I concluded my Q3 Barchart report on the animal protein sector with the following:

The forward curves for beef and pork futures highlight the expectations for continued tightness and high prices during the 2026 peak grilling season. Any significant correction in the deferred contracts over the coming weeks and months could be a buying opportunity for the peak season in 2026.

While live and feeder cattle and lean hog futures prices moved lower in Q4, the declines were not dramatic.

A Q4 decline for the sector, but a significant gain in 2025

The animal protein composite, including live and feeder cattle and lean hog futures, fell 6.41% in Q4 but was 18.95% higher in 2025.

The fourth quarter decline was seasonal, as the meat futures were in the demand offseason, which began in early September 2025 and runs through late May 2026.

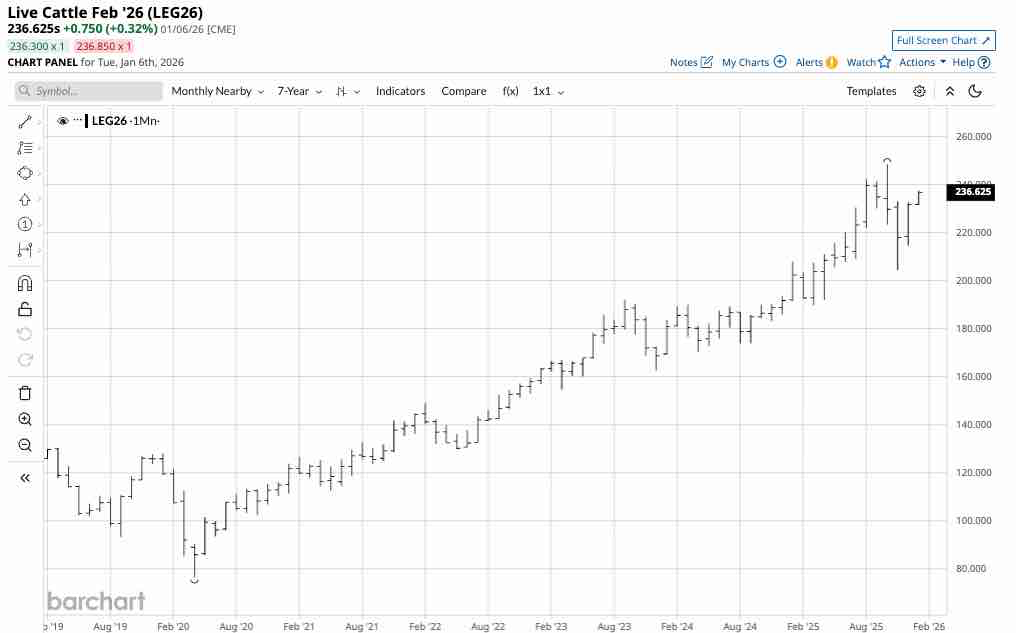

Live cattle futures edged lower in Q4- An over 20% gain in 2025

Live cattle futures edged only 0.11% lower in Q4.

The monthly continuous contract live cattle futures settled 2025 at $2.3160 per pound. While the futures experienced a slight Q4 decline, the bullish trend since the 2020 low remains firmly intact as it heads into 2026. Live cattle futures moved 20.88% higher in 2025.

