/Arista%20Networks%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

While investors chase the most obvious artificial intelligence (AI) winners, some of the most powerful opportunities are building quietly behind the scenes. As the AI boom shifts from hype to infrastructure, one overlooked player, Arista Networks (ANET), is emerging at the center of massive data flows, cloud expansion, and next-generation networks, positioning it to deliver outsized upside as AI scales.

Growth Fueled by AI Momentum

While much of the attention in AI has been on chips and models, companies that enable AI to develop are just as vital. Arista Networks creates networks that transfer massive volumes of data fast, safely, and efficiently between servers, GPUs, and storage, which is essential for AI training, inference, and cloud computing.

The importance of Arista’s business model led to the generation of nearly $2.31 billion in revenue in the third quarter, an increase of 27.5% year-over-year (YoY), driven by strong demand across cloud, AI, enterprise, and campus customers. Software and services accounted for 18.7% of revenue, highlighting the growing relevance of Arista's higher-margin solutions. Adjusted gross margin increased to 65.2%, thanks to a positive product mix and inventory benefits. Diluted EPS increased 25% YoY to $0.75. Deferred revenue increased to $4.7 billion, suggesting high demand and continuous product ramps, notably in AI-related use cases.

The Americas accounted for over 80% of revenue, with international markets accounting for approximately 20%. Management stressed that the scale of AI-driven network demand is unparalleled, with customers moving large amounts of data over increasingly complex, multi-planar architectures. Arista's success is built around its EtherLink portfolio, which offers a single point of network control for automation, security, traffic engineering, and telemetry. Arista's networks are designed to improve the efficiency of AI accelerators, ensuring that data moves faster and more reliably on a large scale. EtherLink fabrics are already powering some of the world's largest AI systems, giving full-line-rate performance with no hotspots even at petabyte scale.

Furthermore, the Ethernet Scale-Up Networking (ESUN) effort, which was created in partnership with industry experts through the Ultra Ethernet Consortium, intends to produce compatible standards for large-scale AI systems. EtherLink speeds are predicted to increase from 800 gigabits to 1.6 terabits in the near future.

A Quiet Force in an Explosive AI Trend

While Arista collaborates closely with Nvidia (NVDA), the company is deliberately building a broad and open ecosystem. Its partners also include AMD (AMD), Arm Holdings (ARM), Broadcom (AVGO), OpenAI, Anthropic, Pure Storage, and Vast Data, among others.

Management emphasized that AI infrastructure includes more than just compute. Compute, memory/storage, and networking must all work together seamlessly. Arista is attempting to create a stable network foundation that allows both training and inference models to run effectively at scale.

The company's balance sheet is as robust as its top and bottom lines, with $10.1 billion in cash, cash equivalents, and investments. It generated approximately $1.3 billion in operating cash flow during the quarter and still has $1.4 billion available under its authorized share repurchase program. The company reiterated its goal of generating at least $1.5 billion in AI-related revenue by 2025, including both front-end and back-end deployments. Looking ahead, for fiscal 2026, Arista is targeting $2.75 billion in AI center revenue as part of a broader $10.65 billion total revenue target, implying around 20% growth.

Management expects the total addressable market for networking to exceed $100 billion in the coming years, and Arista remains poised to capitalize on it, which increases its long-term revenue runway. Analysts covering Arista expect explosive earnings growth over the next two years. Earnings are expected to increase by 26.8% in 2025 to $2.88 per share, followed by an increase of 16.7% in 2026 to $3.36 per share. At 39× forward earnings, Arista trades at a premium valuation, meaning the market already expects strong execution.

