/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

Quantum computing still sits at the edge of today’s technological frontier, but its trajectory is unmistakable. As classical systems hit physical and economic limits, quantum machines are emerging as the next leap, capable of solving problems in optimization, chemistry, and cryptography that traditional supercomputers simply cannot. What’s experimental today could become foundational by the end of the decade.

That’s where IonQ (IONQ) steps in. As one of the most recognized commercial players in quantum computing and networking, IonQ is building its systems on a trapped-ion architecture, a design known for superior coherence, high fidelity, and native all-to-all connectivity. Those technical advantages position the company to remain resilient as quantum moves from lab curiosity to real-world utility.

Wedbush Securities believes that moment is coming sooner than many expect. The brokerage firm’s analyst, Antoine Legault, called quantum a “transformational” opportunity and the next frontier of computing, and initiated coverage on IONQ. He rates IonQ with “Outperform” and a $60 price target, citing long-term demand, expanding compute spend, and a generational total addressable market.

Meanwhile, IONQ shares have retreated sharply from their highs. For long-term investors, this pullback may present a strategic entry point into a technology still in its early growth phase, making IONQ a compelling addition to a forward-looking portfolio.

About IonQ Stock

Founded in 2015, IonQ is a leading pure-play quantum computing company built around its proprietary trapped-ion technology. Headquartered in Maryland with a market capitalization of about $15.9 billion, IonQ delivers cloud-based quantum access through AWS, Microsoft Azure, and Google Cloud.

The company has recently improved its full-stack platform through the acquisitions of firms such as Oxford Ionics and Vector Atomic. Through these moves, IonQ will be able to offer customers electronic qubit control, quantum sensing, and enhanced navigation solutions in one platform.

IONQ’s stock journey through 2025 has unfolded like a classic high-beta comeback story. The year began on shaky footing, with shares under pressure through the first quarter. But sentiment turned decisively as momentum built, erasing year-to-date (YTD) losses and propelling the stock to a fresh all-time high of $84.64.

However, that rally proved overheated. Since then, IONQ has retraced roughly 43.6% from its peak, settling slightly over the mid-$40s. Even so, the bigger picture remains constructive, with the stock still up about 25.9% over the past 52 weeks and 19.14% over the last six months.

Technically, the chart shows cooling rather than collapse. The 14-day RSI, which surged into overbought territory in September and briefly again in October, has eased to around 44.6, signaling neutral momentum and room to reset. Meanwhile, the MACD oscillator tells a quietly improving story. The yellow MACD line has crossed above the blue signal line, the slope is turning higher, and the histogram has flipped positive, early signs of a potential trend reversal.

This was reinforced on Thursday, as IONQ stock rose on upbeat analyst targets and renewed optimism.

IonQ’s valuation remains stretched by traditional standards, with its forward price-to-sales ratio near 150 times, far above the broader tech sector. Deeply negative profitability metrics, including a negative 127% return on equity, reflect an aggressive investment phase. With earnings absent, IONQ’s share price is anchored less to fundamentals and more to long-term growth expectations.

IonQ’s Q3 Revenue Climbs But Losses Deepen

IonQ’s third-quarter 2025 earnings report, released after the market closed on Nov. 5, told a story of rapid momentum paired with deliberate spending. The quantum computing firm generated revenue of $39.9 million, up an eye-catching 222% year-over-year (YOY). That figure not only topped Wall Street’s expectations but also came in roughly 37% above the high end of the company’s own guidance, signaling that customer demand is accelerating faster than anticipated.

And yet, profitability remains a distant goal. IonQ reported a net loss of about -$1.1 billion, sharply wider than the -$52.5 million loss a year earlier. Adjusted EBITDA loss deepened to -$48.9 million from -$23.7 million in the year-ago quarter, reflecting sustained investment in scaling its platform and advancing core technology. Adjusted loss per share widened to -$0.17, compared with -$0.11 per-share loss of last year’s quarter.

Sales and marketing costs jumped 117.8% annually to $14.4 million, reflecting higher payroll, increased promotional activity, and broader go-to-market efforts. Research and development spending nearly doubled to $66.3 million, while general and administrative expenses surged to $82.5 million as the company scaled its operations.

Operationally, the quarter delivered meaningful progress. Management highlighted several milestones achieved ahead of schedule, including a world-record 99.99% two-qubit gate fidelity and the early completion of its #AQ 64 Tempo target, both seen as critical building blocks for long-term differentiation.

Looking ahead, management raised its full-year 2025 revenue outlook, anticipating top line between $106 million and $110 million, while maintaining its adjusted EBITDA loss midpoint between $206 million and $216 million.

