Under Armour (UAA) started with a straightforward promise — make athletes better. What began as performance compression gear grew into a global brand spanning apparel, footwear, and accessories by solving everyday problems athletes actually faced.

Its omni-channel reach, premium positioning, and expanding direct-to-consumer playbook have kept Under Armour relevant, while momentum in international regions and growing pull with younger consumers signal a brand quietly regaining its edge. A clean balance sheet adds patience to the turnaround.

UAA shares have tumbled by double digits over the past year, pushing sentiment into skeptical territory even as the brand’s fundamentals stabilize. However, one UBS analyst argues this disconnect has gone too far. Analyst Jay Sole says investors materially undervalue Under Armour’s brand, which ranks alongside industry heavyweights in awareness, purchase intent, and consumer appeal according to UBS's Global Sportswear Survey.

Sole expects innovation to reaccelerate growth, forecasting a 25% five-year EPS compound annual growth rate (CAGR). The analyst calls the valuation gap with peers unjustifiably wide, setting up a compelling case for 2026.

About Under Armour Stock

Founded in 1996, Under Armour sprinted from a small idea to a global sportswear force, crafting gear built to make athletes better. From compression tees to loose-fit hoodies, running shoes to cleats, and gloves to backpacks, it blends innovation with style. Beyond apparel, the firm plays in footwear, accessories, and digital ventures, currently boasting a $2.26 billion market capitalization.

UAA stock has spent much of the past year under heavy pressure, sliding 36% as patience wore thin. But the tone has shifted since mid-December. Freshly positive calls from brokerages like Guggenheim have helped spark a rebound, lifting shares nearly 20% over the past month and 14% in just five days.

That surge has pushed the 14-day RSI above 70 recently and into overbought territory. That hints that the rally may pause or cool near term, even as momentum clearly turns constructive.

Under Armour’s valuation reflects caution, not collapse. Trading at just 0.41 times forward sales, UAA stock sits below sector peers and its own historical median, quietly offering room for upside if execution continues to firm up.

A Snapshot of Under Armour’s Q2 Results

Under Armour’s second-quarter earnings update, released on Nov. 6, was like a progress report from a company intent on earning its comeback. The quarter came in ahead of management’s prior outlook, and for a brand long defined by North America, the most important takeaway was that early signs of momentum are beginning to reappear at home. CEO Kevin Plank said the strategy, operating model, and go-to-market approach are now firmly in place, with sharper products and clearer storytelling restoring belief among consumers and wholesale partners alike.

The numbers still show pressure, but also discipline. Revenue fell 5% year-over-year (YOY) to $1.3 billion, yet exceeded expectations. North America declined 8% YOY to $792 million, while international revenue grew 2% to $551 million. Within that mix, EMEA stood out with 12% growth, and Latin America rose 15%, offsetting a 14% decline in Asia-Pacific. Wholesale revenue slipped 6% to $775 million, while direct-to-consumer (DTC) declined 2% to $538 million. Owned stores were steady, but e-commerce fell 8% and accounted for 28% of DTC sales.

By category, apparel proved resilient, down just 1% to $936 million. Meanwhile, footwear dropped 16% to $264 million and accessories declined 3% to $113 million.

Gross margin fell 250 basis points to 47.3%, reflecting tariff-driven supply-chain costs and an unfavorable channel and regional mix, partially offset by pricing and foreign exchange benefits. Adjusted operating income reached $53 million, and adjusted EPS of $0.04 topped Wall Street forecasts.

The balance sheet tells a parallel story of cleanup and control. Cash totaled $396 million. Under Armour used proceeds from its 2030 Senior Notes, revolver borrowings, and cash to defease $600 million of 2026 notes, placing funds in a restricted account to cover remaining obligations. It also repurchased $25 million of Class C shares during the quarter.

Looking ahead, fiscal 2026 remains a reset year. Revenue is expected to fall 4% to 5%, with pressure in North America and Asia-Pacific offset by growth in EMEA. Gross margin is projected to decline 190 to 210 basis points, while adjusted operating income is forecast at $90 million to $105 million and adjusted EPS at $0.03 to $0.05.

