Trade policy has long been a swing factor for retail and consumer discretionary stocks, especially those reliant on global supply chains. Tariffs can quickly pressure margins, disrupt sourcing strategies, and weigh on investor sentiment, while delays or rollbacks often spark sharp relief rallies. That dynamic was clearly on display this week when President Donald Trump delayed higher tariffs on furniture imports, giving the industry some unexpected breathing room as it heads into 2026.

One of the biggest beneficiaries was luxury home furnishings retailer RH (RH), whose shares jumped sharply about 8% following the announcement. The pause removes a looming cost headwind that had weighed heavily on the stock amid tariff concerns.

With pricing power, a premium brand, and now temporary tariff relief, RH suddenly looks like a very different setup for long-term investors, raising a key question: Does this reprieve make RH stock a buy here for 2026?

About RH Stock

RH, formerly Restoration Hardware, is a design-driven luxury retailer focused on upscale home furnishings and décor. The company offers curated collections of furniture (seating, case goods, beds, and dining items), lighting, textiles, and outdoor living pieces. Its model is unusual, with high prices, a members-only pricing structure, and immersive showroom “galleries.”

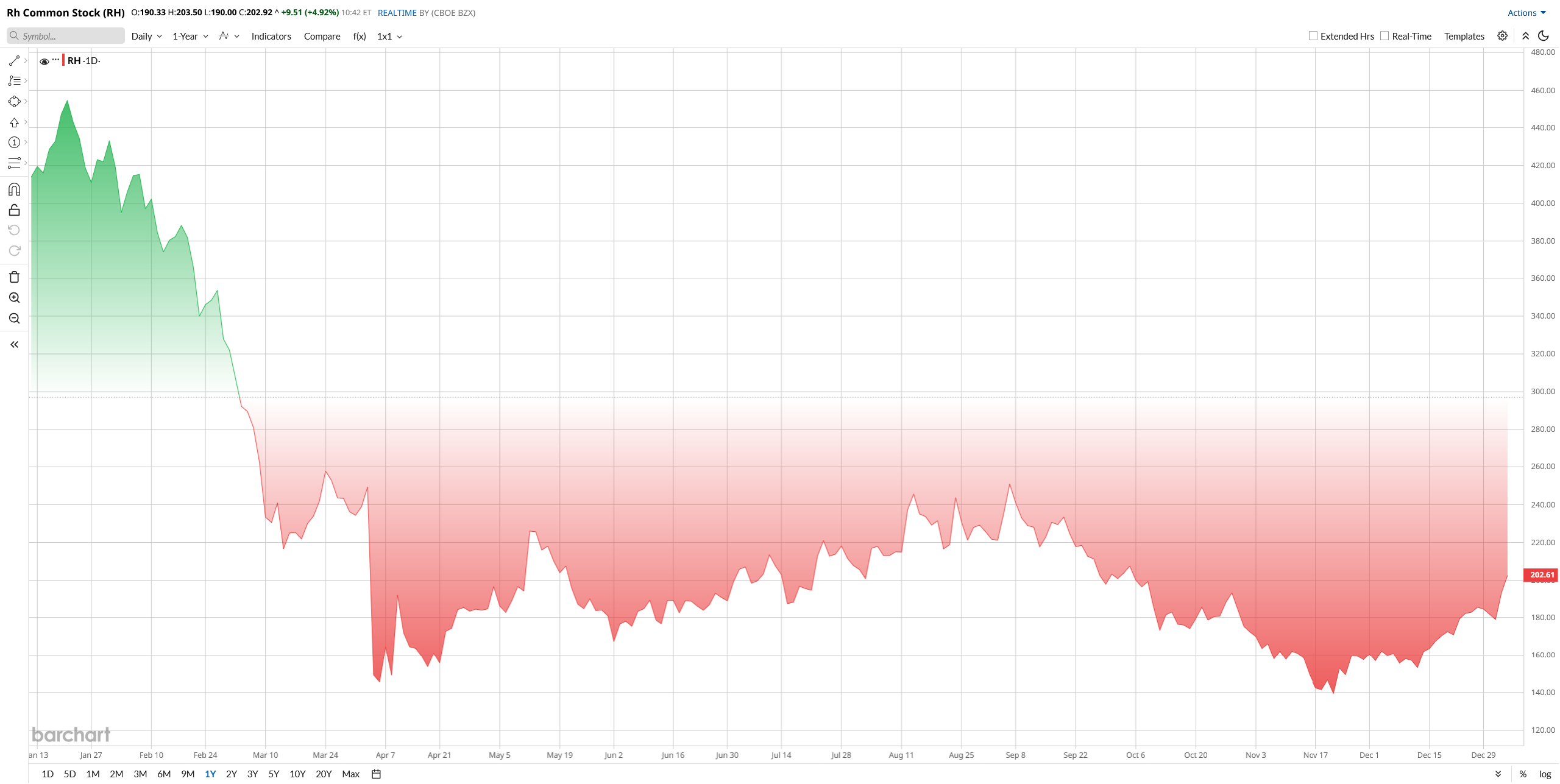

Having a small cap of $3.6 billion, RH shares had a difficult 2025, declining sharply as high mortgage rates and slowing home sales weighed on demand for big-ticket furnishings. The stock fell more than 50% year-to-date (YTD) before rebounding late in the year.

