/Lululemon%20Athletica%20inc_%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

Activist investing heavyweight Elliott Investment Management just made a bold bet, acquiring a $1 billion stake in Lululemon (LULU). The firm's involvement, coupled with the abrupt departure of CEO Calvin McDonald, has investors wondering whether this marks the beginning of a genuine turnaround or the start of a painful restructuring.

LULU stock surged around 10% last week following the news of McDonald's exit. Yesterday, it rose more than 3% after Elliott disclosed a $1 billion investment in the athleisure giant. Lululemon reported a 2% decline in its core market amid competition from startups including Vuori and Alo Yoga.

Moreover, tariff-related headwinds impacted the bottom line by $210 million. Alternatively, strong demand from China helped Lululemon grow international sales by 33% year-over-year (YoY).

Elliott has a mixed track record with retail turnarounds. However, LULU stockholders should be prepared for strategic changes given the activist investor’s involvement. Elliott has already roped in former Ralph Lauren (RL) CFO Jane Nielsen to the table as a potential CEO candidate. This indicates a plan to push for operational improvements and possible portfolio restructuring.

Despite the ongoing rally, LULU stock is down almost 60% from its all-time high. Let’s see if the retail company is a good buy in December 2025.

Should You Buy the Dip in Lululemon Stock?

Lululemon faces a critical inflection point as it navigates mounting challenges in its largest market amid leadership transitions. In fiscal Q3 of 2026, the athletic apparel maker reported revenue of $2.57 billion, up 7% year-over-year (YoY).

While revenue from the Americas fell 2%, comparable sales were down 5% YoY. The company management expects sluggish sales to persist through the crucial holiday quarter.

The company projects fourth-quarter revenue between $3.5 billion and $3.59 billion, down almost 3% from the year-ago period. Additionally, it projects the operating margin to compress by 680 basis points in fiscal Q4. Tariffs and the elimination of duty-free shipping exemptions account for 410 basis points of that pressure, creating a structural headwind that won't disappear quickly.

Lululemon’s management outlines a recovery plan focused on product creation, activation, and enterprise efficiency. This strategy aims to increase new-style penetration to 35% by spring while reducing product development cycles from 18 months to 12 months.

Recent launches, including Milemaker and Shake It Out, have generated positive guest response, though not enough to offset weakness in legacy franchises, which have lost their novelty among high-value customers. Notably, revenue from Mainland China rose 46%, while comparable sales in the country surged by 25% due to strong outerwear performance and successful platform activations.

Management now expects full-year China growth at or above the high end of its 20%-25% guidance range. The geographic divergence highlights opportunity and risk, as Lululemon could depend on international expansion to offset domestic headwinds.

Lululemon ended Q3 with $1 billion in cash and zero balance sheet debt. Its gross margin contracted 290 basis points in Q3 due to tariff impacts and higher markdowns. It expects gross margin to decline approximately 270 basis points for the full year, with pressure intensifying in the fourth quarter.

Management indicated that negative factors will likely outweigh positives as the company enters its first full year under heightened tariff rates. The path to margin recovery appears to be a multi-year journey rather than a near-term achievement.

Is LULU Stock Undervalued?

Analysts tracking LULU stock forecast revenue to rise from $10.6 billion in fiscal 2025 to $14 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $14.6 per share to $19.5 per share.

Today, LULU stock is trading at 17.7x forward earnings, below its three-year average of 24.6x. If Lululemon stock continues to trade at 18x earnings, it will be priced at $351 in late 2028, indicating an upside potential of 63% from current levels.

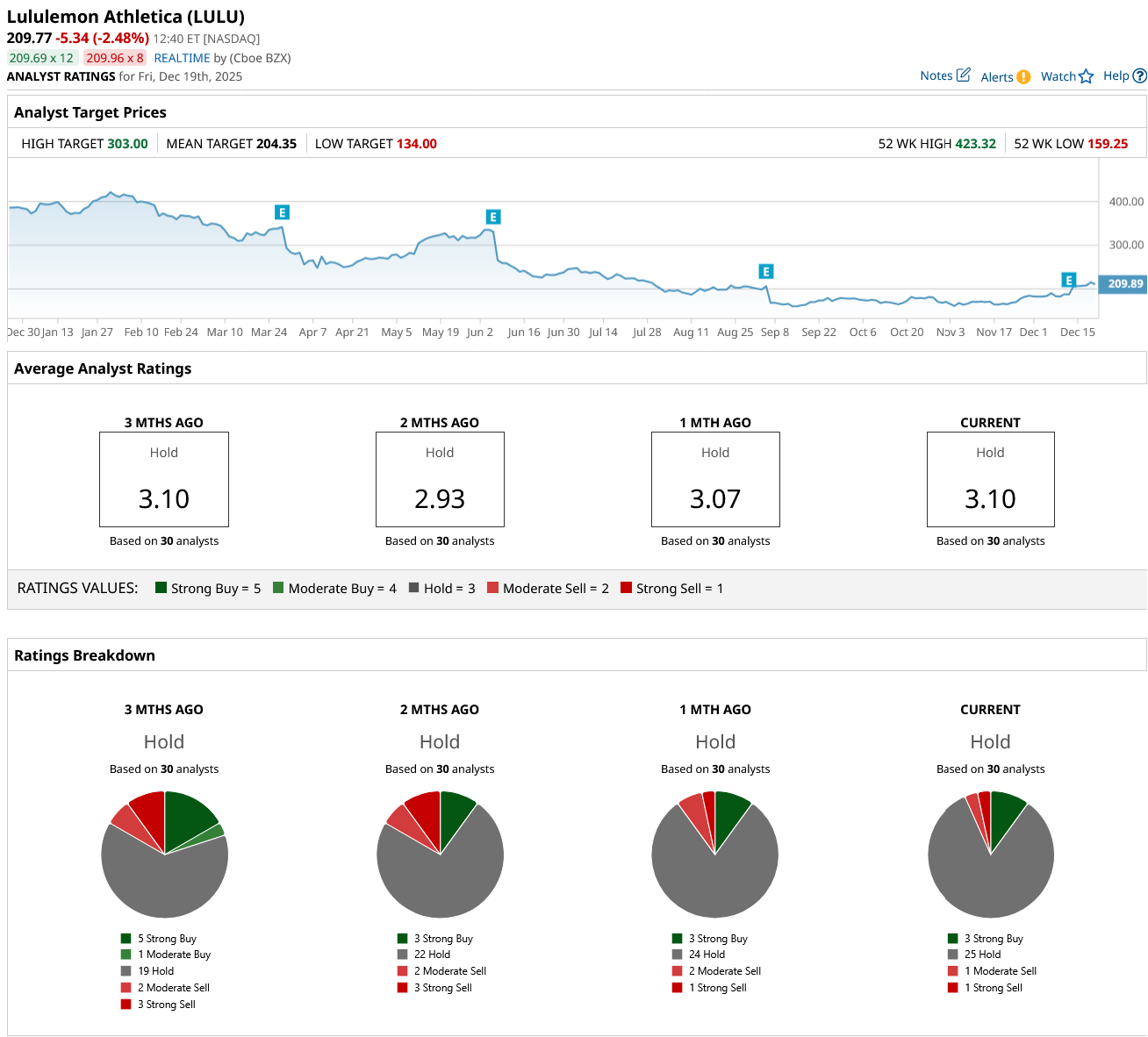

Out of the 30 analysts covering LULU stock, three recommend “Strong Buy,” 25 recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average LULU stock price target is $204.35, which is below the current price of $210.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)