It is quite uncommon to compare the business fundamentals of Enterprise Products Partners LP EPD and ConocoPhillips COP. Although both are large energy players, their business models are different. While Enterprise Products is a midstream energy giant, COP is a leading exploration and production company.

However, such a comparison becomes relevant now, as oil prices are expected to remain relatively soft next year. This outlook heightens the need for investors to weigh the relative merits of midstream stability versus upstream exposure when choosing between these two energy players.

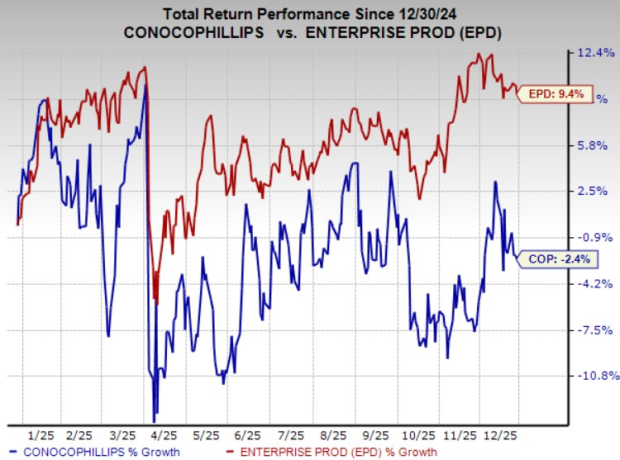

Looking at the one-year price chart, EPD has surpassed COP. Over the period, EPD has jumped 9.4%, surpassing COP’s 2.4% decline. However, before concluding which stock will outperform in 2026, we need to analyze the stock’s fundamentals and oil pricing environment in detail.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Oil Price Likely to be Low in 2026

The U.S. Energy Information Administration (“EIA”), in its latest short-term energy outlook, stated that the spot average price of West Texas Intermediate crude will be $65.32 per barrel this year, lower than the $76.60 per barrel recorded last year. For 2026, EIA expects the commodity price to decline further to $51.42 per barrel. EIA stated that rising worldwide oil inventory will hurt the commodity price.

With the advent of advanced drilling techniques like horizontal drilling and hydraulic fracturing (fracking), the cost of operations in oil and gas resources has declined considerably over the years, leading to low breakeven costs. Thus, although oil prices will likely be soft next year, the cost of operations for exploration and production activities might be profitable.

Strong Lower 48 Presence to Aid ConocoPhillips

ConocoPhillips has a strong presence in the Lower 48, which comprises the Permian – the most prolific basin in the United States – Eagle Ford and Bakken. The company’s acquisition of Marathon Oil late last year has further bolstered its footprint in the prolific Lower 48.

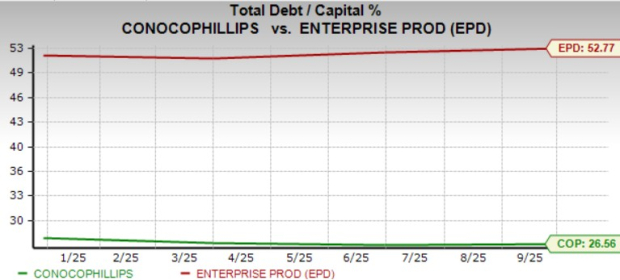

The breakeven costs in the resources are low, and hence will likely enable COP to sail through the business environment when oil prices are expected to turn low next year. COP can also bank on its strong balance sheet, as reflected in its debt-to-capitalization of only 26.6%, to sail through the low oil price business environment next year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

EPD’s Inflation-Protected Contracts

Enterprise Products, a top-tier North American midstream service provider, boasts a vast and diversified asset portfolio. The partnership’s pipeline network spans more than 50,000 miles, transporting oil, natural gas and other commodities. The partnership also has more than 300 million barrels of liquid storage capacity, which is expected to continue generating stable cash flows through 2026 and beyond.

Importantly, the business model of Enterprise Products is inflation-protected because almost 90% of its long-term contracts include a provision for increasing fees when the business environment becomes inflationary. This is how the midstream energy player is able to safeguard its cash flow generation in all business scenarios.

EPD also expects incremental cash flows from its key capital projects, including Mentone West 2, Athena and others, which are expected to come online next year. Thus, with the partnership’s business model mainly being inflation-protected and likely to generate incremental cash flows from project backlogs, the stock could be attractive for income seekers.

COP or EPD: Which Stock Will Gain in 2026?

Given that the oil pricing environment will likely be soft next year, risk-averse investors can stay invested in Enterprise Products, considering the stable business model of the partnership. However, those who want to play with a little more risk can hold onto ConocoPhillips.

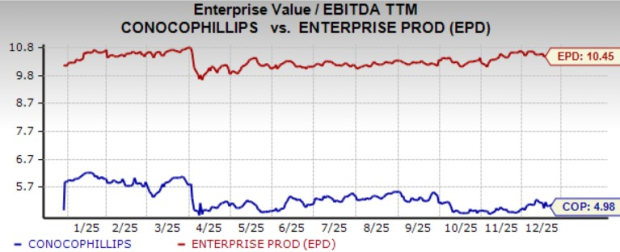

The valuation story is also revealing this picture, with investors currently assigning a higher premium to EPD than to COP. Enterprise Products is currently trading at a 10.45x trailing 12-month Enterprise Value to Earnings Before Interest, Taxes, Depreciation and Amortization (EV/EBITDA), which is at a premium compared with the broader industry average of 4.98x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Both firms currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP): Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)