/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Investor excitement around space stocks has been building rapidly as President Donald Trump renews his push for U.S. leadership in space and pledges a return to the Moon before the end of the decade. That rhetoric has helped lift the entire space technology sector, sending shares of both well-known names and obscure microcaps higher.

One of the beneficiaries of this shift has been Sidus Space (SIDU), a little-known microcap that has seen its shares soar as optimism around Trump’s space agenda spreads across the sector. Recent headlines around defense contracts and capital raises have only added fuel to the move. But beneath the excitement lies a critical question for investors: does a more aggressive U.S. push toward the Moon actually translate into meaningful financial upside for Sidus Space—or is the stock simply being swept higher by speculation and short-term momentum? Let’s take a closer look!

About Sidus Space Stock

Valued at a market cap of $94.1 million, Sidus Space operates across the commercial space, aerospace, and defense sectors. The company acts as a space mission enabler, offering services that span satellite design, manufacturing, and data collection. Its flagship product, LizzieSat, is a 3D-printed, multi-mission satellite built for flexibility and cost efficiency, with the ability to integrate new technologies to support a wide range of mission needs. The company also provides AI-driven Data-as-a-Service (DaaS) through its Orlaith AI ecosystem, which features proprietary FeatherEdge and Cielo platforms for processing and delivering space-based data insights.

Shares of the innovative space and defense technology company have dropped 27% on a year-to-date (YTD) basis. However, SIDU shares have spiked more than fourfold over the past month, largely driven by three key catalysts that I’ll outline below.

Why Sidus Space Stock Skyrocketed This Month

On Dec. 22, SIDU stock nearly doubled after the company announced it had secured a contract under the Missile Defense Agency’s (MDA) Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) program. The SHIELD contract supports President Trump’s plan for the “Golden Dome” for America's missile defense system. The indefinite-delivery/indefinite-quantity (IDIQ) contract has a ceiling value of $151 billion. Notably, securing a spot on the IDIQ makes Sidus Space eligible to compete for future task orders as the MDA defines work requirements, but it does not guarantee any revenue on its own.

“This milestone reflects our ability to deliver integrated solutions across multiple domains and demonstrates the strength of our approach to building long-term capability within the defense sector,” said Carol Craig, founder and CEO of Sidus Space.

Earlier, on Dec. 19, SIDU shares jumped more than 35% after President Trump signed an executive order titled “Ensuring American Space Superiority,” which formally calls for a U.S. return to the lunar surface by 2028, aligning with the final year of his second term. The directive represents an update to his first-term 2017 space policy, which had originally targeted 2024 for a human landing before facing delays.

Sidus Space took advantage of its stock surge by pricing two public offerings. The first offering closed last Wednesday, raising roughly $25 million in gross proceeds, while the second closed on Monday and generated about $16.2 million. Interestingly, SIDU shares sold off after the first offering was announced but rebounded once it closed, and the same pattern played out following the second offering. This suggests investors shifted their focus to the company’s long-term growth prospects, betting that the fresh capital will be used to fund future expansion. The company said it plans to deploy the new capital toward sales and marketing, operating expenses, product development, manufacturing expansion, working capital, and general corporate purposes.

Such capital raises are especially critical for companies generating only modest revenue while continuing to burn cash, and in SIDU’s case, the timing could hardly have been better. In the third quarter, the company’s revenue stood at $1.3 million, down 31% year-over-year (YoY). The revenue decline reflected a strategic pivot away from legacy services toward new commercial models. At the same time, its net loss widened 55% YoY to $6.0 million. The company held $12.7 million in cash as of Sept. 30, while cash burn totaled $14.1 million over the first nine months of the year, equating to roughly $4.7 million per quarter. However, following the recent capital raise, the company’s liquidity position appears solid.

Space Stocks Post Strong Year With Further Upside Likely Amid U.S. Lunar Mission Push

SIDU’s stock gains have come amid a favorable backdrop for space technology companies. The sector has had a strong year, buoyed by rising excitement around a potential SpaceX IPO, increased launch activity, and President Trump’s executive order calling for a U.S. return to the Moon by 2028. Newly appointed NASA Administrator Jared Isaacman said on CNBC last Friday that the U.S. will return to the Moon during President Trump’s second term. Isaacman told CNBC’s “Closing Bell Overtime” that Mr. Trump’s renewed commitment to lunar exploration is critical to unlocking what he called the “orbital economy.” “We want to have that opportunity to explore and realize the scientific, economic, and national security potential on the moon,” Isaacman said.

Isaacman said lunar opportunities include building space-based data centers and infrastructure, along with the potential extraction of Helium-3, a rare gas embedded in the moon’s surface that could one day serve as a key fuel for fusion power. He added that once a “moon base” is established, NASA would look to invest in nuclear power and space-based nuclear propulsion to support further exploration. NASA is currently working with multiple contractors, including SpaceX, Blue Origin, and Boeing (BA), as part of its Artemis campaign, which is focused on returning to the Moon and laying the groundwork for future missions to Mars.

