/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

The artificial intelligence trade is one that most investors would agree defined 2025. With a similar outlook expected for 2026, one should consider the impact AI is expected to have on overall GDP growth. I do think companies driving the ball forward in this part of the economy will continue to be looked up to as potential winners in the New Year.

With more and more attention now being paid toward so-called “picks-and-shovels” plays in the AI space (those companies providing the infrastructure and technology to support the AI revolution from the back end), I do think that companies like NetApp (NTAP) could be atop many investor watch lists. Overlooked names like NTAP could win big from the AI trade running hot again in 2026.

Let's dive into why NTAP stock could be a top pick for investors in January.

The Bull Case for NetApp Relative to Other AI Stocks

For starters, NetApp's stock chart isn't as pretty as a number of other top AI stocks in this market. In fact, in some respects, I'd argue this chart is pretty ugly in the grand scheme of things. Down nearly 7% on a year-to-date (YTD) basis, there are plenty of other AI stocks in this market with better charts to consider, and that's something this company is undoubtedly contending with when it comes to fresh capital flows into this stock.

Now, when we zoom out from this stock's lows in April, it's worth noting that NetApp has made a nice move higher, surging around 50% off those levels. That said, the volatility this stock has displayed highlights just how important market timing and sentiment have become with owning these names. Outside a few investors who are willing to buy and hold for the very long term, near-term sentiment swings can mean a great deal for this cloud services and data storage provider. Despite strong tailwinds tied to the ongoing AI data center infrastructure buildout, it's also true that concerns around the absolute spending levels of companies on these endeavors could result in some volatility. And for key players like NetApp that carry significant valuation premia.

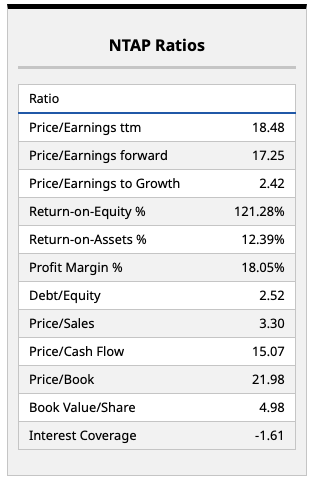

Looking at NetApp's fundamentals above, it's clear that's probably at least part of the story in terms of how this stock has performed thus far. This has to do with its margins, which are relatively low at around 18% compared to other cloud players. That said, with a sky-high triple-digit return on equity metric, as well as a price-sales multiple that's just 3.3 times (actually cheap for any AI-related stock), and a forward price/earnings ratio of just 17 times. I'd say this stock is favorably valued in the universe of AI stocks investors have to choose from.

What Do the Analysts Think?

There's a broad range of analyst opinions on NTAP stock, with a low price target of $110 per share (right around where this stock is trading right now) and a high target of $137 per share. With a consensus target of $124.47 per share on NTAP stock, this company could have upside of more than 15% from here if Wall Street analysts are correct in their assumptions around this company.

I do think the whole AI data center buildout narrative is one that should continue to garner plenty of attention in the New Year. Meaning, the recent momentum NetApp has seen could materialize into a continuation of the bullish trend we've seen in this company's capital appreciation performance of late. Combined with the aforementioned fundamentals, which can really only be viewed as a net positive, this is one of the top AI-related names I think has become oversold, even after its rally from April lows.

I'd go so far as to say the high price target on the Street may not effectively capture NetApp's potential over the next 12-18 months. If I were setting a target on this stock, it would be closer to $150 over the same time frame. But that's just me.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.