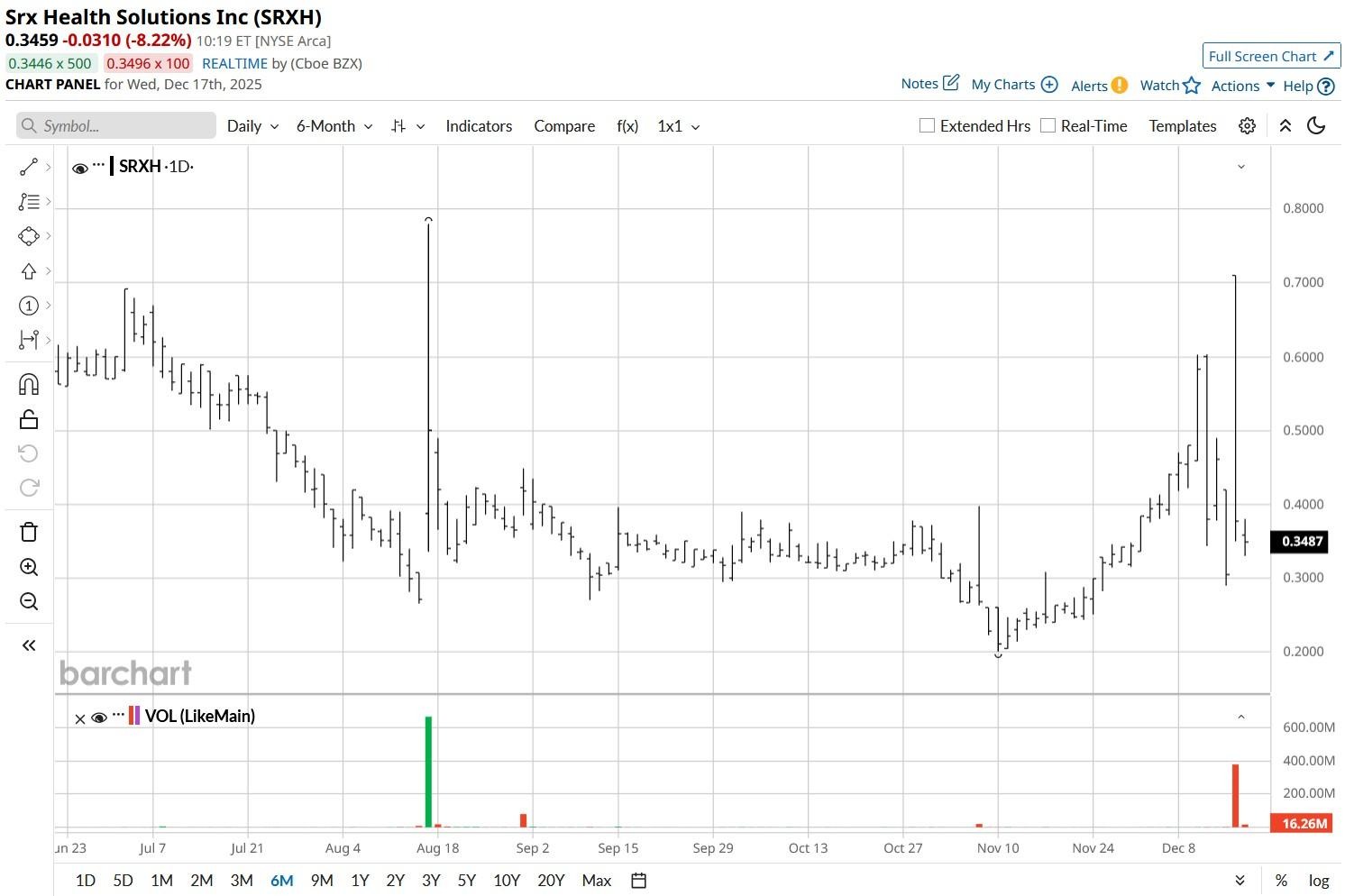

SRx Health (SRXH) shares soared a remarkable 85% on Dec. 16 after the Florida-based company announced a pivot into digital asset treasury management.

As part of this pivot, the health and wellness firm has agreed to merge with EMJ Crypto Technologies (EMJX) in an all-stock deal valued at about $55 million.

Eric Jackson, a renowned hedge fund manager, will lead the joint company once the transaction closes in the first quarter of 2026.

At one point after the EMJ announcement, SRx Health shares were seen trading over 200% higher than their year-to-date low in November.

Why Did SRXH Stock Soar on Tuesday?

Following the initial surge, SRXH stock reversed nearly all of its intraday gains by market close on Dec. 16.

This suggests the upward momentum was more sentiment-driven than fundamental backed, which has been a trend with micro-cap companies announcing a crypto pivot in 2025.

While Eric Jackson’s lead does bring some credibility to SRXH’s digital asset treasury strategy, the shift, nonetheless, remains untested, highly speculative, and far too risky to justify an investment.

What’s also worth mentioning is that MSCI is considering excluding companies with north of 50% crypto exposure from major indices, which adds uncertainty to the overall bull case for SRx Health.

Is It Worth Buying SRXH Shares Today?

SRXH shares remain unattractive also because the company’s digital asset treasury strategy comes at a time when the broader cryptocurrency market is struggling to regain momentum.

While this could prove advantageous if crypto assets ended up recovering in early 2026, for now, the timing exposes investors to continued volatility and regulatory uncertainty.

Investors should also note that despite the recent rally, SRx Health continues to trade at less than $1, which means the immediate risk of delisting remains on the table.

Moreover, being a penny stock, it runs the risk of price manipulation and pump-and-dump behavior as well that often hurts late investors.

Wall Street Doesn’t Cover SRx Health

Another major red flag on SRXH stock is the absence of Wall Street coverage.

So, there aren’t any analysts vetting the company’s claims, no independent earnings models you can benchmark against, and no professional scrutiny to help you separate genuine progress from promotional noise.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever. On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)