/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

A new chapter is unfolding in the semiconductor market as artificial intelligence (AI)-driven computing reshapes data center demand and revives pricing power for memory makers. With DRAM and NAND supplies tightening, prices are climbing just as hyperscalers and neocloud firms step up capital spending. That backdrop has thrust Micron Technology (MU) back into focus, with improving fundamentals, rising memory prices, strong analyst backing, and its growing role as a key high-bandwidth memory supplier for AI servers driving recent momentum.

Needham analyst Quinn Bolton believes the pricing upcycle has legs, arguing that higher memory prices could persist for several quarters as supply remains constrained. Reflecting that confidence, Bolton raised his price target on Micron to $300 from $200 and reiterated a “Buy” rating, pointing to robust data center demand and limited industry capacity expansion through 2026.

With Micron’s shares recently pulling back despite average memory prices jumping, does this analyst-driven optimism mark the early innings of a longer run, or are investors already arriving late to the trade after MU’s 278% run from its April lows?

About Micron Stock

Headquartered in Boise, Idaho, semiconductor powerhouse Micron Technology operates as the only U.S.-based manufacturer of DRAM, NAND, and NOR memory technologies. Micron designs and fabricates high-performance memory and storage solutions under the Micron and Crucial brands for AI, data centers, mobile, automotive, and industrial markets. The company's current market capitalization stands near $253.5 billion.

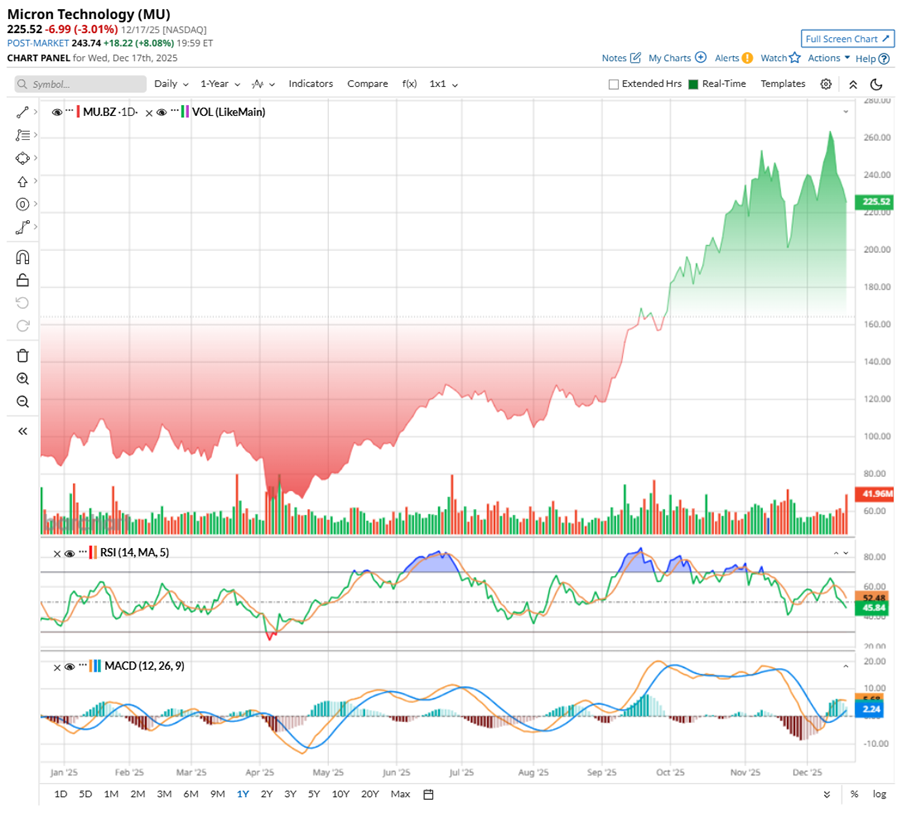

After a decade-long run delivering more than 1,600% in returns, MU hit a high of $264.75 in December, before cooling off about 4.8%. Even so, the bigger picture remains commanding. The stock holds at an impressive 198.69% year-to-date (YTD), and the recent rally was fueled by a broad tech and semiconductor rally after the Federal Reserve’s rate cut reignited risk appetite.