Despite the pullback, RH is still trading at a premium valuation on traditional metrics. Its price/book ratio is exorbitantly high at 1,003, vastly exceeding the sector median of 2, indicating a potentially overpriced stock. Additionally, RH's price/earnings ratio of 29 is notably higher than the sector's 17, suggesting its valuation is stretched.

Why the Tariff Delay Matters

The latest catalyst for RH is political. Trump’s decision to delay higher tariffs on imported furniture until 2027 removes a significant near-term risk for the company. RH sources a meaningful portion of its products internationally, and higher tariffs would have pressured margins or forced price increases. By maintaining current tariff levels for another year, RH gains breathing room to manage supply chains, protect gross margins, and avoid passing costs to high-end consumers. The market viewed the move as a meaningful reprieve, pushing RH shares higher and improving the outlook for 2026 earnings.

Q3 CY2025 Earnings: Signs of Stabilization

RH’s latest reported quarter, Q3 calendar 2025, offered cautious optimism. Revenue came in at approximately $884 million, representing high-single-digit growth year over year despite a challenging housing environment. Growth was driven primarily by the core RH brand, while newer initiatives such as RH Hospitality and interior design services continued to gain traction.

Net income rose modestly, $36 million from the prior year, reflecting improved cost controls and stable demand among affluent customers. Adjusted earnings per share increased year over year, though results still fell short of the company’s longer-term targets. Free cash flow remained solid for the quarter, and RH ended the period with over $40 million in cash and equivalents.

CEO Gary Friedman struck a confident tone on the earnings call, noting that the company delivered growth “in one of the most challenging housing markets in decades,” while continuing to invest in long-term brand expansion.

Looking ahead, management guided for mid-single-digit revenue growth in the next quarter and reaffirmed expectations for high-single-digit growth for the full fiscal year. Analysts currently expect full-year revenue and EPS to improve in 2026 as housing activity stabilizes.

What Wall Street Is Saying About RH Stock?

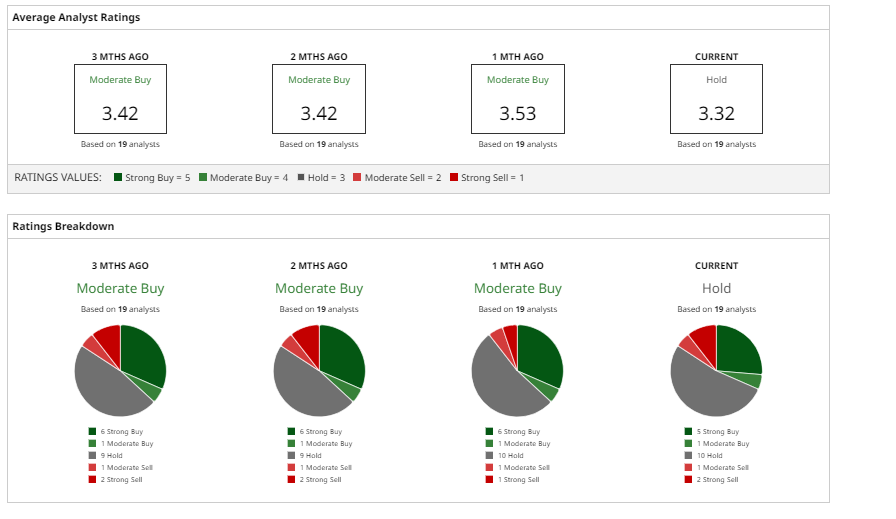

Analyst sentiment remains mixed but is gradually improving. Morgan Stanley recently trimmed its price target to $250 from $300 while keeping an “Overweight” stance, saying it still backs RH’s long-term brand strength and cash-generation potential.

Goldman Sachs cut its target sharply to $144 and kept a cautious/sell view, flagging valuation and demand concerns despite reduced tariff risk.

Bank of America lowered its target to $170 and maintains an “Underperform” stance, citing the premium multiple and the need for clearer signs of sustained demand recovery.

Across the Street, the 12-month consensus target sits near $199, which suggests a modest 3% upside from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)