/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

When investing in artificial intelligence (AI) stocks, individuals tend to focus on the large, mega-cap stocks that are all the rage, yet the next wave of AI may more comfortably benefit smaller infrastructure businesses. As capital shifts from model development to deployment, people are demanding more cloud capacity, superior compute power, and AI-ready data centers, making the demand hot.

One quietly notable name that has been catching Wall Street's eye is Nebius (NBIS). Wedbush analyst Dan Ives just listed NBIS as his top AI infrastructure pick for 2026, arguing the company’s positioning and tech make it a likely acquisition target for a hyperscaler such as Microsoft (MSFT), Alphabet (GOOG) (GOOGL), or Amazon (AMZN).

For investors looking beyond the obvious AI leaders, here’s a closer look at why NBIS is drawing bullish attention heading into 2026.

About NBIS Stock

Based in Amsterdam, Nebius provides full-stack cloud and GPU-accelerated AI infrastructure across Europe and North America. It builds sustainable data centers and rents AI‑optimized compute clusters with liquid cooling and high‑power GPUs to hyperscalers and enterprises. The company emerged from a restructuring of the former Yandex infrastructure business and now combines its core AI cloud service with subsidiaries in autonomous vehicles and education technology.

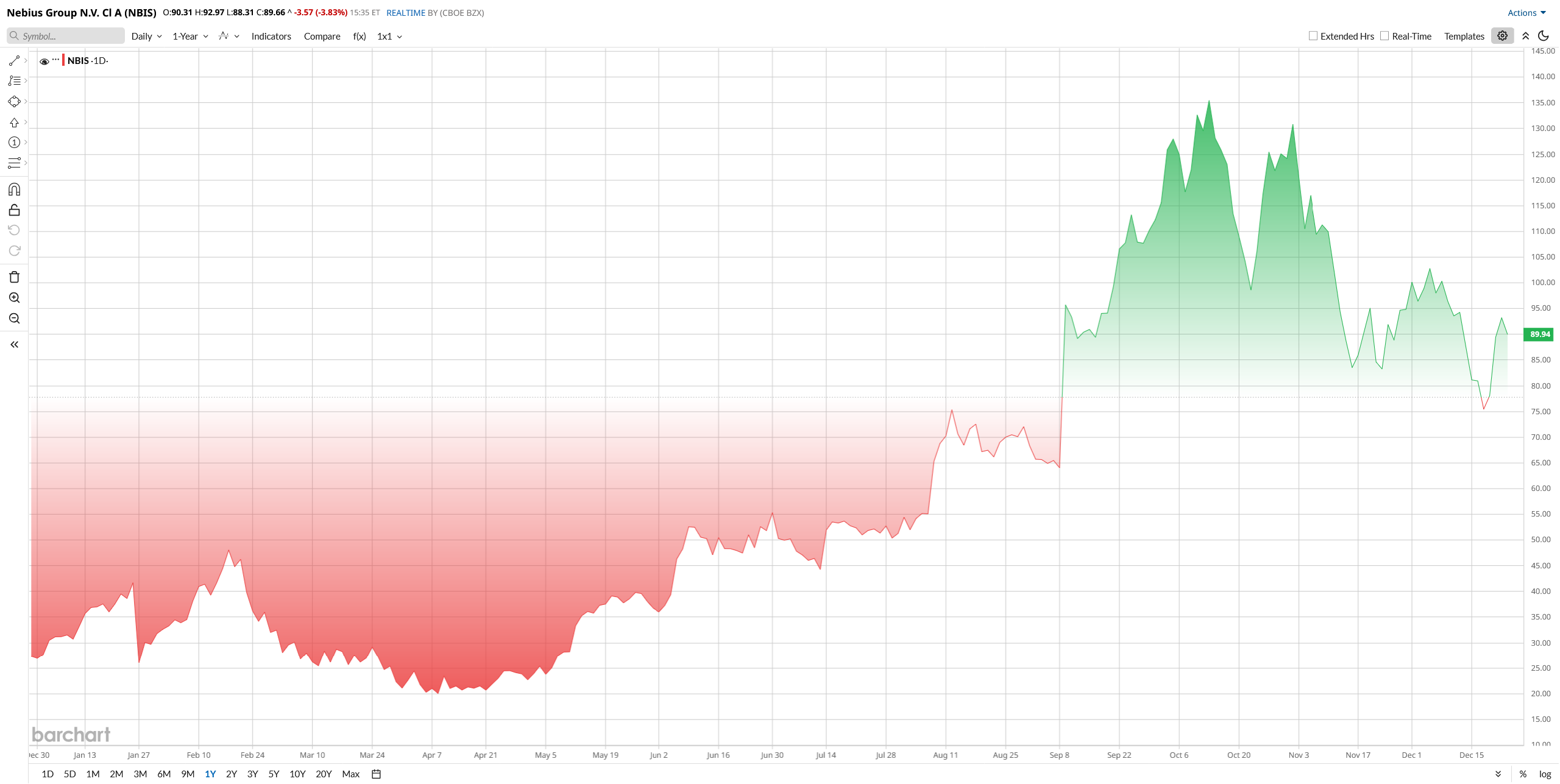

Valued at around $23 billion by market cap, NBIS stock has been stellar this year. After languishing post-restructuring, the shares rallied over the summer, in part when Nvidia (NVDA) disclosed a stake in the company, peaking above $140 by October. A surge in new contracts with tech giants, such as Microsoft and Meta (META), further fueled investor enthusiasm. Until now, Nebius has gained roughly 225% year-to-date (YTD), despite a pullback from the recent high.

That performance comes with clear trade-offs. Nebius now trades at valuation levels that leave little room for error. Its trailing price-to-sales multiple sits in the mid-50s, far above the sector median, which trades closer to 4x, and its own 5-year historical average, which sits at 24x.

