/RTX%20Corp%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Raytheon (RTX) stock has been in focus in recent sessions after President Donald Trump publicly criticized the company for being “the least responsive” to Pentagon needs.

Trump even threatened to terminate the defense giant’s government contracts unless it halts stock buybacks, caps executive pay, and reinvests in production capacity.

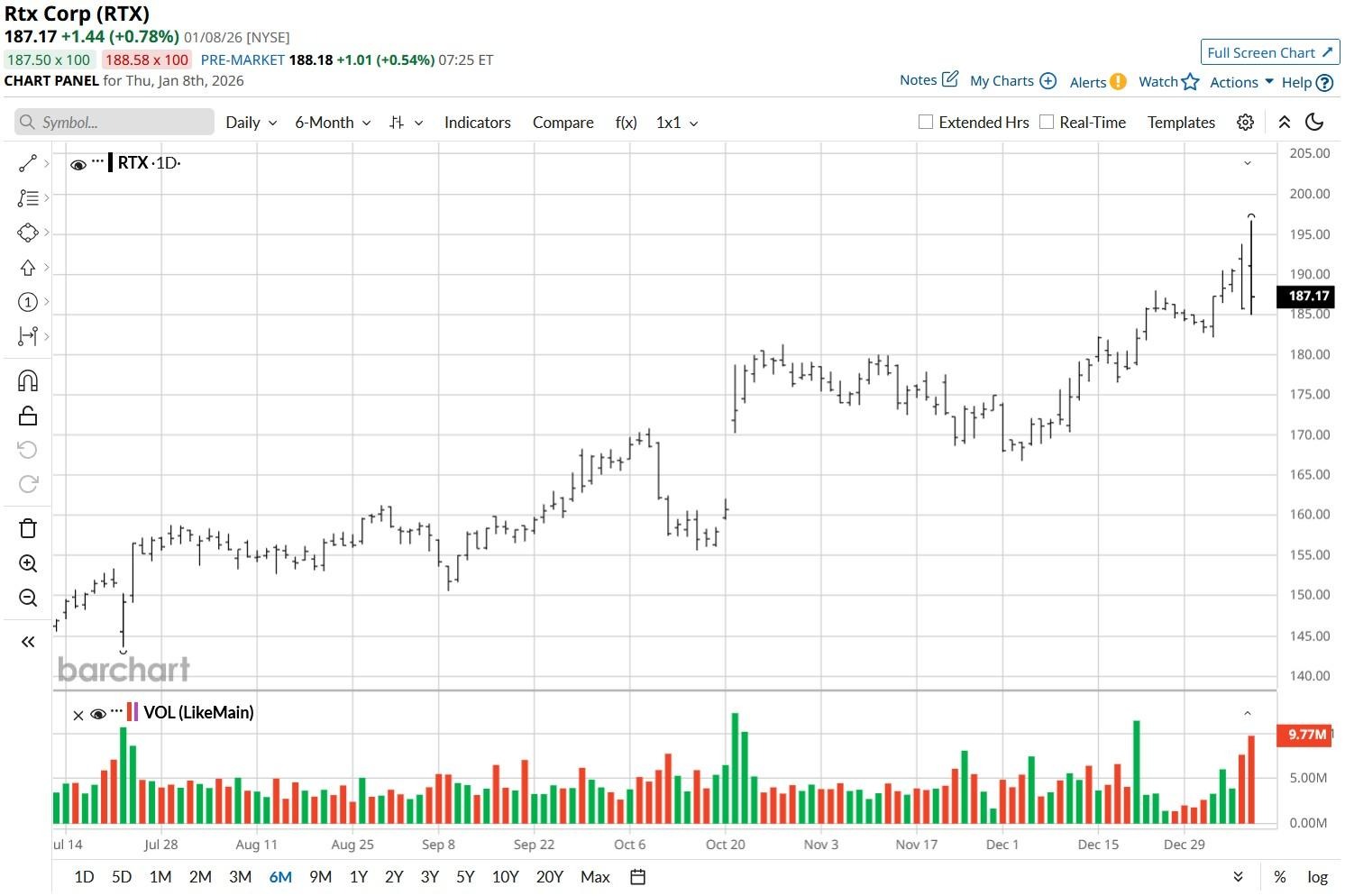

RTX shares have still held their own this week, however, and are currently up a whopping 65% versus their 52-week low.

What Trump’s Warning Means for RTX Stock

For investors, the U.S. president’s direct attack on RTX is concerning as it threatens the company’s core revenue stream, federal defense contracts.

Markets often prize defense contractors for stable cash returns and predictable margins, but Trump’s comment suggests RTX could be stripped of both, which undermines the overall investment thesis.

Meanwhile, being singled out as “least responsive” is a major hit to Raytheon’s reputation as well.

In short, a combination of policy risk, reputational damage, and reduced shareholder returns create significant downside pressure on RTX stock.

