/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Alphabet (GOOG) (GOOGL) stock has delivered significant gains, climbing 66% in 2025 and comfortably outperforming many of its Magnificent Seven peers. This surge reflects growing investor confidence in Google’s ability to translate its artificial intelligence (AI) capabilities into durable growth, particularly as competition in AI intensifies.

A key reason behind the stock’s rally is renewed confidence in Google’s AI strategy. The company’s steady progress in AI, especially the launch of Gemini 3, has strengthened Alphabet’s competitive positioning, easing concerns that Google was falling behind and positioning the company as a serious, competitive force.

Hardware has also emerged as a significant growth lever for the company. In October, Alphabet announced an agreement with Anthropic, the developer of Claude, granting access to up to 1 million of Google’s custom Tensor Processing Units (TPUs). This multi-billion-dollar deal reflects rising demand for Google’s in-house AI chips.

At the same time, The Information reported that Alphabet may begin selling its TPUs to Meta (META). If realized, it would broaden Alphabet’s AI monetization beyond software and cloud services, adding a high-growth revenue stream while deepening its role in AI infrastructure.

Taken together, these developments have boosted Alphabet stock higher and positioned it well to deliver strong growth ahead.

AI-Driven Momentum Sets the Stage for Growth in 2026

The momentum built in 2025 in Alphabet’s business is likely to carry into 2026, with AI acting as a key growth catalyst across Search and Cloud.

In Search, features such as AI Overviews and AI Mode are driving higher engagement, enhancing the user experience while strengthening the monetization potential of Google’s core business. Moreover, in the Google Cloud business, its end-to-end enterprise AI portfolio is translating into accelerating growth.

The Cloud segment continues to benefit from its AI-optimized technology stack, which includes custom-built TPUs and some of the industry’s most advanced AI models. In the third quarter, Cloud revenue rose 34% year-over-year to $15.2 billion, with Google Cloud Platform (GCP) growing significantly faster than the segment overall. This growth is being driven primarily by enterprise AI products, which are now generating billions of dollars in quarterly revenue.

Looking ahead, the demand environment suggests further acceleration. Google Cloud is adding new customers at a rapid pace, with the number of new GCP customers increasing nearly 34% year-over-year (YoY) in the third quarter. At the same time, deal sizes are expanding. Through the first nine months of the year, Alphabet signed more contracts exceeding $1 billion than it had in the previous two years combined. These large, long-term commitments point to growing confidence among enterprises in Google’s AI and cloud capabilities.

Equally important is the deepening of existing customer relationships. More than 70% of current Google Cloud customers are already using AI products, indicating strong cross-selling opportunities and higher lifetime customer value. Within GCP, demand remains robust across enterprise AI infrastructure such as TPUs and GPUs, AI-powered solutions built on Google’s models, and core cloud services, including cybersecurity and data analytics.

To support this growth, Alphabet is continuing to invest aggressively in TPU capacity to meet surging demand from customers and partners. Moreover, the segment’s backlog remains strong, rising 82% YoY to $155 billion by the end of the third quarter. This expanding backlog provides strong revenue visibility and a solid foundation for sustained growth.

Overall, Alphabet’s AI-driven strategy is strengthening its competitive position across multiple businesses. With Search engagement improving, Cloud scaling rapidly, and enterprise demand for AI showing no signs of slowing, the company appears well-positioned to sustain its momentum into 2026 and beyond.

Is GOOGL Stock a Buy for 2026?

Alphabet's diversified and resilient AI-driven growth engine, expanding backlog, larger deals, and deepening enterprise relationships position it well to deliver strong growth in 2026. This momentum in its business could continue to support further gains in its stock price.

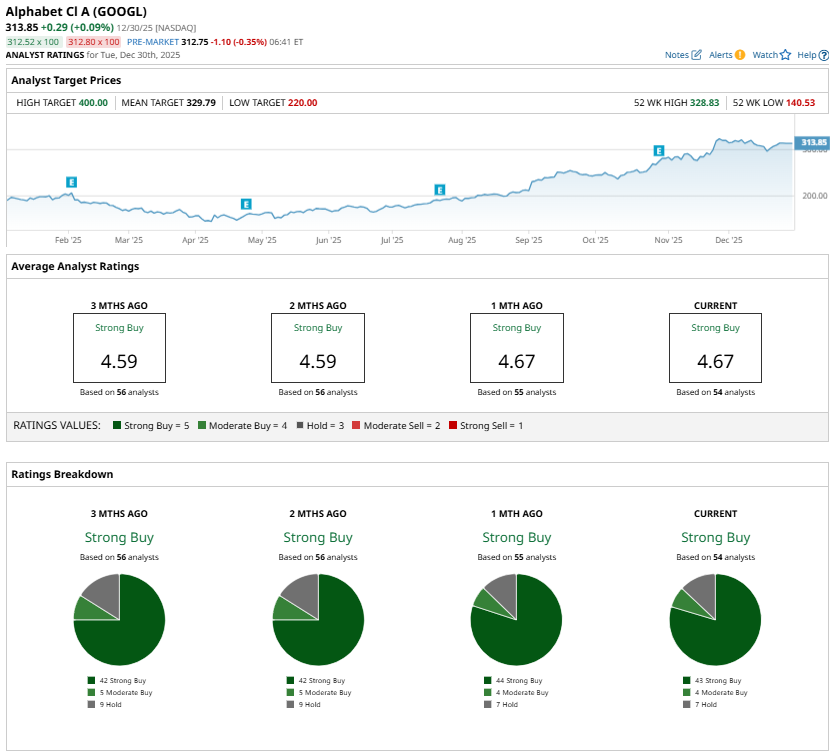

Even after the stock’s strong rally, analysts continue to favor Alphabet, with GOOGL carrying a “Strong Buy” consensus rating. This reflects Wall Street’s confidence in the company’s AI-led strategy.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)