Happy New Year market watchers!

The page on the calendar has officially turned! It is time to deploy all that wisdom from past experience and make it the best year ever!

It sure doesn’t feel like January in the Southern Plains with temperatures heating back up again. That very much depends where you are however as the Northeast is continuing to experience heavy snowfall and blizzard conditions in select areas. There is also snow cover in parts of the Midwest. After a warmup in these areas next week, there are ideas that a deep freeze could return in the second half of January into early February.

With the more moderate start to winter, it only seems fitting that we see the cold return. The flip flopping temperatures are beginning to bring a higher probability of moisture, which is greatly needed for many of the key cropping areas across the country. The 6-10 day outlook from NOAA is showing above average probabilities for moisture, most of which is rain versus snow. Hopefully this materializes to soften the colors of the US drought monitor that have continued to deepen.

Warmer temperature forecasts have made the recovery rally in natural gas extremely volatile as we saw at the end of last year. It makes a producer wonder if lower natural gas prices, the key ingredient in nitrogen fertilizers, will result in cheaper urea or anhydrous ammonia. The answer: not that we’ve seen yet. It reminds us of the October-November correction in the cattle market that did not result in cheaper retail beef prices. Different song, but same tune.

The imminent announcement to reopen the US-Mexico border to imports of live cattle and other animals seems less likely in the short-term given warmer temperatures with the odds worsening this week. Another case of New World Screw Worm was detected in a week-old calf in the northern state of Tamaulipas, 197 miles from the US border. On January 1st, there was a positive detection of NWSW in a goat in the State of Mexico, bordering Mexico City. This recent track record increases the risk of the USDA reopening the border in the near-term.

This vacuum of live cattle flowing across the border has helped keep US cattle prices firm and resulted in more US corn exports to Mexico to feed those cattle. Feeder and Live cattle futures contracts surged Friday to kick off the New Year with significant strength, closing near session highs. Despite increasingly negative margins, packers have been caught underbought with fed cattle cash trade topping out Friday at $232 in Kansas and Nebraska with the same bid in Texas, but not yet passed at the time of submitting this commentary.

The next gap on January feeders fills at $356.875 with this contract trading to a high of $356.625 in Friday’s session. Are we heading for the all-time high made on October 16, 2025, at $380.200 and perhaps beyond? It feels possible with nothing in the near-term able to address the “supply” problem as long as demand holds.

China this week announced additional 55 percent tariffs on beef imports that exceed quota levels for Brazil, Australia and the US in order to “protect its domestic cattle industry.” I have traveled extensively throughout China visiting its domestic beef industry and I think we all know that is not the real reason. However, it is difficult to argue such a move is anything but nationalistic that is a common theme in global trade at present.

Tensions are rising in the Asia-Pacific with things heating up around Taiwan this past week. Expect elevated tensions to be the new normal for the next several years if not the next decade and possibly beyond.

US cattle futures ignored this news from China as the fundamentals are far tighter domestically than worrying too much about exports to China that have declined in recent years due to greater domestic demand and higher prices. However, it can be a negotiating card for them to play at upcoming US-China meetings in April.

Grain and oilseed markets have been under pressure in the recent week, which probably only lends support to the cattle complex. While wheat and soybeans rebounded well off their lows on Friday, corn contracts closed near session lows. I could see March KC wheat possibly reaching $5.23 area, which is the 38.2 percent Fibonacci retracement level as well as the 9- and 20-day moving averages. The $5.29 ½ level is also the crossover of the 50- and 100-day moving averages, which is also possible, but with rains coming to the Southern Plains, the rally may stall if those forecasts perform. Despite strong corn exports, there is growing concern that the economics for spring planting favor corn over soybeans. Softer energy markets and uncertainty over US biofuel mandates are keeping optimism subdued for corn futures.

The USDA releases its monthly supply and demand reports on Monday, January 12th with grain stocks and winter wheat planting reports out at the same time. The trade will be highly anticipating these reports given both a lack of data and questions around the accuracy of prior released data due to the extended government shutdown and agency staff reductions due to DOGE. The next funding deadline for the US government is on January 30th and so it could be déjà vu all over again soon.

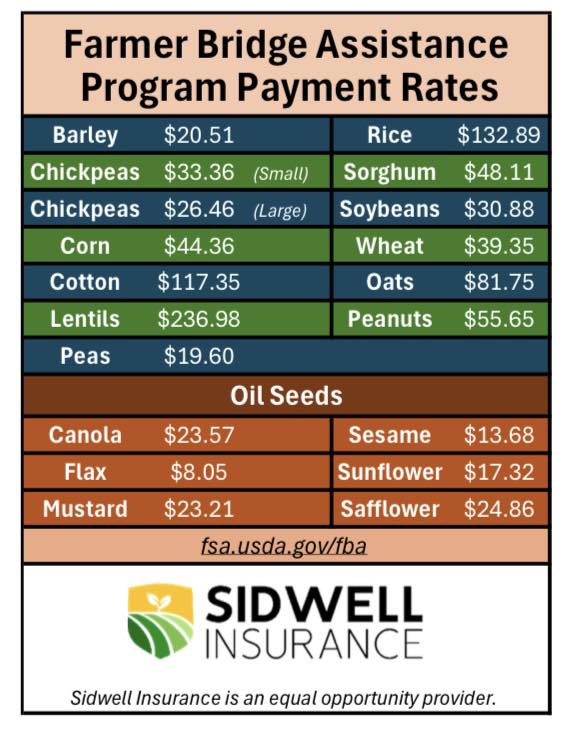

The Trump Administration finally announced specific bridge payments by crop on the last day of 2025. These payments by crop on a per acre basis are below.

We often see an early January rally in markets followed by choppy trade. This seems to apply across asset classes and not just commodities with New Year optimism soon thereafter fading. Next week is packed with economic data that will be important for the broader market to buck this trend.

President Trump is expected to make the announcement for the new Fed Chair this month, which will be some news for the market. However, the FOMC is a committee and so it doesn’t cement any outcome on interest rate expectations per se, but will likely be reacted to nonetheless. Chair Powell’s term officially ends on May 15, 2026. The recently released FOMC meeting minutes from the December rate cut showed that it was a much closer call than many expected. Weaker jobs data would favor interest rate cuts while inflationary pressures would favor a pause. We will have to wait and see which of these factors outweigh the other in coming interest rate decisions that will be critical to the overall economy outlook in the year ahead.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)