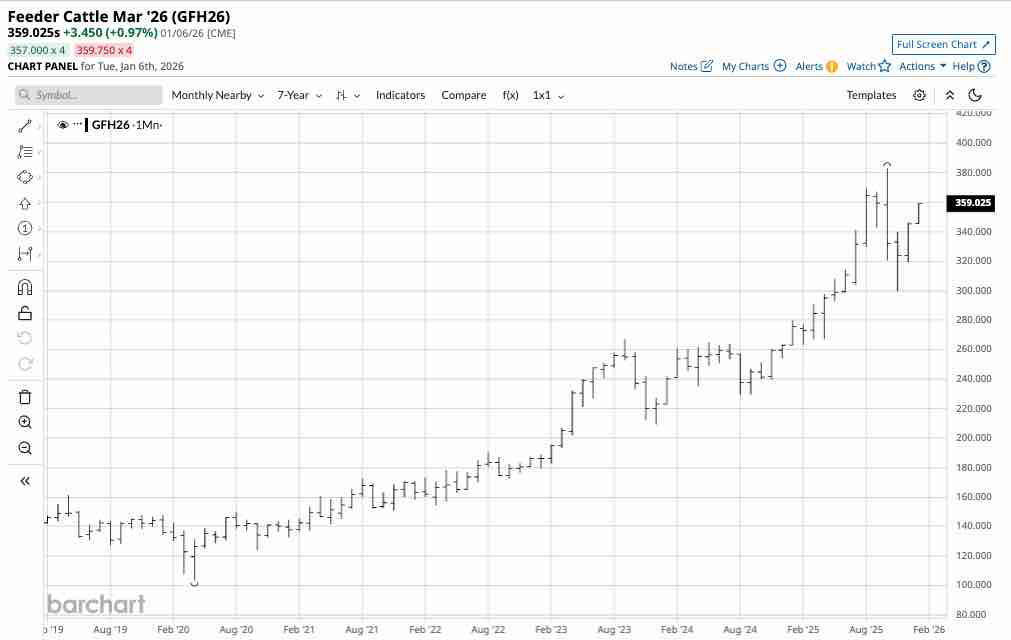

Feeder cattle futures fell more than fat cattle in Q4- An over 31% gain in 2025

Feeder cattle futures declined by 4.35% in Q4.

The monthly continuous contract feeder cattle futures settled 2025 at $3.45325 per pound. While the futures experienced a Q4 decline, the bullish trend since the 2020 low remains firmly intact as it heads into 2026.

Feeder cattle futures moved 31.29% higher in 2025.

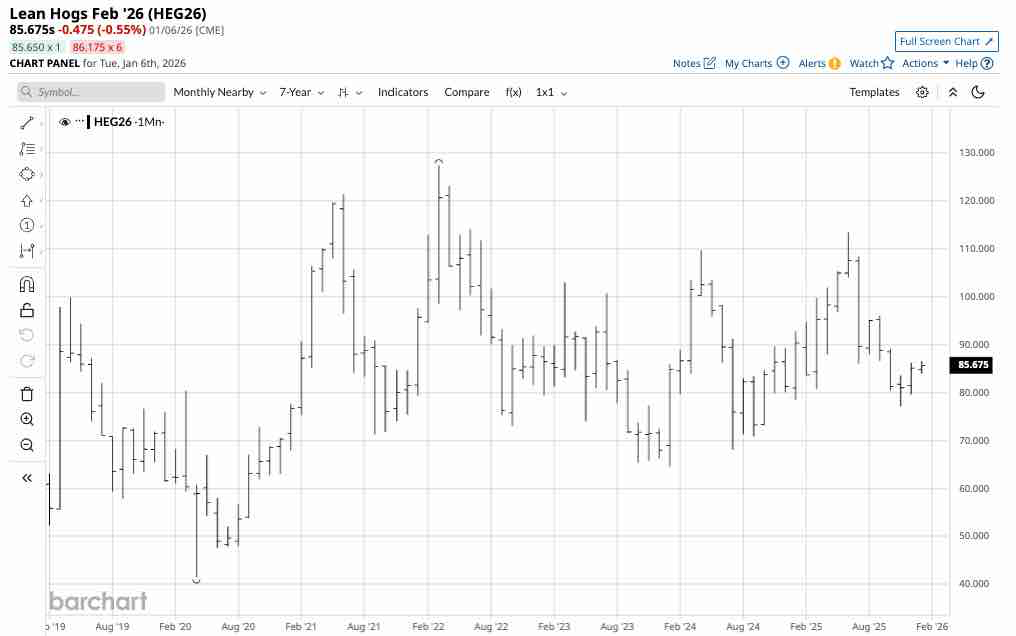

Lean hogs led on the downside in Q4, but managed an overall gain in 2025

Lean hog futures led the sector lower in the fourth quarter, down 14.77%.

The monthly continuous contract lean hog futures settled 2025 at 85.100 cents per pound. While the futures experienced a significant Q4 decline, the bullish bias since the 2020 low remains intact as it heads into 2026.

Lean hog futures gained 4.67% in 2025. The lean hog futures have experienced more seasonal price action over the past years, but have made higher lows since the 2020 pandemic-inspired bottom.

Q1 2026 could be interesting for meat prices

As cattle and hog futures markets will remain in the demand offseason from January through March, prices could experience downside pressure. However, any significant selloffs could be buying opportunities for the 2026 peak grilling season, which begins on Memorial Day in late May and runs through Labor Day in early September.

Other factors that may impact meat futures include rising production costs due to inflationary pressures, grain and oilseed prices over the coming months, which are critical animal feed inputs, and U.S. tariffs on worldwide trading partners that produce and consume beef and pork.

I would be a buyer of cattle and hog futures on any significant declines over the coming months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)