/Green%20hydrogen%20by%20Scharfsinn%20via%20Shutterstock.jpg)

Plug Power (PLUG) stock has been a major disappointment for investors since early October, but there’s reason to assume that 2026 will prove its much-anticipated redemption.

The hydrogen fuel cell specialist expects to break even on gross margin by the middle of next year, which may drive institutional capital to PLUG next year.

At more than 50% below the year-to-date high, Plug Power shares are attractively valued for 2026.

What Makes Plug Power Stock Worth Owning for 2026?

PLUG’s push into the data center market adds a compelling new dimension to its growth story.

The Nasdaq-listed firm has already started monetizing electricity rights, and is committed to serving as a reliable backup provider for that energy-intensive industry.

If successful, this foothold could evolve into primary power supply contracts – opening a lucrative revenue stream beyond its traditional clean-energy applications.

With hyperscale data centers demanding resilient, low-carbon energy, Plug Power Inc’s technology aligns perfectly with industry requirements.

This strategic pivot bolsters PLUG stock’s long-term outlook and offers investors a fresh catalyst for upside.

Craig-Hallum Reiterates ‘Buy’ Rating on PLUG Shares

In its current financial quarter, Plug Power is expected to lose $0.11 on a per-share basis, a 93% year-over-year improvement, signaling the company is making progress towards profitability.

That’s part of the reason why Eric Stine – a senior Craig-Hallum analyst – continues to recommend buying this clean energy stock for the coming year.

In his latest research note, Stine cited the firm’s letter of intent with HY2gen for the installation of a 5MW PEM electrolyzer at Sunrhyse for his bullish view as well.

From a technical perspective, Plug Power shares’ short-term relative strength index (9-day) sits at about 37 only, indicating the bearish momentum is near exhaustion heading into 2026.

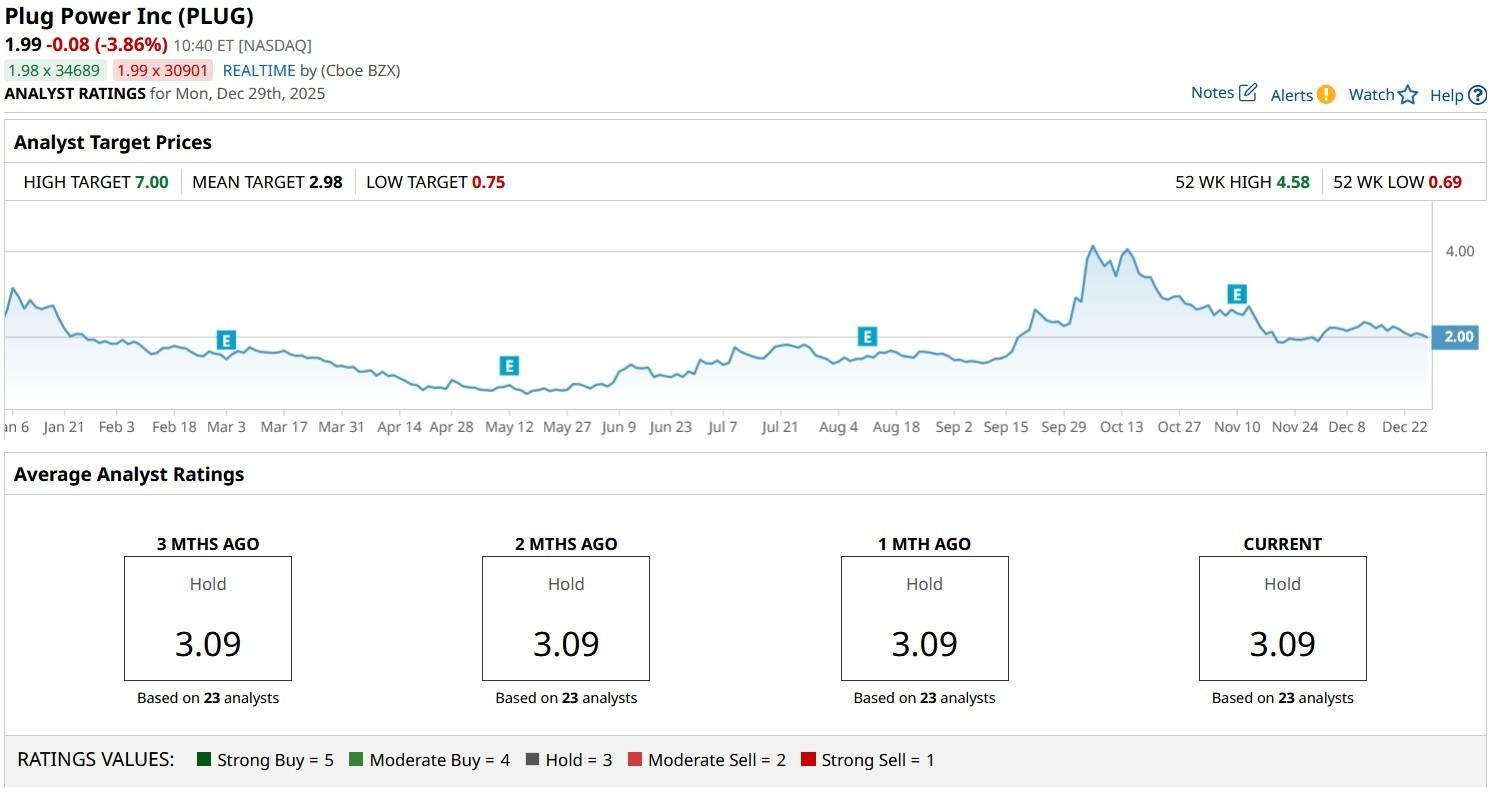

What’s the Consensus Rating on Plug Power?

Investors could also take heart in the fact that Craig-Hallum isn’t the only Wall Street firm keeping bullish on PLUG shares for the coming year.

According to Barchart, while the consensus rating on PLUG stock currently sits at “Hold” only, the mean target of about $2.98 suggests potential upside of more than 45% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)