Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

In the weeks since cocoa was added to the upcoming January rebalancing schedules for the Bloomberg Commodity Index (BCOM) and S&P GSCI, traders have been watching closely for confirmation that passive flows were beginning to influence price. That confirmation is now visible—not only in the magnitude of recent gains, but also in how the market is behaving technically. While the initial article focused on the scale of required index buying, the latest price action shows that cocoa has shifted from a steady downtrend into a transition phase where flow-driven demand is starting to overwhelm selling pressure.

Updated Index Buying Estimates: Still a Major Shock

The latest projections now call for approximately 37,400 cocoa futures contracts to be purchased during the January rebalance window.

- Required buying: ~37,400 contracts

- Share of open interest: ~31% of total OI

- Execution window: Concentrated in early January

Even with modest revisions from earlier estimates, the scale remains extraordinary. A requirement equal to nearly one-third of total open interest represents a structural imbalance that few commodity markets can absorb without meaningful price adjustment.

What the Chart Is Telling Us Now

The accompanying chart adds important context to the flow story. For much of the past year, cocoa traded within a well-defined downward trend, with rallies consistently capped by a descending trendline and the 50- and 100-day moving averages. That trendline defined seller control. Over the past few weeks, that structure has changed.

- Price has broken above the primary downtrend line, signaling a shift in market character.

- The market has stabilized above short-term moving averages, suggesting selling pressure has eased.

- Pullbacks since the breakout have been shallower and more controlled, rather than impulsive.

This type of technical transition is typical when non-economic buyers—such as index-linked funds—begin to exert influence. Unlike discretionary traders, passive flows are insensitive to price and tend to compress volatility temporarily before producing larger directional moves. Importantly, the market has not accelerated vertically. Instead, cocoa appears to be absorbing supply while building a base, which often precedes stronger continuation once the bulk of forced buying begins.

Why the Move May Still Be Early

Despite the recent stabilization and breakout:

- Most index-linked buying has not yet occurred.

- Discretionary positioning remains relatively light, suggesting many traders are still under-allocated.

- Commercial selling has not meaningfully expanded, limiting natural resistance to incoming flows.

From a structural standpoint, the market has transitioned from trend exhaustion to flow anticipation. Historically, this is the phase where volatility compresses before expanding again as execution windows narrow.

Hedge Fund Positioning Remains a Powerful Tailwind

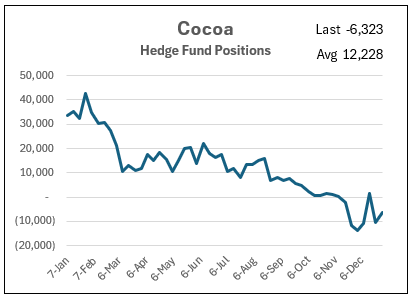

Another factor reinforcing the upside risk is speculative positioning. Despite the recent rally, hedge funds remain meaningfully under-positioned in cocoa. Current estimates show hedge funds net short approximately 6,323 contracts, a stark contrast to the 52-week average net long position of about 12,228 contracts. In other words, positioning is nearly 18,000 contracts lighter than average, even as prices have already begun to respond to anticipated index flows.

This matters for two reasons. First, it confirms that the recent advance was not driven by crowded speculative longs—it occurred while positioning was still depressed. Second, it leaves substantial room for discretionary funds to reverse from short to long as the index rebalancing approaches. If hedge funds begin covering shorts or building long exposure alongside forced passive buying, the incremental demand could materially amplify price pressure in an already thin market.

Key Variables to Watch Going Forward

Several factors will determine how aggressively price responds from here:

1. Pace of Front-Running - The recent breakout suggests early positioning is underway, but not yet crowded. Acceleration would signal broader participation.

2. Commercial Response - If producers and merchants increase forward selling into the roll, it could temper the move. A lack of supply response would amplify price pressure.

3. Volatility Re-Expansion - Once index execution begins in earnest, price sensitivity often increases as liquidity thins and order flow becomes one-sided.

Bottom Line

Cocoa has moved from theory to execution.

- ~37,400 contracts still need to be purchased

- ~31% of total open interest

- A narrow, calendar-driven execution window

The chart confirms that the market is already responding—breaking its prior downtrend and stabilizing as buyers gain control. If this technical shift is occurring before the bulk of index buying begins, the coming weeks could bring renewed volatility and upward pressure as forced demand meets limited supply. This remains one of the clearest examples of a flow-driven setup in the commodity complex heading into year-end.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)