What Analysts Think of ANET Stock

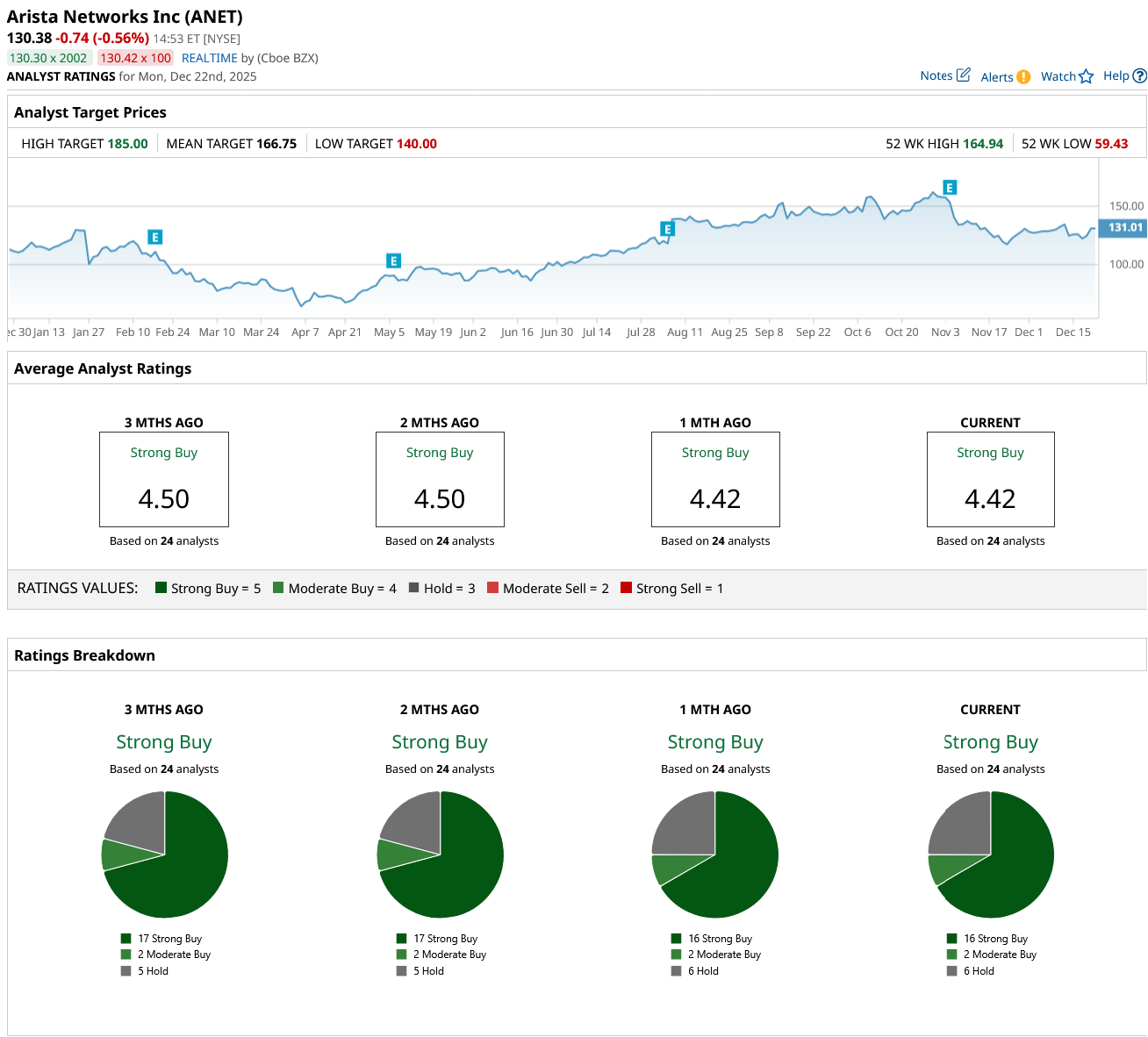

ANET stock has surged 19% YTD, outperforming the overall market. Its average price target of $166.75 suggests an upside potential of 28% from current levels. However, its Street-high estimate of $185 implies a potential upside of about 42% in the next 12 months.

Overall, Wall Street rates Arista stock a “Strong Buy.” Out of the 24 analysts covering ANET stock, 16 have a “Strong Buy” recommendation, two rate it a “Moderate Buy,” and six suggest it’s a “Hold.”

For the stock to outperform the current price estimates, Arista must meet or exceed earnings expectations, and margins and growth must stay resilient, even as competition increases. Investors willing to handle this risk might want to start with a small stake in this exceptional AI stock.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)