Meanwhile, Sidus Space serves as a key subcontractor to Collins Aerospace on NASA’s $3.5 billion Exploration Extravehicular Activity Services (xEVAS) contract, helping develop next-generation spacesuits and hardware for the ISS and Artemis lunar missions. It also supports lunar exploration through other NASA programs such as the Intuitive Machines-led RACER lunar rover team. Earlier this month, Sidus Space announced it was serving as a subcontractor to MobLobSpace under a NASA Small Business Innovation Research (SBIR) award focused on improving orbital debris monitoring. It’s also worth noting that this year, Sidus Space completed on-orbit operations of its advanced onboard edge computer, FeatherEdge GEN-2, integrated into the ongoing commissioning of LizzieSat-3.

Does the U.S. Lunar Mission Push Make SIDU Stock a Buy?

Undoubtedly, the U.S. push to return to the Moon provides a positive backdrop for the entire space sector. However, it appears the key catalyst currently driving Sidus Space shares is the company’s inclusion on the SHIELD contract. In any case, I don’t view SIDU stock as a “Buy” at current levels. Buying the stock now would amount to chasing a rally, which is rarely a good idea, and the recent surge appears driven largely by speculation and short-squeeze dynamics rather than underlying fundamentals. That’s because neither a renewed commitment to lunar missions by the Trump administration nor inclusion on the SHIELD contract guarantees a direct financial impact.

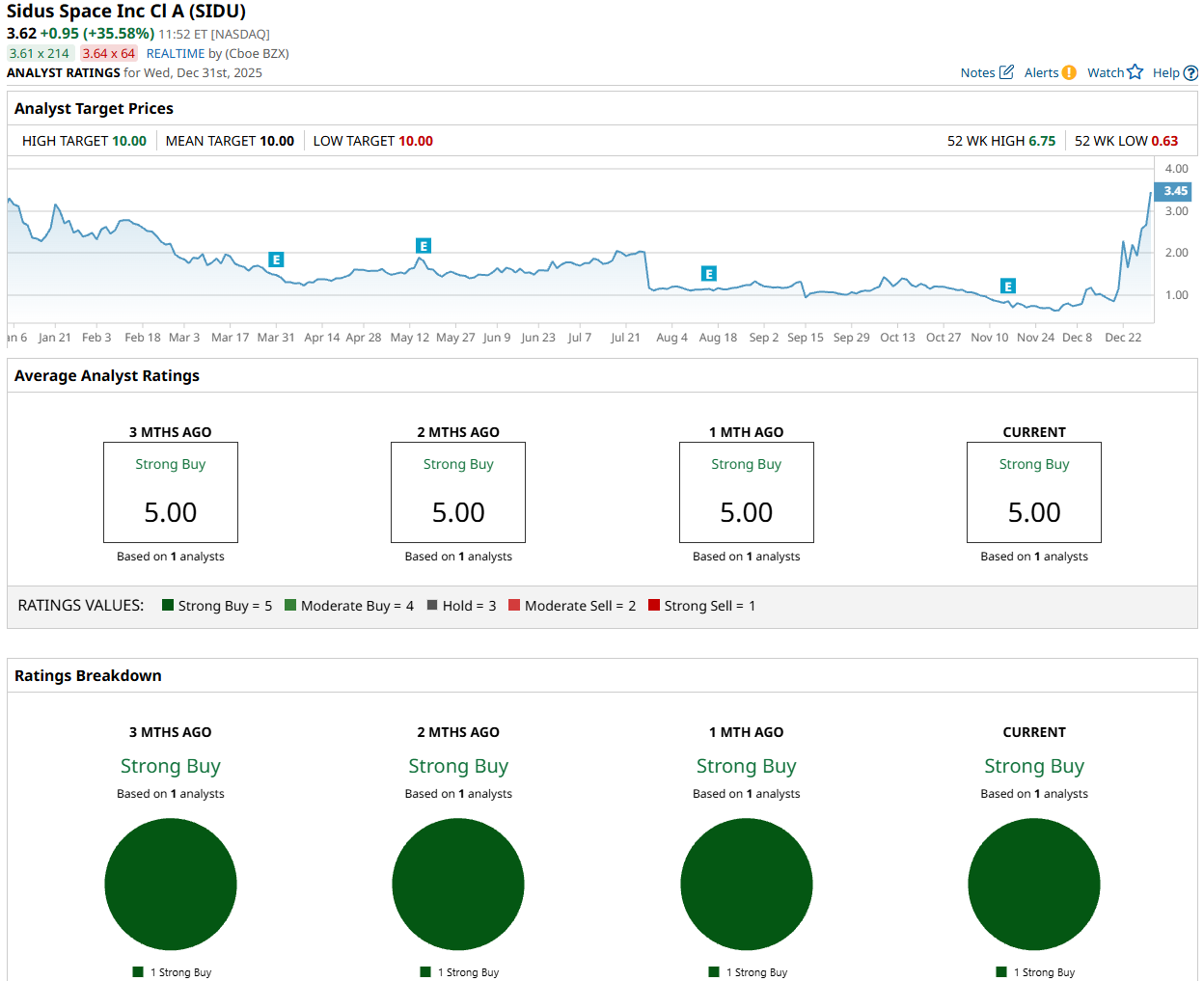

Sidus Space has light coverage on Wall Street, with just one analyst following the stock and assigning it a “Strong Buy” rating. The analyst’s bullish stance is also reflected in SIDU stock’s $10 price target, which implies upside potential of more than 270%.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.