RTX Shares Aren’t Very Attractive Anyways

Even without Trump’s criticism, Raytheon isn’t a particularly attractive name to own in 2026.

At the time of writing, the defense giant is trading at a forward price-to-earnings (P/E) multiple of about 28x, which makes it significantly more expensive compared to peers like Lockheed (LMT).

Additionally, RTX is grappling with an earnings decline. In the current quarter, it’s expected to earn $1.45 a share, down nearly 6% on a year-over-year basis.

What’s also worth mentioning is that RTX shares are trading a tad above their key moving average (20-day) on Jan. 9. A break below this level could accelerate bearish momentum in the near term.

Taken together with Trump’s warning and what it may mean for Raytheon this year, these insights suggest there are better names to own within the U.S. defense and aerospace market than RTX.

How Wall Street Recommends Playing Raytheon

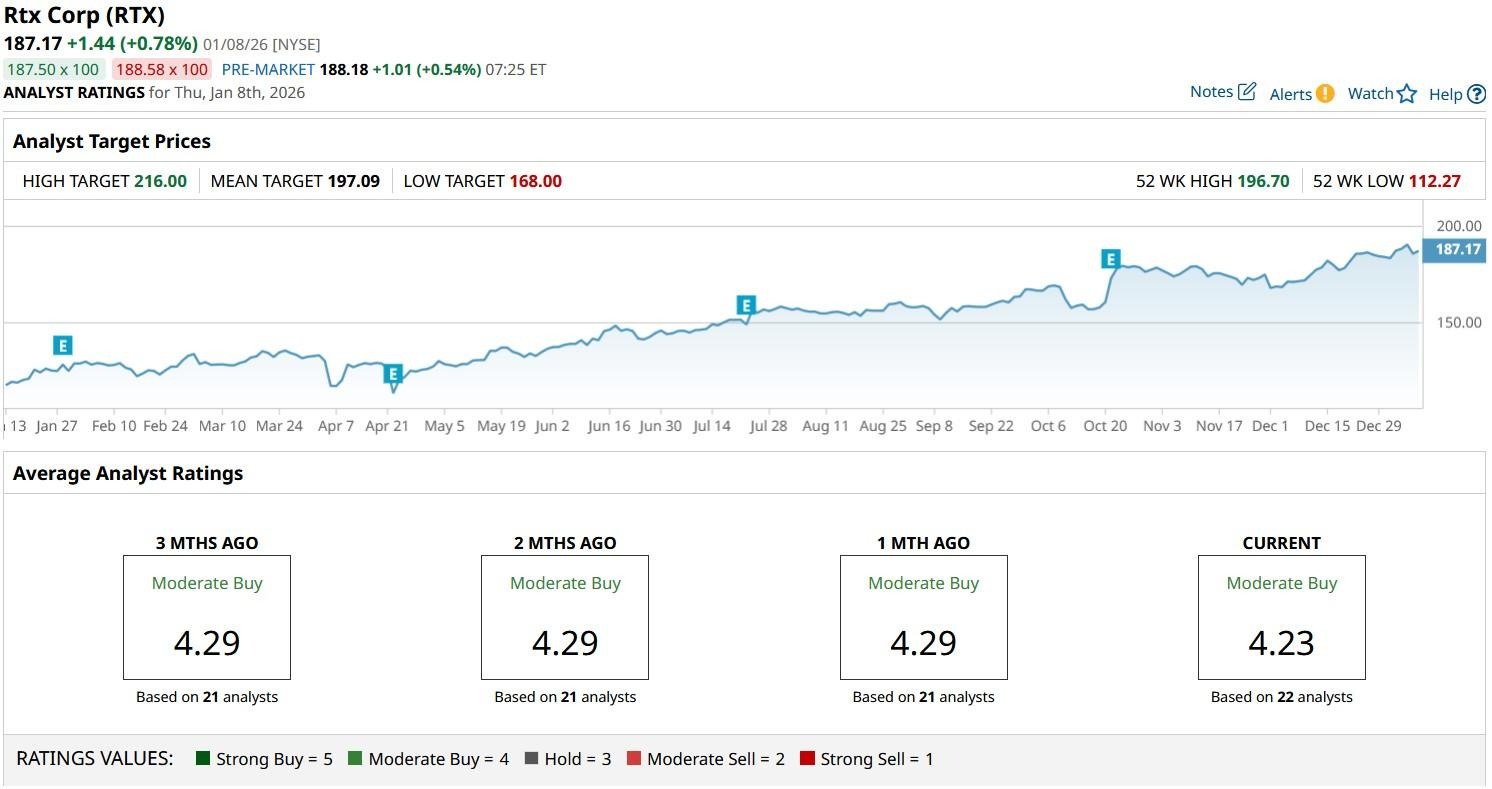

Wall Street analysts are no longer super constructive on RTX stock either.

While the consensus rating on Raytheon remains at “Moderate Buy,” the mean target of about $197 indicates potential upside of only 5% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)