Analysts anticipate IonQ’s loss per share to widen 229.5% YOY to -$5.14 in fiscal 2025, but improve by 66.2% to reach -$1.74 in fiscal 2026.

What Do Analysts Expect for IonQ Stock?

Wedbush sees IonQ as a front-runner in what it calls a generational computing shift. While quantum technology remains early, the firm believes its total addressable market will expand meaningfully as the industry moves from research into commercial deployment.

Wedbush projects quantum spending to grow from a negligible base today into a meaningful share of global compute budgets by 2030, driven by optimization benefits, energy efficiencies, and rising enterprise demand. Within this landscape, IonQ’s technology and strategic positioning stand out.

Analyst Antoine Legault initiated coverage with an “Outperform” rating and a $60 price target, arguing that shareholder value should improve as costs decline and processing power scales. Wedbush also expects stronger U.S. government support, citing national security priorities and global competition, while noting that broader adoption will unfold within a hybrid computing model as error correction advances.

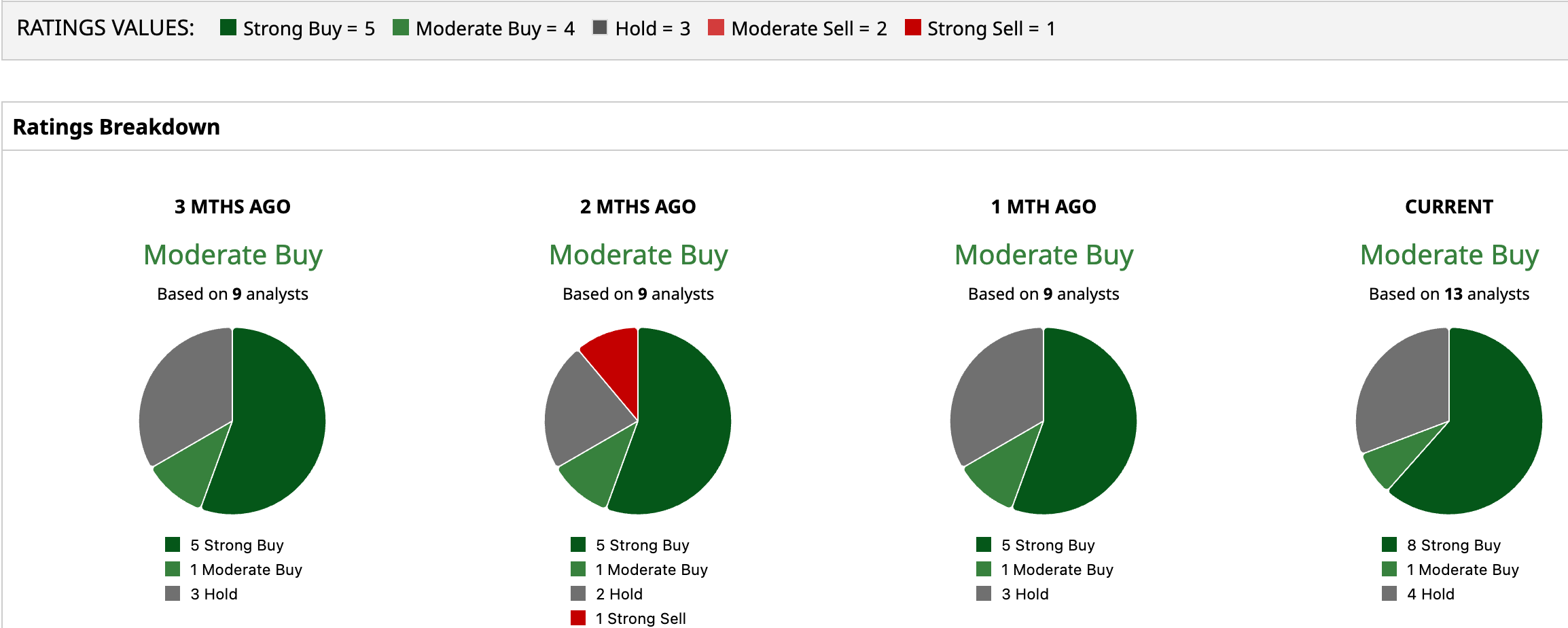

IONQ stock has a consensus “Moderate Buy” rating overall. Out of 13 analysts covering the quantum computing stock, eight advise a “Strong Buy,” one recommends a “Moderate Buy,” and the remaining four analysts are sitting on the sidelines with a “Hold” rating.

Investor expectations for IONQ are all over the map, with price targets spanning from $47 to $100, highlighting the uncertainty in the quantum computing space. The mean target price of $75.50 implies potential upside of approximately 60.3% from current levels. Jefferies’ Street-high target of $100 suggests the stock could rally almost 112% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)