Analysts monitoring the company predict EPS to be $0.04 for fiscal 2026, down 87% YOY, before surging by 400% annually to $0.20 in fiscal 2027.

What Do Analysts Expect for Under Armour Stock?

UBS frames Under Armour as a turnaround where perception lags reality. Analyst Jay Sole reiterated a “Buy” rating with an $8 price target, pointing to 47% potential upside and a projected 25% five-year EPS CAGR that he believes will surprise investors.

The core of the thesis is brand power. UBS’s Global Sportswear Survey places Under Armour among the world’s most recognized and liked athletic labels, in the same tier as names like lululemon (LULU) and adidas (ADDYY). Yet those peers command an average market value near $19 billion, versus roughly $2.26 billion for Under Armour — a gap Sole says is simply too wide. Strong unaided brand awareness and purchase intent underscore that disconnect. The analyst expects renewed product innovation to improve consumer perception, support full-price selling, lift North America growth, and drive revenue toward $5.6 billion by 2030.

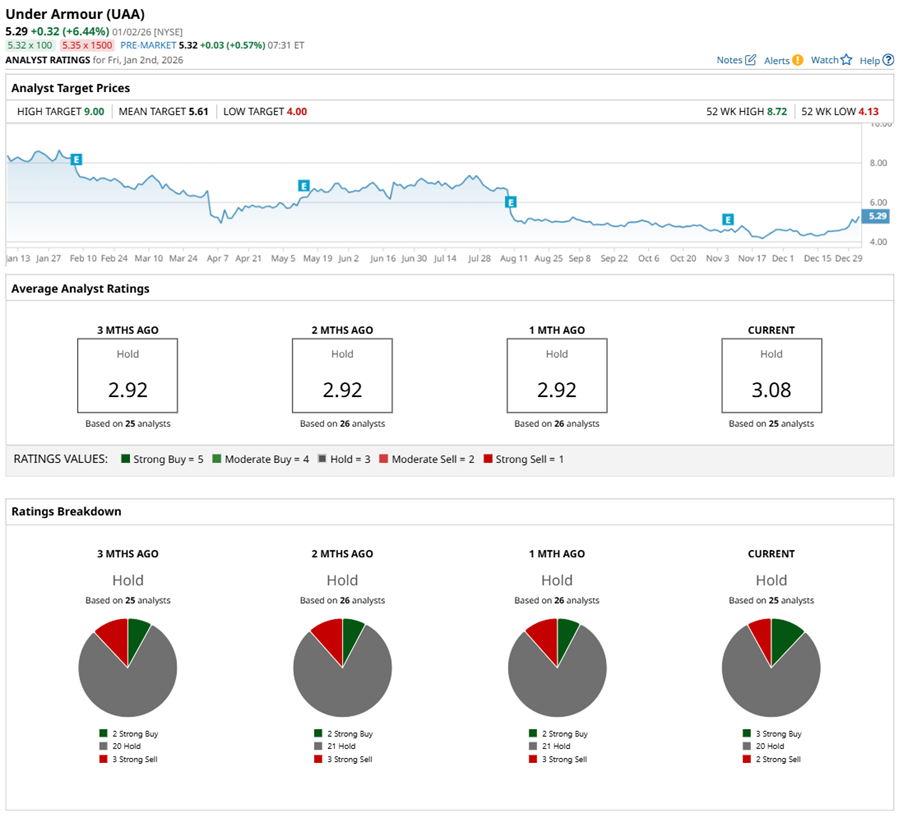

UAA stock has a consensus “Hold” rating overall. Out of 25 analysts covering the tech stock, three recommend a “Strong Buy,” 20 analysts stay cautious with a “Hold” rating, and two analysts have a “Strong Sell” rating.

The average analyst price target for UAA is $5.61, indicating potential upside of around 3% from here. However, the Street-high target price of $9 suggests that the stock could rally as much as 65%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)