/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir (PLTR) stock is inching down on Jan. 8 following a multi-session rally on speculation that it was involved in the U.S. military’s recent attack on Venezuela.

According to Arvind Ramnani, a senior Truist analyst, long-term investors should consider loading up on PLTR on this pullback as it’s the “best-in-class” artificial intelligence (AI) asset for 2026.

Ramnani’s bullish call is particularly significant given Palantir shares are already up some 180% versus their 52-week low.

Why Truist Is Bullish on Palantir Stock

In his latest research note, Ramnani conceded that PLTR is an expensive stock, but said the firm’s strong financial profile does warrant a premium multiple.

Palantir sits exceptionally high on the “Rule of 40” metric, with a reported score of more than 100 as of its Q3 earnings release.

“We continue to view PLTR stock as a buy – given its significant opportunity to drive AI adoption for governments and enterprise,” the Truist analyst wrote.

His $223 price objective suggests Palantir Technologies could push another 30% higher from here over the next 12 months.

Cramer Agrees With Truist on PLTR Shares

Ramnani expects artificial intelligence adoption to accelerate this year and sees Palantir shares as “ideally positioned” to benefit from it.

In his report, the Truist analyst also cited “international expansion” as a potential driver of future growth.

“Now operating at a 40% plus free cash flow (FCF) margin profile – we see potentially for PLTR to significantly increase capital returns over the long term.”

Famed investor Jim Cramer echoed the optimism in a recent segment of CNBC as well. According to him, Palantir has “radically” changed all of its client companies (for the better) and that’s a mark of a truly phenomenal business.

According to Barchart, bullish options data also currently suggests Palantir will be trading at north of $200 within the next three months.

What’s the Consensus Rating on Palantir?

While not nearly as bullish as Truist Securities, other Wall Street firms haven’t thrown in the towel on PLTR shares either.

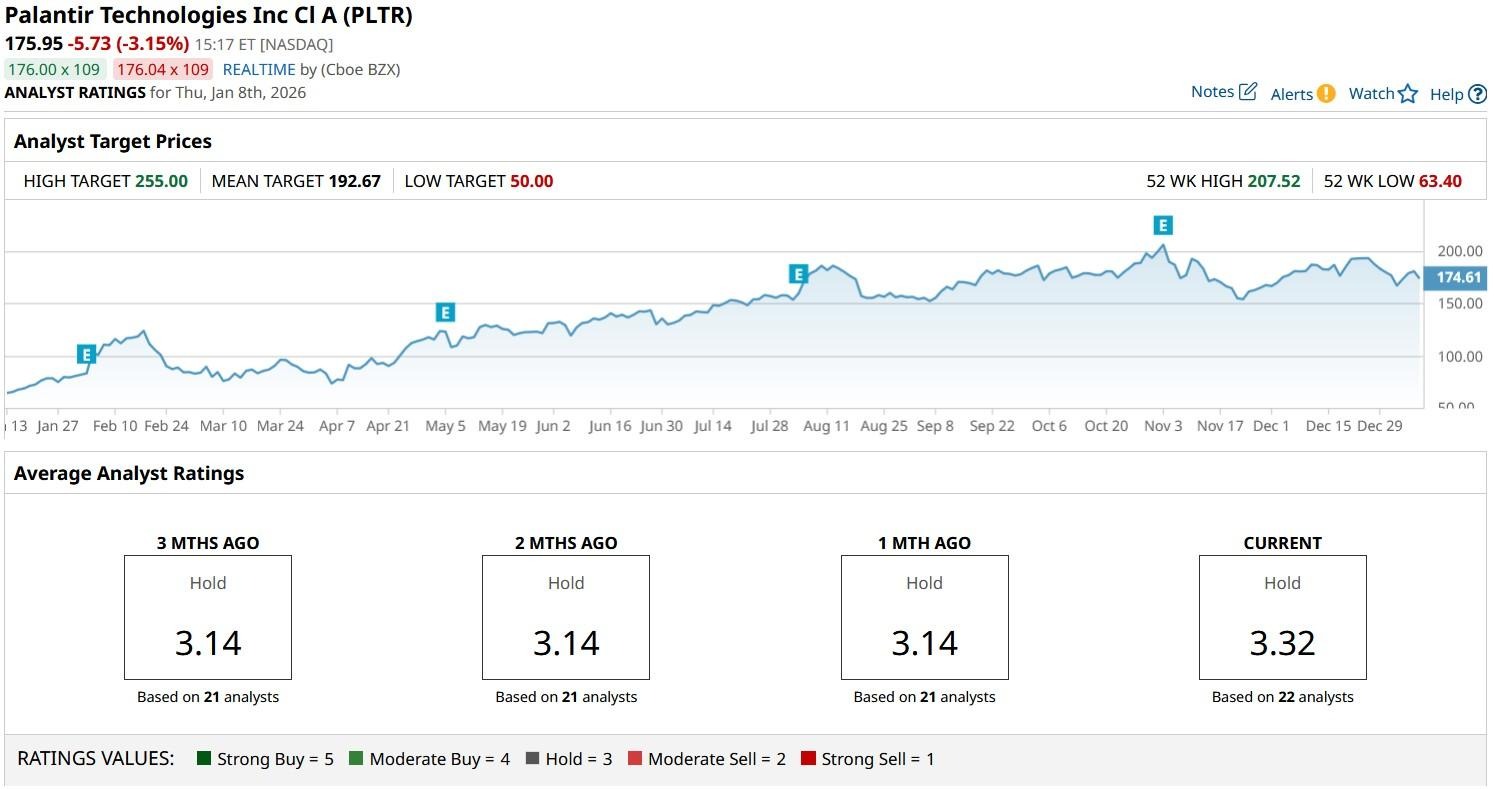

While the consensus rating on Palantir stock sits at “Hold” only, the mean target of roughly $193 signals potential upside of about 10% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)