For 2025, small-cap stocks have experienced a significant turnaround, outperforming large caps, especially in the past 6 months. During this period, the December Russell 2000 futures rose 16%, while the December S&P 500 was up 11%. Driven by lower rates, economic resilience, and a shift away from concentrated large-cap tech rallies, the Russell 2000 is showing substantial gains alongside higher earnings growth expectations for small firms. However, overall valuations remain historically low compared to large caps.

Source: Barchart's Futures Performance Leaders

Key Drivers for Small-Cap Strength in 2025:

- Interest Rate Environment: Lower rates have historically favored smaller companies, and a reversal of prior trends has boosted small caps.

- Broadening Growth: Earnings growth is expected to become more widespread, benefiting smaller firms beyond the tech giants.

- Valuation Gap: Small caps remain historically cheap relative to large caps (e.g., lower Price-to-Book ratios), attracting value investors.

- Economic Factors: A resilient U.S. economy and increased M&A activity have supported smaller companies.

Over the past few years, we've all watched mega-cap stocks, especially the AI giants, dominate the market, leaving small caps in the dust and pushing valuation gaps to extremes we haven't seen in decades. But lately, small caps have started punching back hard, and it's worth paying attention as a futures trader. With valuations much lower right now, they're positioned for a real catch-up trade, especially given the earnings outlook: FactSet's numbers show small caps growing profits by around 22% next year, compared to just 15% for large caps. If this rotation keeps momentum, it could signal a broader shift away from the concentrated big-tech rally we've been riding, giving index traders a fresh angle on where the real upside might lie heading into 2026.

Technical Picture

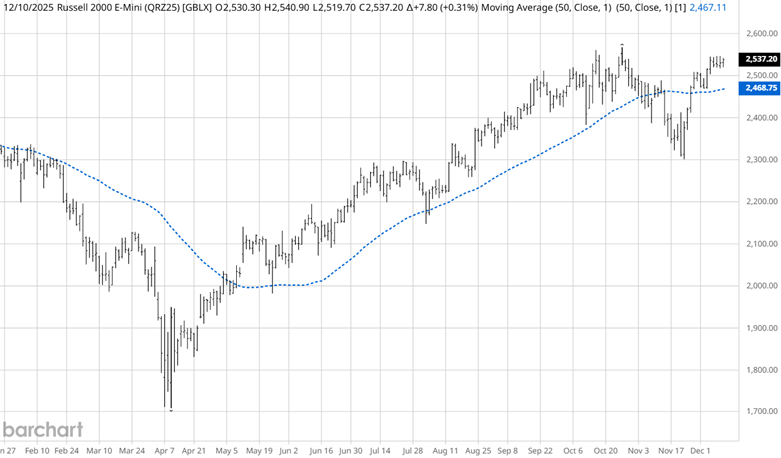

Source: Barchart

Year-to-date, the nearby daily chart of the Russell 2000 shows that the 50-day simple moving average (SMA) has served as both support and resistance. After a brief dip under the SMA in early November, the Russell 2000 has come back strong. Reaching levels that are within striking distance of all new highs.

Previous Year's Correlations

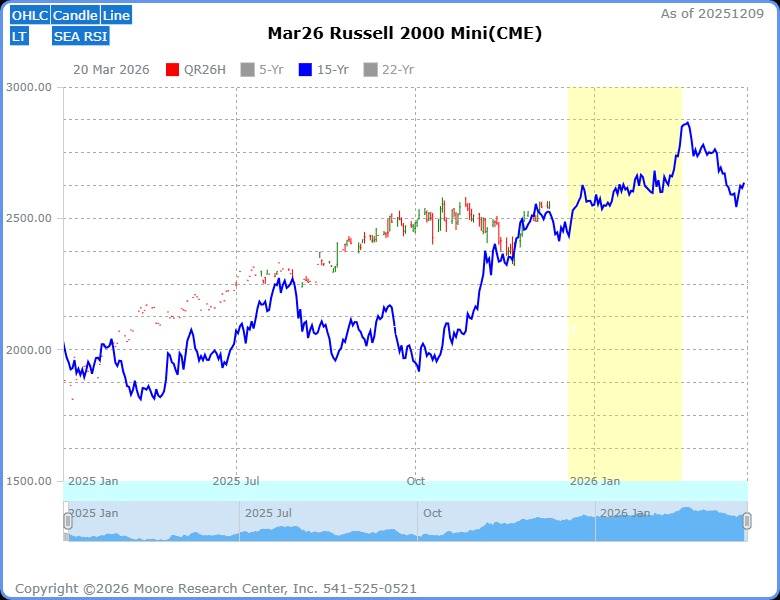

Source: Moore Research Center, Inc. (MRCI)

The stock indexes have recently rolled to the March 2026 contract. The new contract has shown strong correlations with recent years of uptrend. Currently, there is a significant correlation (green) with 2004 (87%), 2010 (90%), 2014 (91%), and 2021 (84%). The current move could extend into mid-January. Leaving plenty of opportunity for traders to participate.

What really gives you an edge here is layering on the seasonal tailwinds: small caps have a proven habit of grinding stronger through December and into January with that classic year-end rebalancing and January effect kick, so combining these correlated paths with the typical late-year push could hand disciplined futures traders some serious room to ride the momentum without fighting the tape.

Optimal Seasonal Window

Source: MRCI

MRCI research has identified a 15-year (blue) seasonal buying pattern in the March Russell 2000 futures. After refining the research to maximize returns and minimize drawdown during the trade, they identified an optimal seasonal window (yellow). During this window, the March Russell 2000 contract has closed higher on approximately February 15 than on December 19 in 13 of the past 15 years, for an 87% occurrence rate. During this hypothetical trading period, the average profit per trade was 62.21 points, yielding $3,110.33 in returns per contract.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider technical and fundamental indicators, risk management strategies, and market conditions to make informed, balanced trading decisions.

Source: MRCI

Assets to Trade the Russell 2000

Futures traders can trade the mini-Russell contract (QR) or the micro contract (RX). Both of these trade for 23 hours per day on the CME Group exchange.

Equity traders could trade the exchange-traded fund (ETF) (IWM).

Options are available for both futures and equity products.

In Closing…

As we wrap up 2025, it's clear that small caps have finally started to reclaim some ground after years in the shadow of those mega-cap tech darlings. With cheaper valuations, more substantial earnings growth on the horizon, and a favorable setup from lower rates and a solid economy, this points to more upside ahead. The technicals are cooperating too, the Russell futures are bouncing off key support and eyeing new highs. At the same time, while those high-correlation years and that MRCI seasonal pattern into mid-February (87% winners over 15 years, averaging over 60 points) are screaming for attention right now in the March '26 contract. If you're a futures or equities trader sitting on the sidelines, this feels like one of those setups worth digging into deeper. Pull up your charts, layer in the seasonals with the fundamentals and technicals, properly manage your risk, and see if there's a real opportunity here to catch the next leg of this rotation before it plays out.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)