Analysts at Morgan Stanley recently gave a bullish outlook on confectionery giant Hershey Foods (HSY), raising HSY stock’s rating from “Equal Weight” to “Overweight.” Morgan Stanley noted that the company could be facing a comeback after one of the most significant periods of negative revisions in Hershey’s history.

Analysts see early-stage positive inflection in the company’s fundamentals, which could drive faster EPS growth. They also raised the stock price target from $195 to $211, implying 13% upside from current levels.

Should you buy into Hershey now?

About Hershey Stock

Headquartered in Hershey, Pennsylvania, Hershey Foods dominates the global confectionery sector with extensive manufacturing operations. Founded in 1894, it operates advanced production facilities across the United States, Mexico, and international sites, creating iconic brands including Hershey's, Reese's, Kit Kat, Twizzlers, Jolly Rancher, Almond Joy, and more.

The company oversees a vast portfolio of multiple brands, distributed across several countries through regional hubs. Hershey drives innovation through dedicated centers such as its Latin America facility, while prioritizing sustainability, employee wellness, and efficient sales and marketing worldwide. Hershey has a market capitalization of $38 billion.

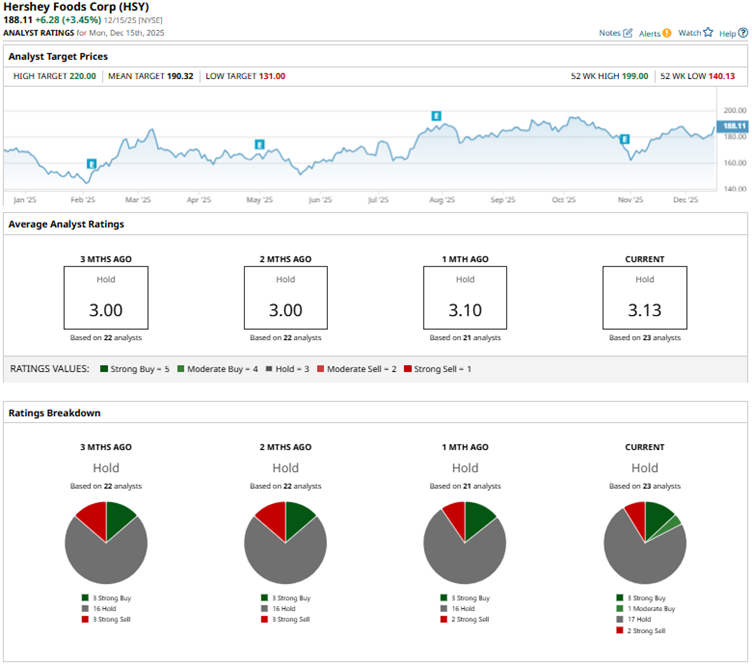

Amid tepid sentiment toward Hershey, HSY stock has gained 9% over the past 52 weeks and 8% over the past six months. The shares had reached a 52-week high of $199 in late July but are currently down 6% from that level. Facing pressure from high cocoa prices, Hershey announced that it would raise its U.S. retail prices by either reducing packet sizes or raising list prices outright.

HSY stock is trading at a relatively pricey valuation. Its price-to-earnings sits at 31.5 times, higher than the industry average.

Hershey’s Q3 Results Were Better Than Expected

On Oct. 30, Hershey reported its third-quarter results for 2025, which exceeded Wall Street analysts’ expectations. The company’s net sales increased by 6.5% year-over-year (YOY) to $3.18 billion, which was higher than the $3.13 billion that Wall Street analysts had expected.

The North America Confectionery segment, the company’s largest, reported 5.6% YOY growth in net sales to $2.62 billion. However, this was primarily due to price increases, as the segment also reported a slight decrease in volume. This segment’s income declined 21.2% from the prior year’s period to $571.48 million.

Hershey’s other two segments, North America Salty Snacks and International, reported volume increases. In fact, the International segment reported a 6% increase in volume, driven by double-digit growth in Brazil and a shift of shipments from the fourth quarter in Europe and Mexico.

The North America Salty Snacks segment reported a 6.9% YOY increase in its segment income. As a whole, Hershey’s segment income dropped 22.4% annually to $615.62 million. The company’s non-GAAP EPS was $1.30 for the quarter, which was 44.4% lower than the $2.34 figure it had reported a year earlier. On the other hand, the non-GAAP EPS figure also topped the $1.09 that Wall Street analysts had expected.

For 2025, Hershey expects to report net sales growth of approximately 3%. The company also expects its adjusted EPS to be in the range of $5.90 to $6, down 36% to 37% from the year-ago value.

Wall Street analysts are not optimistic about Hershey’s bottom-line growth trajectory. For Q4, analysts expect EPS to decline by 48% YOY to $1.40. For the current year, the company’s EPS is projected to decline 36.% to $6, followed by a 14.5% YOY increase to $6.87 in the following year.

What Do Analysts Think About Hershey Stock?

While Morgan Stanley analysts are bullish on Hershey, other Wall Street analysts have been lukewarm on the stock. Recently, analysts at Stifel Nicolaus reaffirmed a “Hold” rating while raising its price target to $195. This primarily reflects the effects of elevated cocoa prices and high tariff costs, which could affect Hershey’s profitability.

Analysts at Jefferies also resumed coverage on HSY stock with a “Hold” rating and a $181 price target. Jefferies analysts are taking a cautious stance, although the company has navigated high cocoa costs this year. While Hershey is recovering margins, its valuation may already reflect that.

Wall Street analysts are taking a cautious stance on Hershey’s stock now, with a consensus “Hold” rating overall. Of the 23 analysts rating the stock, three analysts give a “Strong Buy” rating, one analyst has a “Moderate Buy” rating, a majority of 17 analysts play it safe with a “Hold” rating, and two analysts have a “Strong Sell” rating. The consensus price target of $191.32 represents 3% potential upside from current levels. The Street-high price target of $220 indicates 18% potential upside from current levels.

Key Takeaways

Despite early signs of recovery, Hershey continues to experience margin declines amid input cost pressures. Moreover, despite Morgan Stanley's bullish view, the consensus rating on the stock remains neutral. Therefore, investors might consider observing Hershey for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)