/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

Nvidia (NVDA) has successfully positioned itself as the global face of artificial intelligence (AI). Still, a different large-cap AI stock actually outperformed it in 2025 – enter Micron (MU).

An unprecedented AI-driven demand for NAND and DRAM memory chips helped MU stock more than quadruple over the past eight months.

Still, Morgan Stanley analysts believe Micron shares will push significantly higher from here next year.

Is It Too Late to Invest in Micron Stock?

Micron is one of the only three companies that make high-bandwidth memory (HBM) that’s widely used in AI applications, the other two being Samsung and SK Hynix.

However, it’s much more aligned with President Donald Trump’s broader commitment to onshore manufacturing since neither of the other two are based in the U.S.

And that, in itself, is a bull case of sorts.

Earlier in December, the company posted a better-than-expected quarterly release, reinforcing its stature as “an essential artificial intelligence enabler.”

In fact, Morgan Stanley analysts dubbed is Q1 top- and bottom-line growth “the best in the history of US semis,” strengthening the case for owning it heading into 2026.

Where Options Data Suggests MU Shares Are Headed

Despite the explosive recent rally in Micron shares, options data remains skewed to the upside for 2026.

According to Barchart, contracts expiring March 20 currently have the upper price set at nearly $342, indicating MU stock could rally another 20% over the next three months. The put/call ratio for those contracts is 0.41, indicating the bullish tilt.

More importantly, the Boise-headquartered firm is currently trading at a forward price-earnings (P/E) multiple of about 9x only, well below some of the other best-of-breed artificial intelligence names, including Nvidia at north of 40x.

Wall Street Remains Bullish on Micron

Investors should also note that Morgan Stanley isn’t the only Wall Street firm that’s recommending owning Micron stock heading into 2026.

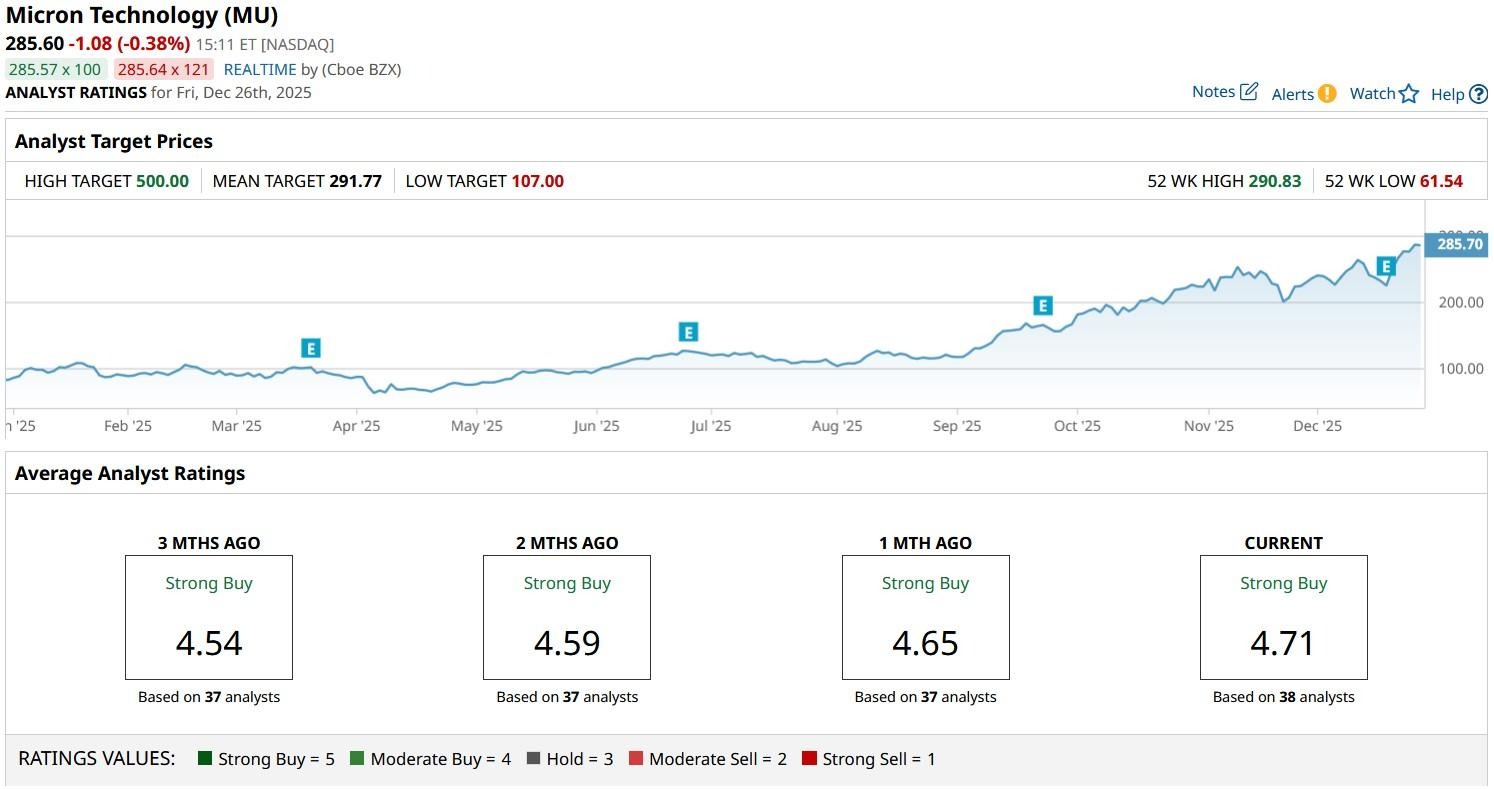

According to Barchart, the consensus rating on MU shares sits at “Strong Buy” with price targets going as high as $500 indicating potential upside of roughly 70% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)