In short, the market is pricing Nebius as a future cornerstone of AI infrastructure. That may prove correct, but it also means any slowdown in contract growth, pricing pressure, or capital-spending misstep could weigh heavily on the stock. At today’s levels, execution matters as much as vision.

Impact of Ives’ Acquisition Thesis

Dan Ives’s endorsement, calling Nebius “ripe” for a 2026 acquisition by a hyperscaler, gave the stock a short-term boost. The day his comments were publicized, NBIS spiked about 14% following the news. Investors interpreted it as validation of Nebius’s strategic value. Ives specifically noted that among AI “neocloud” firms, Nebius is the most likely buyout candidate, which fueled positive sentiment.

For the company, this means fresh investor interest and higher trading volume, though it’s too early to say if any deal is imminent. In the near term, the news underscores Nebius’s industry stature; if true, a 2026 deal could be transformative. But even absent an actual acquisition, the hype helps spotlight Nebius’s core business and contracts, potentially improving access to capital.

Nebius Delivered Solid Revenue Yet Widened Losses

Nebius delivered a strong quarter in Q3 2025, posting revenue of $146.1 million, up 355% year-over-year (YoY), as demand for AI infrastructure surged and large new contracts came online. This growth was largely driven by strong uptake across its core AI infrastructure business, which now accounts for the vast majority of results.

Profitability, however, remains a work in progress. Nebius reported a GAAP net loss of $119.6 million, wider than a year earlier, reflecting aggressive expansion and rising depreciation tied to new data center capacity. But there was a bright spot below the surface. Adjusted EBITDA loss narrowed sharply to $5.2 million, a significant improvement from nearly $46 million last year, as higher revenue began to offset operating expenses.

On the other side, spending ramped up sharply as the company accelerated its buildout. Operating cash burn rose to $80.6 million, while capital expenditures jumped to nearly $1.0 billion in the quarter, underscoring how capital-intensive AI infrastructure has become. Even so, Nebius ended the period with a formidable $4.8 billion cash balance, supported by recent equity and debt raises, giving it ample firepower to execute its growth plans.

Looking ahead, management remains aggressive. Nebius is targeting an annualized revenue run rate of $750 million to $1 billion by the end of 2025 and plans to scale connected power capacity to 800 to 1,000 megawatts by 2026, with even more capacity already under contract.

CEO Arkady Volozh has said the company has effectively sold out its existing capacity, with future capacity already pre-committed. While losses are expected to persist in the near term, the strategy is clear: scale first, optimize later.

Recent Developments

Since the quarter's close, Nebius has continued to make headlines. On Dec. 17, it launched Nebius AI Cloud 3.1 featuring Nvidia’s new Blackwell ultra-power GPUs. The company said it is now “the first cloud in Europe to operate” these cutting-edge Nvidia GB300 and HGX B300 systems in production, a technical milestone for customers.

Nebius also highlighted its $3 billion AI infrastructure agreement with Meta (announced in September) as a revenue backlog boost. These announcements were viewed positively as further proof of Nebius’s scale and partnerships.

Analyst's Perspective on NBIS Stock

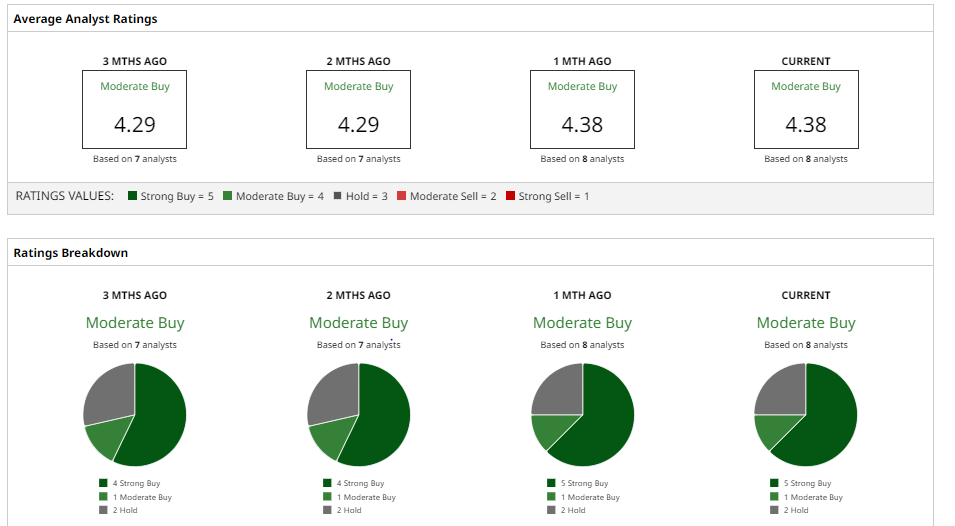

Wall Street remains broadly positive on NBIS stock, though analysts are clear about the risks. Goldman Sachs reiterated a “Buy” rating in November 2025 and raised its 12-month price target to $155, citing accelerating demand for AI infrastructure and improving visibility on large-scale contracts.

Similarly, D.A. Davidson also maintained a “Buy” with a $150 target, while CICC initiated coverage at $143, pointing to Nebius’ growing role in global AI compute buildouts.

Taken together, on average, the rating given by analysts is “Moderate Buy,” and the broader consensus sits at about $150, which implies roughly 70% upside potential, which shows analysts' confidence in Nebius’ growth trajectory rather than near-term profitability.

However, that optimism comes with caveats. Analysts consistently highlight Nebius’ rapid revenue growth and ability to secure large enterprise deals, but many also flag valuation as demanding. The investment case assumes smooth execution, disciplined capital spending, and sustained customer demand. Any stumble could weigh heavily on NBIS stock.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)