/Solar%20panels%20in%20nature%20sunny%20by%20Mrganso%20via%20Pixabay.jpg)

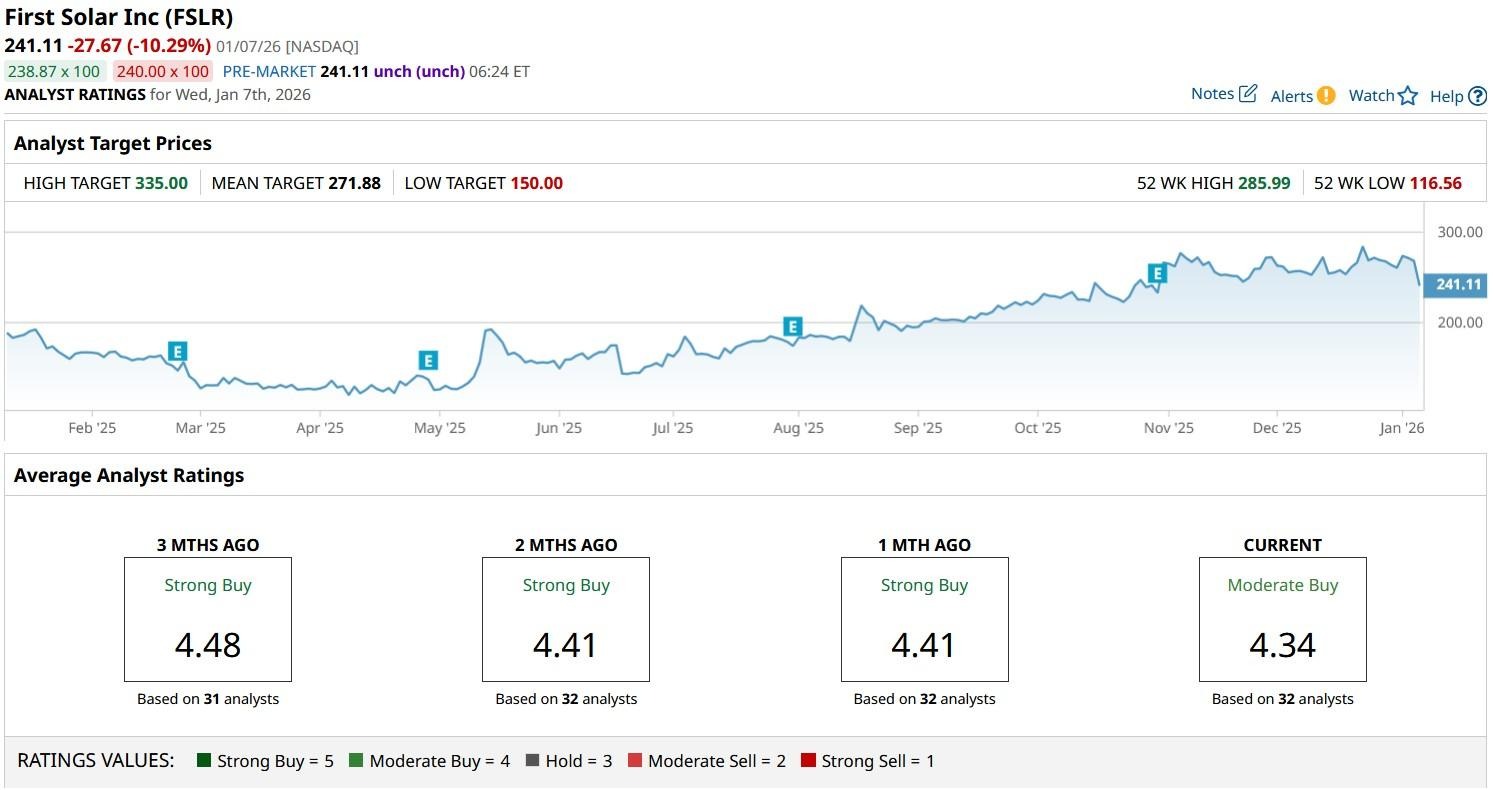

First Solar (FSLR) shares tanked more than 10% on Jan. 7 after senior Jefferies analyst Julien Dumoulin-Smith downgraded the Tempe-headquartered clean energy company to “Hold.”

Dumoulin-Smith cited concerns about limited visibility into 2026 bookings and reduced policy tailwinds following recent legislative changes.

Margin pressure from logistics costs and potential facility underutilization could also weigh on the solar stock this year, he added.

Despite this decline, however, First Solar shares remain up some 100% versus their 52-week low.

Why Jefferies Downgraded First Solar Stock

FSLR stock is currently trading at an attractive forward price-earnings (P/E) multiple of 11.54x and maintains a strong balance sheet with improving free cash flow.

But this fundamental strength is being offset by near-term headwinds that warrant caution in playing it at current levels, the Jefferies analyst argued in his research note.

These include the company’s heavy reliance on tax credits for margin support, which has become a vulnerability under President Donald Trump.

First Solar’s gross margins deteriorated to about 11% in 2025 from a staggering 20% a year earlier. Plus, average selling prices are keeping roughly flat, indicating pricing power remains limited in the current competitive landscape as well.

Lack of Revenue Growth to Hurt FSLR Shares

Another major issue is FSLR’s book-to-bill ratio that currently stands at about 0.5x only coupled with recent cancellations from a major BP (BP) affiliate that expose counterparty risks and suggest softer demand.

Moreover, the clean energy company’s management continued to lower its guidance through 2025, further exposing the fragility of previous demand assumptions.

In fact, analysts now see First Solar’s revenue keeping flat on a year-over-year basis in 2026.

What’s also worth mentioning is that historically, the Nasdaq-listed firm has lost 1.20% on average in February. The seasonal trend makes First Solar stock even less attractive to own at current levels.

Wall Street Still Remains Bullish on First Solar

While FSLR stock slipped under key moving average (50-day) on Wednesday, signaling continued bearish momentum ahead, other Wall Street firms seem to disagree with Jefferies on the solar company.

The consensus rating on First Solar shares remains at “Moderate Buy” with the mean target of about $272 indicating potential upside of nearly 13% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)