/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

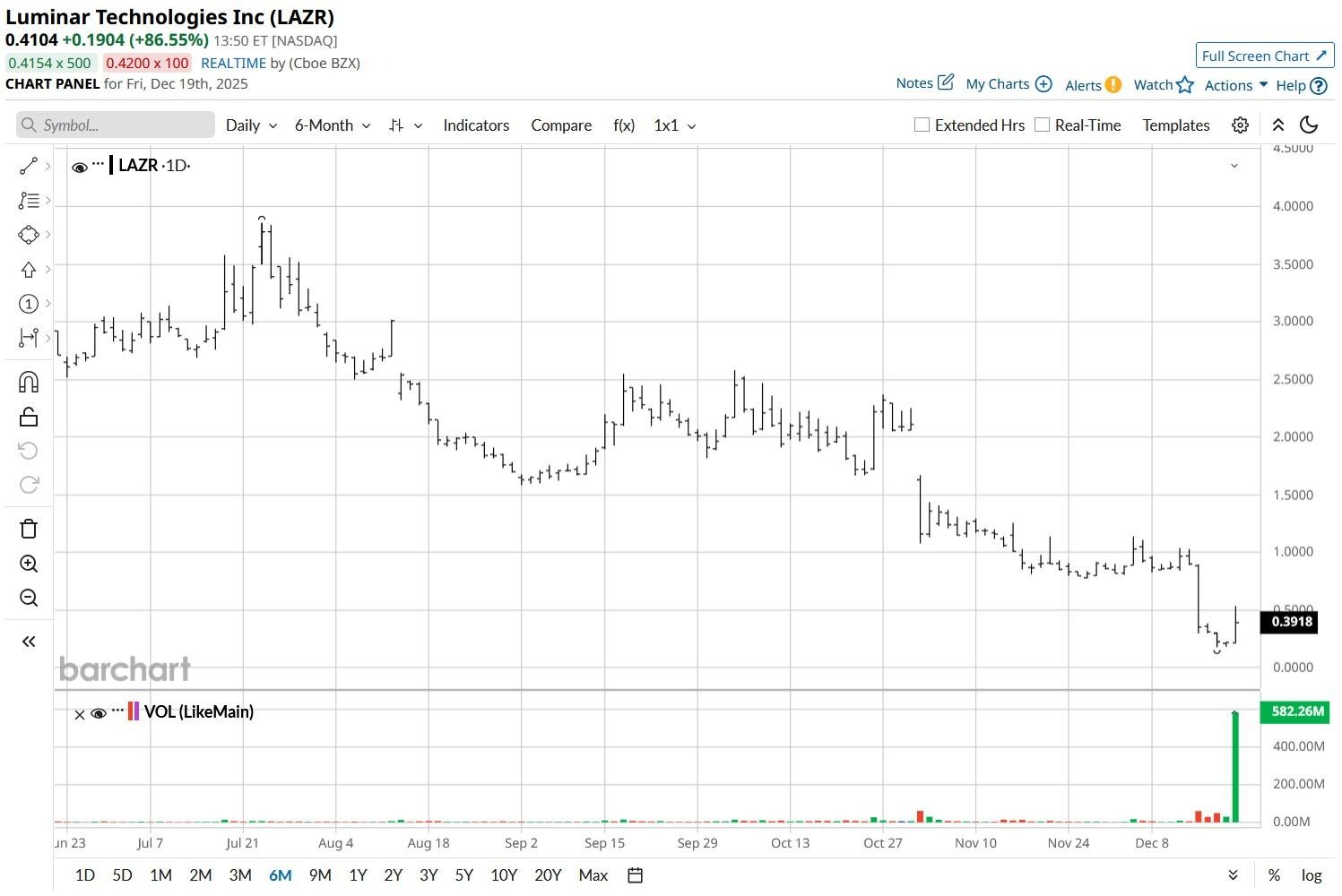

Luminar Technologies (LAZR) shares more than doubled on Friday even though the sensor maker filed for Chapter 11 bankruptcy after losing a key contract with the European automaker Volvo.

As part of the restructuring, LAZR has agreed to sell its semiconductor business to Hoboken-based Quantum Computing (QUBT) for about $110 million in cash.

Despite Friday’s so-called rally, Luminar stock is going only for a fraction of its price at the start of 2025.

Should You Buy Luminar Stock?

Investors are cautioned against chasing LAZR stock as much of its movement on Dec. 19 was momentum driven, not backed by fundamentals.

At less than $0.50, Luminar Technologies is highly susceptible to speculative swings and price manipulation.

Such rallies based on retail frenzy and social media chatter often leave latecomers exposed to sharp reversals once the sentiment cools.

The fact that LAZR has filed for bankruptcy signals there’s hardly anything left in it fundamentals-wise to warrant an investment heading into 2026.

LAZR Shares Are Destined to Crash Again

Orlando-headquartered Luminar Technologies’ bankruptcy filing highlights the severity of its financial distress and the lack of a viable path forward.

Losing Volvo as a key customer has stripped the company of its most important revenue stream, while the sale of its chips unit is more about raising cash to pay creditors than fueling innovation.

With liabilities mounting and restructuring uncertainty ahead, those invested in LAZR shares face the real risk of being wiped out or heavily diluted.

The stock’s volatility may attract short-term traders, but for long-term investors, its fundamentals point to a speculative gamble with hardly any upside left for 2026.

How Wall Street Sees LAZR Heading Into 2026

Luminar Technologies shares currently receive coverage from about four Wall Street analysts, and they have a mean target of $2 on them, indicating potential upside of more than 300% from here.

However, both the coverage and the price target will likely fade in the days ahead, now that LAZR has filed for Chapter 11 bankruptcy.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)