ConocoPhillips Inc. (COP) stock has a 3.63% annual yield and could be up to 18% undervalued. Another play here is to sell short out-of-the-money OTM) puts as an income play. For example, 5% OTM COP puts have a 1% monthly yield. This article will show how this works.

COP stock is at $92.67 midday on Friday, December 19. COP has been relatively flat over the last 6 months. Moreover, its $3.36 annual dividend per share (DPS) provides a long-term holder with a yearly yield of 3.626%.

That's not the only way a value investor could play the stock. I discussed this in my last article a month ago (Nov. 21: “ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could be 24% Undervalued.”

I suggested selling short out-of-the-money (OTM) put options (i.e., 8.54% below the trading price) at $80.00 for expiry today on Dec. 19. The yield, given the 61 cents premium received, was 0.7625% (i.e., $61/$8,000 per put shorted).

Today's the $80 strike price puts are set to expire worthless, making this a profitable play. That means an investor can redo this income play.

What COP Stock is Worth

One of the simplest ways to value an oil and gas stock is to assume that the price will eventually revert to its historical dividend yield. For example, over the last 5 years, its average yield has been 3.12%, according to Seeking Alpha.

However, Yahoo! Finance says the average 5-year yield has been 2.54%, and Morningstar says it's been 2.29%.

So, the average of these 3 surveys is 2.643%. But just to be conservative, let's use the highest yield. Here is what that implies about COP stock's value:

$3.36 DPS / 0.0310 = $109.39 target price (TP)

In other words, if COP stock reverts to an average yield of 3.10%, COP stock will rise +18% from $92.67 to $109.39, since:

$3.36/$109.39 = 3.10% yield

In fact, if we use the average 2.643% yield, the TP is +37% higher at $127.13 since $3.36/0.02643 = $127.13.

Analysts tend to be between these two TPs. For example, Yahoo! Finance reports that the average TP of 29 analysts is $112.32. Similarly, Barchart's mean TP survey price is $112.23.

AnaChart.com, which tracks recent analyst price targets, reports that 15 analysts have an average TP of $118.39. That's right between my price target and the $127.13 highest dividend yield target.

So, based on its average yield and analysts' targets, COP stock looks undervalued. But what if COP stays flat for the next 6 months, as over the last 6 months?

Shorting OTM Puts

One way, as mentioned above, is to generate monthly income by selling short puts that have strike prices below the trading price.

That way, an investor can set a potentially lower buy-in point and also make better income than owning shares outright.

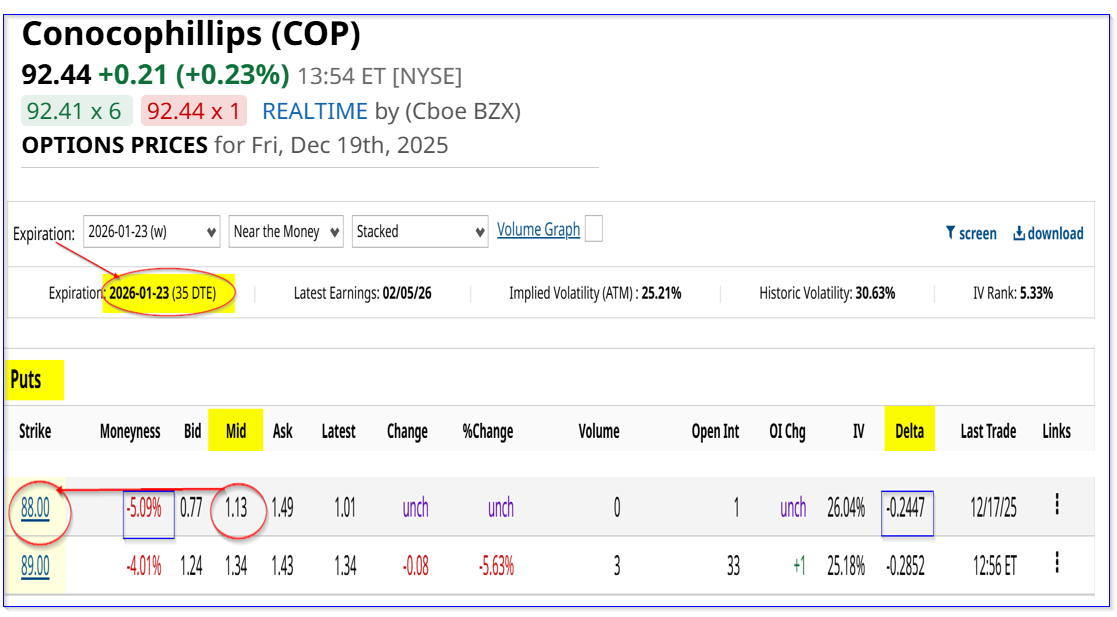

For example, look at the Jan. 23, 2026, expiry period and the $88.00 strike price put option contract. This strike price is 5% below today's price. It shows that the midpoint premium for this put contract is $1.13, or a 1.284% yield.

That means that an investor who secures $8,800 with their brokerage firm can make an immediate income of $113.00. That works out to 1.284% in a one-month yield.

In effect, if an investor can repeat this play every month for a year, the expected return (ER) is 15.4% (1.248% x 12). There is no guarantee that this can happen. But even if it occurs for half that time, the 7.7% yield is still twice the annual yield (3.63%) from holding COP shares outright.

The only issue is that the investor can gain no upside if COP rises. That is why some long-term COP investors like to sell short OTM puts.

That way, their average cost could be potentially lower, and their overall income will be higher, with potential upside if COP rises. Another way to play this is to buy in-the-money (ITM) calls with the income from shorting OTM puts. Moreover, selling OTM covered calls in one-month periods can also help pay for longer-dated ITM calls.

In any case, COP stock looks undervalued here. Using OTM puts and calls, as well as ITM calls, are several ways to play COP stock on a leveraged basis.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)