlier in its lifecycle, and

- One newly opened position.

Each position is designed to last approximately four weeks, but their start dates are staggered, creating a continuous pipeline of option exposure.

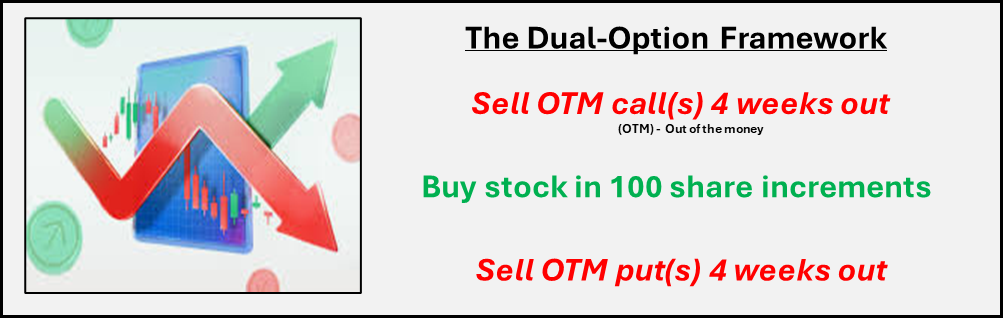

Using Stock Ownership and Dual Option Selling for Income

Many option income approaches begin with long stock ownership, using options to enhance returns rather than replace the position. By selling a covered call above the stock and a cash-secured put below it, traders can collect premium from both sides, widen the range of profitable outcomes, and reduce dependence on precise market timing—allowing time decay to work more consistently around a stable stock position.

Why Laddering Improves Income Consistency

1. Reduces Timing Risk

Markets rarely move in straight lines. When all positions are opened at the same time, a sudden volatility spike or directional move can impact the entire portfolio at once. A ladder spreads exposure across different market conditions, reducing the impact of any single event. Some positions will benefit from rising volatility, others from falling volatility, and others from time decay. The portfolio becomes less sensitive to short-term noise.

2. Smooths the Income Stream

Instead of waiting weeks for all positions to expire at once, a ladder produces regular expirations and settlements. Each week, one portion of the portfolio resolves, allowing gains, assignments, or capital resets to occur incrementally rather than all at once. This creates a more predictable cadence of results and makes performance easier to evaluate and manage.

3. Keeps Capital Deployment Balanced

A structured ladder encourages traders to think in terms of cycle-level exposure, not individual trades. Capital is allocated evenly across time rather than concentrated in a single window. This discipline helps prevent over-deployment during “good looking” markets and under-deployment during uncertain periods—two common behavioral mistakes in option selling.

4. Simplifies Decision-Making

With a ladder in place, the weekly process becomes repeatable:

- One cycle expires.

- One new cycle is added.

- Existing positions are left to work.

Instead of constantly adjusting or second-guessing trades, decisions are made on a schedule, often when markets are closed. This structure reduces emotional interference and improves consistency.

Why Four Weeks?

A four-week duration strikes a balance between competing forces in option pricing:

- It is long enough to absorb normal market fluctuations.

- Short enough to keep time decay meaningful.

- Flexible enough to align with both weekly and monthly option expirations.

Most importantly, it allows positions to mature under different volatility and price environments, which is the core advantage of laddering.

Who Benefits Most from a 4-Week Ladder?

The 4-week ladder is particularly effective for:

- Income-focused traders seeking consistency over maximization,

- Investors combining long stock with option income,

- Traders looking to reduce drawdowns caused by concentrated timing risk, and

- Those who prefer rule-based execution over discretionary adjustments.

The approach is not about predicting the next market move. It’s about structuring exposure so that time, diversification, and probability do more of the work.

Bottom Line

The 4-week ladder is a structural improvement, not a tactical trick. By distributing option exposure evenly across time, traders can reduce timing risk, smooth income, and simplify execution—without relying on forecasts or constant adjustments. Rather than asking whether this week’s trade is “perfect,” the ladder asks a better question: Is the portfolio balanced across time?

Closing Note

For traders interested in applying the 4-week ladder concept within a fully defined, stock-anchored income framework, this structure forms the backbone of the Bull Strangle Strategy, where long stock is paired with disciplined option selling across staggered cycles. That framework is explored in detail in the Bull Strangle Newsletter and related educational materials.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)