The recent wobble unsettled bulls. Despite strong sentiment, shares slid nearly 2.74% over the past five sessions, including a 3% dip just ahead of the fiscal Q1 2026 report. Technically, momentum had stretched too far. The 14-day RSI rolled over from November’s overbought zone to around 57.39, signaling exhaustion rather than outright trend reversal. Volume stayed active, suggesting distribution was orderly, not panicked.

Under the hood, momentum is stabilizing. The MACD oscillator shows the yellow line crossing above the blue signal line, while the histogram has turned positive, hinting that downside pressure may be fading. That technical reset met a powerful catalyst. Micron’s shares surged 11.93% in extended trade on Wednesday after delivering a Q1 beat and a bullish outlook, reminding investors why this pullback looks more like consolidation than collapse.

From a valuation lens, Micron trades at roughly 12.14x forward adjusted earnings, a discount to both the semiconductor peer median and its historical average. That multiple reflects lingering cycle risk tied to memory pricing swings, potential supply increases, and hyperscaler spending trends. Still, improving margins, strengthening cash flows, and better demand visibility suggest the stock looks reasonably valued rather than stretched.

Micron’s Q1 Results Surpassed Projections

Micron delivered a standout first quarter for fiscal 2026 on Dec. 17, which read like a reminder of who controls the levers in a tightening memory market. The company delivered revenue of $13.64 billion, up a striking 56.7% year-over-year (YOY), while non-GAAP EPS surged to $4.78 from last year’s quarter’s $1.79. Both comfortably cleared Wall Street’s bar, but the real story sat beneath the headline numbers.

At the technology level, DRAM remained the undisputed engine, generating $10.8 billion in revenue, a 68.9% annual jump. NAND followed with $2.7 billion, up 22.4%, while the smaller “Other” category, largely NOR, added $88 million, growing 29.4% YOY. Together, they painted a picture of pricing power returning alongside disciplined supply and improving demand.

That momentum was most visible in Micron’s business units. The Cloud Memory Business Unit (CMBU) stole the spotlight, posting a record $5.3 billion in revenue, nearly double YOY and up 16% sequentially. Accounting for 39% of total revenue, CMBU also delivered a robust 66% gross margin, lifted by higher pricing and sharp cost execution. Core Data Center followed with a record $2.4 billion, up 51% sequentially, as hyperscale demand pushed gross margins to 51%.

Mobile and Client proved resilient as well. Revenue reached a record $4.3 billion, driven primarily by higher prices, even as bit shipments eased. Gross margin expanded sharply to 54%, underscoring how pricing discipline can outweigh volume softness. Automotive and Embedded, often the quiet performer, posted $1.7 billion in record revenue, with gross margins climbing to 45% on stronger shipments and pricing.

Cash flow put an emphatic exclamation point on the quarter. Adjusted free cash flow hit a record $3.9 billion, more than 20% above Micron’s previous high from 2018. The balance sheet ended the period with $12 billion in cash, marketable investments, and restricted cash, giving the company ample flexibility as it leans into the next leg of growth.

Looking ahead, management expects Micron’s momentum to strengthen through the year, supported by sustained industry demand and persistent supply constraints that continue to keep memory markets tight, a dynamic it believes could extend beyond calendar 2026. The company is advancing discussions with customers on multiyear contracts with defined commitments, while pushing to maximize output from its existing footprint. At the same time, Micron is ramping its industry-leading technology nodes and investing in new cleanroom capacity to expand supply.

Micron’s Chairman, President, and CEO, Sanjay Mehrotra, struck a confident tone, pointing to technology leadership, a differentiated portfolio, and operational execution as Micron’s edge in an AI-driven world. That confidence carried into guidance. For Q2, management expects revenue between $18.3 billion and $19.1 billion, adjusted EPS of $8.22 to $8.62, and gross margins around 68% (+/-1%). Against the year-ago quarter’s $8.7 billion in revenue and $1.79 EPS, the outlook suggests Micron’s resurgence is not a one-quarter affair, but a cycle decisively turning in its favor.

What Do Analysts Expect for Micron Stock?

Needham analyst Quinn Bolton reaffirmed his “Buy” rating on MU and lifted his price target sharply by 50% to $300, signaling deep confidence in the memory upcycle. Bolton points to a powerful pricing reset, noting that average memory chip prices surged 162% sequentially in Micron’s fiscal first quarter.

