Please join Sean Lusk and Ben Di Costanzo for our last grain and livestock webinar for the year tomorrow December 30th at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

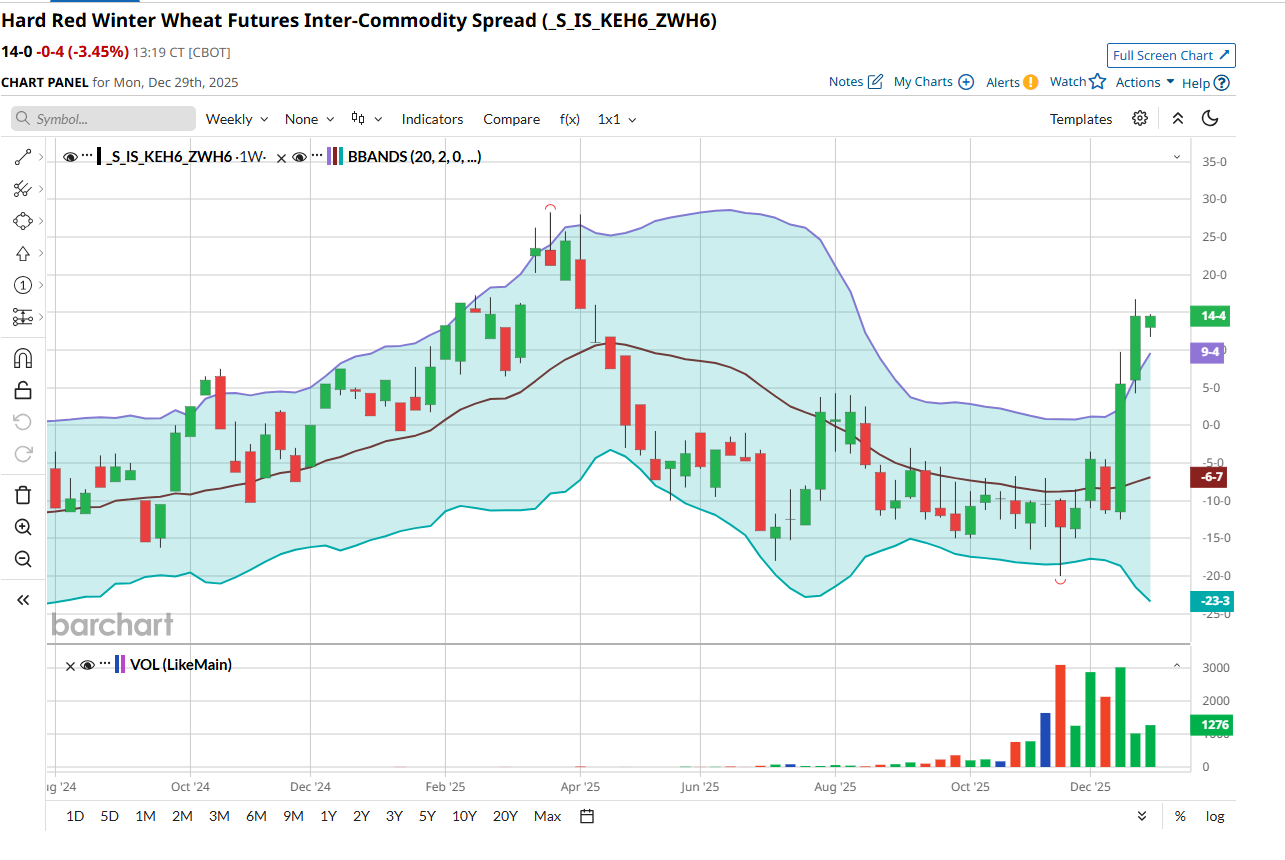

The wheat markets started the last trading week of the year with moderate losses. This could have been the result of year end profit taking that impacted several markets, with the metals seeing the worst losses. Weekly wheat export inspections totaled 11.1M bushels which just edged out top end of estimates ranging 4-11M bu. KC and Chicago both closed lower while MGX held steady bulk of the day. I have been watching Kc vs Chicago lately as Kc finally has traded back to a premium vs Chicago and looked like a potential breakout on the chart in my view. The bulk of the US Southern Plains (KC wheat areas) remains warmer and drier over the coming days which will need to be watched after the prolonged dryness seen. I think that is one reason KC went bid vs Chicago a few weeks prior, with the rally starting at the end of November. Look for values to remain in a holding pattern short-term until we get past the low volume holiday. Below is March KC vs Chicago wheat. Today, we settled at 14.2 cents March KC over. Last yar we saw this spread stay bid until any weather threat evaporated. That tells me this spread could possibly rally 30 cents KC over at some point this winter or it moves quickly back to parity vs Chicago. While the President touted some success with Ukraine over the weekend, Russia continues to fire missiles into Ukraine in the latest series of attacks. The war in my view still feels very far from over. Weather rules here for this inter market spread deep into January.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)