/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

The global artificial intelligence (AI) data-center market is projected to rise from roughly $236 billion in 2025 to $933 billion by 2030, a 31.6% compound annual growth rate (CAGR). That surge in infrastructure demand is exactly what Alphabet's (GOOG) (GOOGL) Google is targeting with its Gemini platform, and the new Gemini 3 Flash release is designed to deliver faster, more efficient AI that can run at scale.

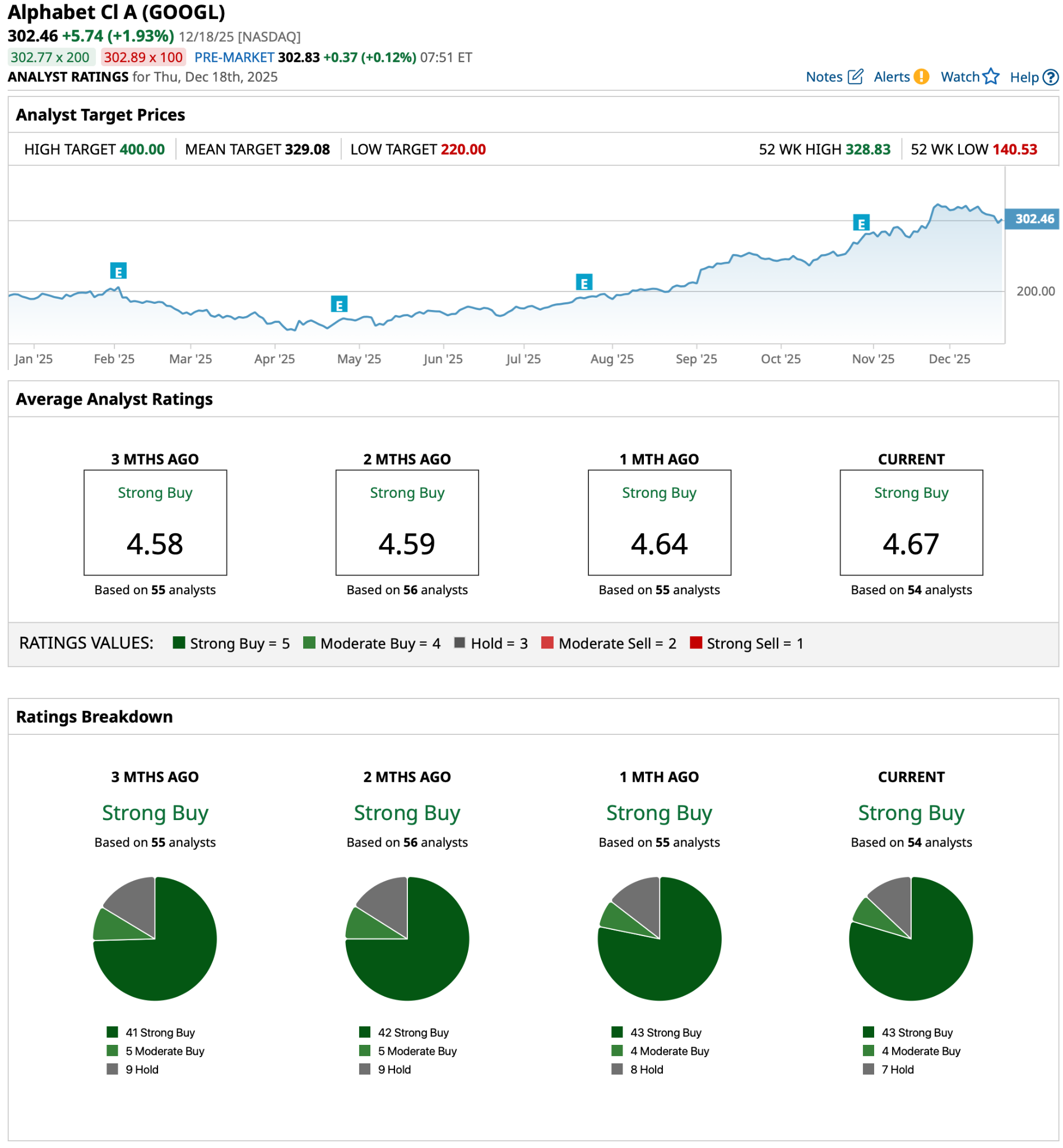

Wall Street is starting to assign larger price targets to the stock. Pivotal Research recently lifted its price target on Alphabet to $400 from $350, reiterating a “Buy” rating and flagging roughly 25% upside from current levels. The call leans on multi-year Google Cloud growth and strengthening free cash flow as key supports for Gemini-driven expansion.

With AI expectations rising and GOOGL already re-rating higher in 2025, the stakes around each Gemini release keep climbing. So, as Gemini 3 Flash rolls out, is this the moment to buy, simply hold tight, or start taking profits in GOOGL stock? Let's find out.

The Numbers Behind GOOGL

Alphabet is a California‑based global technology company that builds search, cloud, advertising, hardware, and AI products at mass scale.