Meanwhile, analysts monitoring the company remain optimistic, predicting its fiscal Q2 2026 revenue to be around $18.8 billion, with adjusted EPS anticipated to be $8.46. Looking ahead, fiscal 2026 EPS is expected to be around $19.15, up 149.4% annually. Looking ahead to fiscal 2027, the bottom line is projected to surge by nearly 27.1% YOY to $24.33 per share.

Baird turned notably more bullish on MU stock, lifting its price target to $443 from $235 while reaffirming an “Outperform” rating, citing robust AI-driven double-digit bit demand growth as the main catalyst. The brokerage firm sees Micron riding a powerful memory upcycle, projecting peak fiscal 2027 EPS of $42. Even as DDR5 and NAND pricing ease in the second half of 2027, Baird expects gross margins to hold steady over the next six quarters, reflecting disciplined supply and cost control.

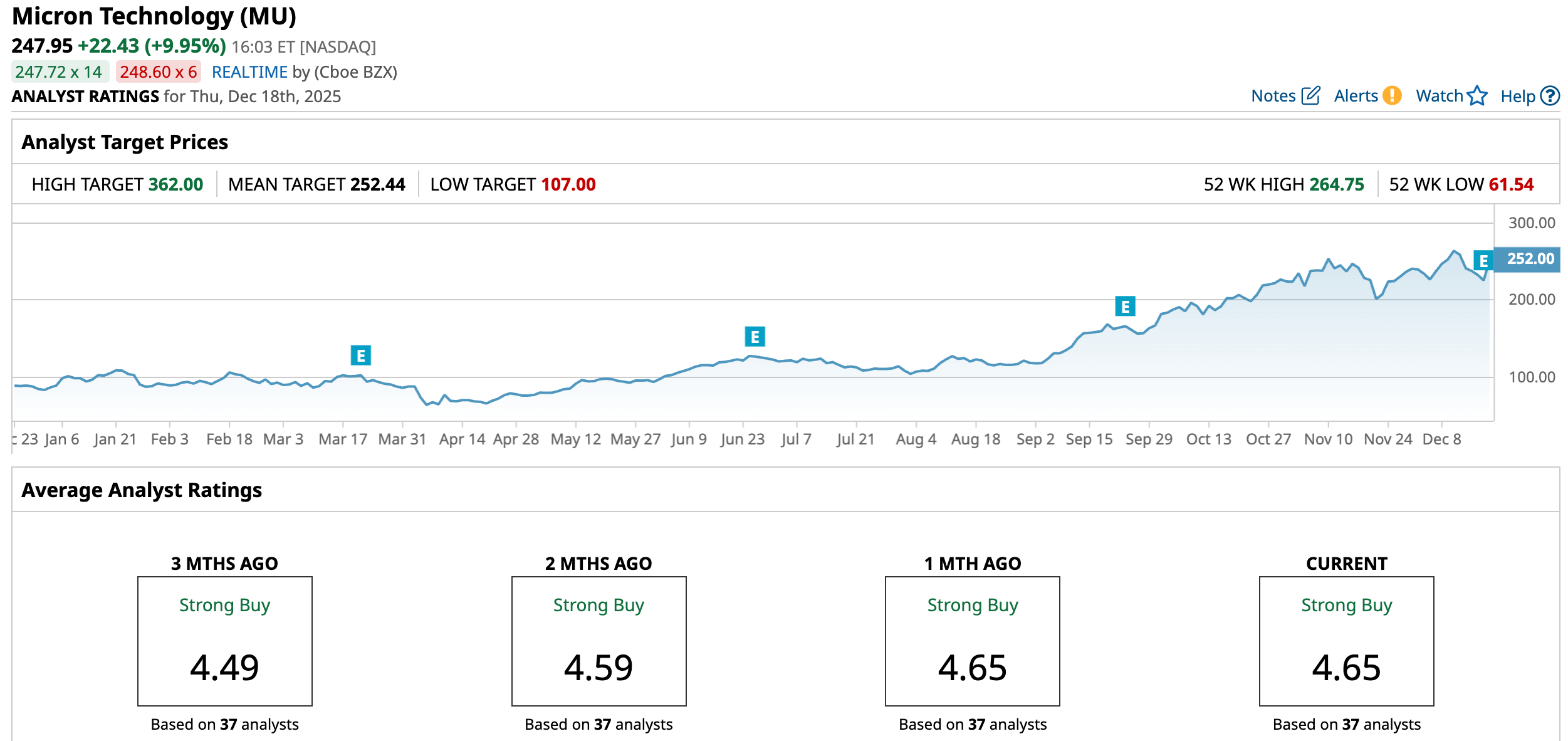

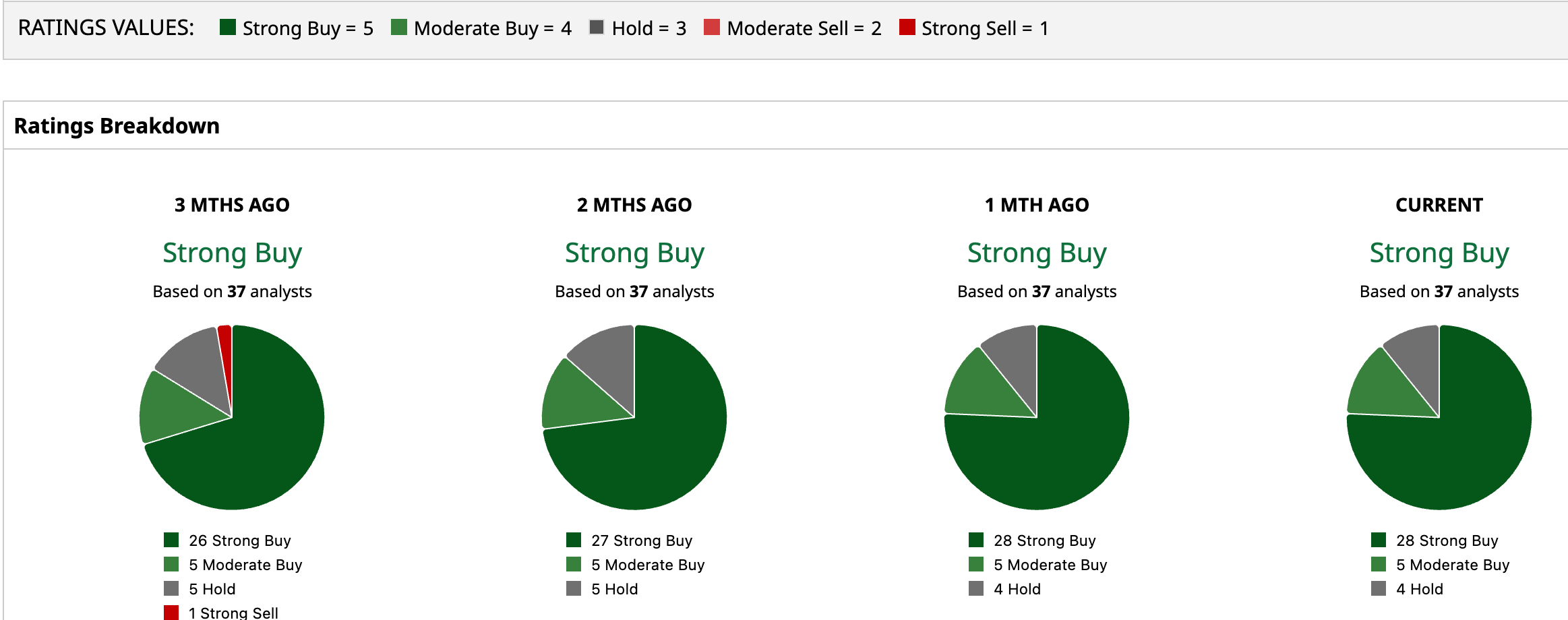

MU stock has a consensus “Strong Buy” rating overall. Out of 37 analysts covering the AI chip stock, 28 recommend a “Strong Buy,” five advise a “Moderate Buy,” and four analysts stay cautious with a “Hold” rating.

The average analyst price target for MU is $252.44, indicating a potential nominal upside of 1.78%. Baird’s target price of $443 suggests that the stock could rally as much as 79%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)