Canadian cannabis stocks, including Tilray (TLRY), surged following reports that President Donald Trump could sign an executive order as soon as Monday reclassifying marijuana from a Schedule I drug like heroin to the less-restrictive Schedule III category, alongside steroids and codeine.

The potential reclassification would allow cannabis companies to deduct business expenses under IRS rules, improve access to banking services, and enable expanded medical research.

Valued at a market cap of $1.4 billion, Tilray (TLRY) is among the largest cannabis companies in the world, and the stock jumped 44% on Friday. However, several Canadian marijuana producers remain high-risk investments due to narrow profit margins, high inventory levels, rising competition, slowing demand, and cannibalization from the illegal market.

Despite the recent rally, the Canada-based cannabis stock is down 17% in 2025 and trades at 98% of its all-time highs. So, let’s see if you should buy the dip in TLRY stock right now.

Is Tilray a Good Stock to Own in December 2025?

In fiscal Q1 of 2026 (ended in August), Tilray reported record revenue of $210 million, an increase of 5% year-over-year (YoY), driven by double-digit gains in domestic and international cannabis markets.

While Tilray’s sales for adult-use cannabis in Canada rose 12%, international revenue was up 10% YoY. Notably, Tilray faced headwinds from permit delays in Portugal and quota restrictions in Germany, which impacted sales in Q1. Tilray also reported a net income of $1.5 million in Q1, compared to a loss of $34.7 million in the year-ago period.

The beverage segment remained flat as management rationalized its SKUs (stock-keeping units) under Project 420, a cost-savings initiative that has generated $25 million in annual savings.

Tilray emphasized its growing craft beer portfolio continues to perform well despite industry-wide pressure. For instance, Shock Top emerged as a top-selling craft beer brand in the Southeast, where dollar sales rose 49% YoY.

The cannabis producer also expanded its hemp-derived Delta-9 THC beverage line across 14 states and secured distribution through major retailers, including Total Wine and ABC Fine Wine & Spirits.

Tilray strengthened its balance sheet considerably during the quarter by reducing outstanding debt by $7.7 million and ending with $265 million in cash. The company raised $22.5 million through its at-the-market equity program after its shares climbed above $1, helping it regain full Nasdaq compliance. Net debt to adjusted EBITDA improved to just 0.07x, providing substantial flexibility for future growth investments.

Earlier this year, management expressed optimism about potential U.S. cannabis rescheduling, estimating the medical cannabis market at $10 billion. Tilray stated that if it can capture 3% to 5% market share, annual revenue could increase by $300 million to $500 million.

Tilray can expand its presence in the U.S. once federal restrictions ease by leveraging its existing EU-GMP-certified cultivation infrastructure spanning 5 million square feet in Canada, along with facilities in Portugal and Germany.

What Is the TLRY Stock Price Target?

At the midpoint guidance, Tilray expects to end 2025 with an adjusted EBITDA of $66 million, which suggests confidence in the business trajectory as regulatory environments evolve across key markets. Moreover, analysts tracking the cannabis stock forecast net income to improve from $6.50 million in fiscal 2026 to $61.5 million in fiscal 2030.

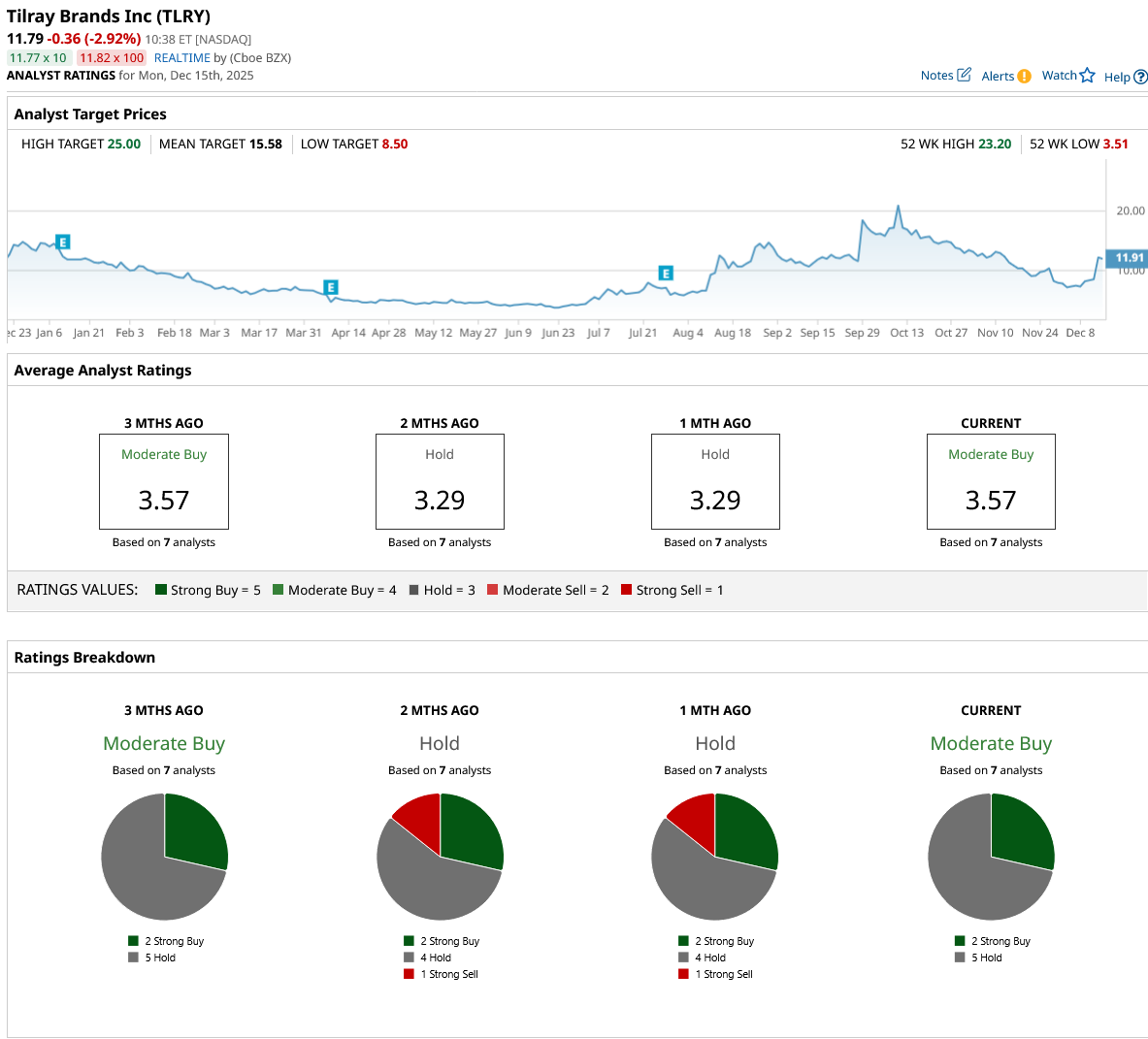

Out of the seven analysts tracking TLRY stock, two recommend “Strong Buy,” and five recommend “Hold.” The average TLRY stock price target is $15.58, above the current price of $11.79.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)