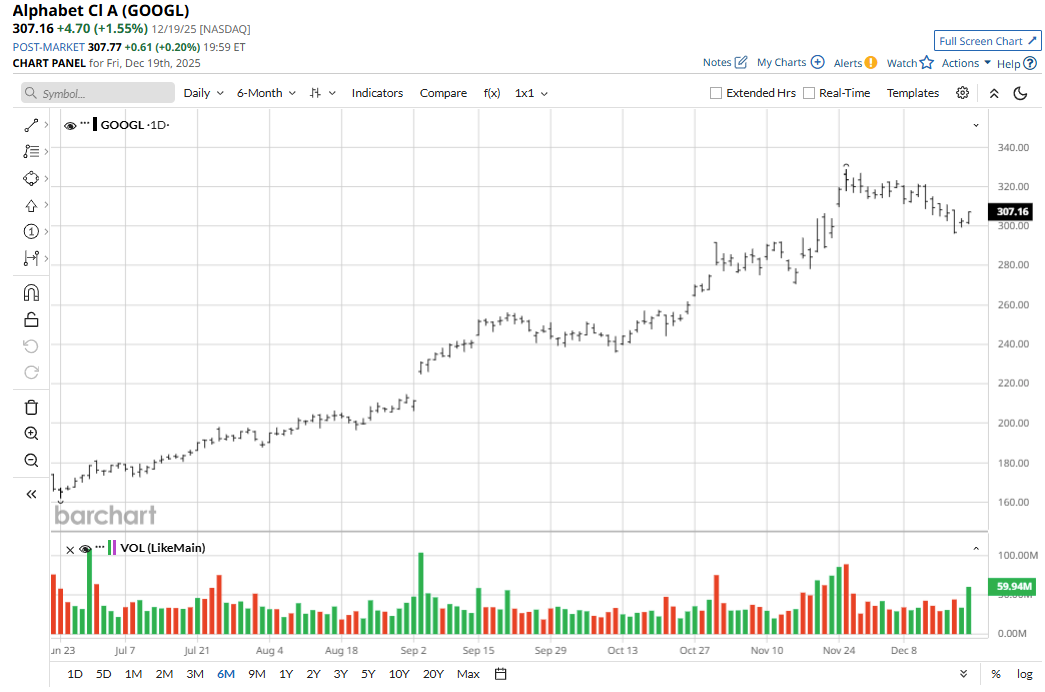

The stock currently trades at $307.16, up 62.3% year‑to‑date. The market capitalization of roughly $3.7 trillion and a price‑to‑sales (P/S) ratio of 10.6x versus a sector median of 1.2x shows how much of a premium the market is willing to pay.

Alphabet's latest earnings report showed third‑quarter net income of roughly $35 billion and earnings per share (EPS) of $2.87 versus a $2.26 consensus, a 27% upside surprise. The company posted total revenue of $102.3 billion, with Google Services and Google Cloud contributing $87.1 billion and $15.2 billion, respectively.

The report also included GAAP operating income of about $31.2 billion, reflecting a 30.5% operating margin. Meanwhile, adjusting for a $3.5 billion European Commission fine pushed operating income to about $34.7 billion and the margin close to 33.9%, showing that scale efficiencies are offsetting higher AI‑related costs. That level of profitability translated into free cash flow of roughly $24.5 billion for the quarter and left Alphabet with close to $100 billion in cash and marketable securities, giving it ample firepower to fund Gemini 3 Flash.

GOOGL’s Proof-of-Demand

Recently, Gemini secured a major win in the form of a contract with the Pentagon. That kind of validation matters more now because Gemini 3 Flash aims to push faster AI performance into real workflows — not just demos.

On the infrastructure front, Google Cloud’s landmark strategic partnership with NextEra Energy (NEE) aims to develop multiple gigawatt‑scale data center campuses in the U.S., each paired with dedicated generation and capacity. This collaboration indicates a deliberate effort to secure massive, long‑lasting footprints for power and data centers. The arrangement also deepens Google Cloud’s role within NextEra itself, using Google’s AI and infrastructure to drive an enterprise‑wide digital transformation.

In terms of commercial services, Colliers (CIGI) has selected Google Cloud as its primary cloud platform as part of a multi‑year plan centered on advanced analytics and AI‑powered products. That migration will move the firm's core systems onto Google Cloud to enable AI‑driven tools, predictive modeling, and integrated workflows across a data‑intensive, regulated industry. The deal is explicitly framed around Gemini‑powered automation and smarter market intelligence for roughly 24,000 Colliers professionals.

Finally, ReNew Energy Global’s long‑term agreement with Google will back a 150 MW solar project in Rajasthan dedicated to Google’s electricity needs in India. This project adds to an already sizable renewable portfolio. More importantly, it tackles one of the most significant constraints on AI growth by securing reliable, low‑carbon power at scale close to where computing is needed.

How Wall Street Prices GOOGL

Wall Street is lining up behind GOOGL ahead of its next earnings report. For the current quarter, the average EPS estimate sits at $2.59, up from $2.12 a year ago. Looking at next quarter, the EPS estimate is $2.52 versus $2.81 last year, a decline that cools near-term expectations.

From a full-year perspective, the story looks more in sync with the bullish narrative. For fiscal year 2025, the average EPS estimate is $10.58 compared to $8.04 for the previous year, implying a hefty 31.6% increase.

On the ratings side, the Street’s stance on GOOGL is about as clear as it gets. Across 54 analyst opinions, the consensus rating is a “Strong Buy." The average price target is $329.08, implying upside from its current price.

Conclusion

GOOGL looks like a “buy on strength, add on dips” story rather than a stock to dump after Gemini 3 Flash. Strong earnings, solid cash flow, and healthy growth estimates support that case. A broadly bullish analyst consensus with double‑digit upside also points to shares grinding higher over the next year, even if the pace cools versus the last 12 months. Most likely, the stock will continue to trend upward with pauses around earnings and AI headlines, rewarding patient buyers more than short‑term traders.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)