/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Out-of-the-money (OTM) Alphabet, Inc. (GOOGL) put options can give a 1.77% to short-sellers over the next month. Moreover, GOOGL stock has +32% upside based on an FCF-based target. Buying in-the-money calls is another play.

GOOGL closed at $309.29 on Friday, Dec. 12. It's slightly below a recent peak of $323.44 on Nov. 25. But it could be worth as much as $408.27 over the next year, as I recently wrote.

Today's article will discuss ways to play GOOGL stock's upside on a relatively safe basis using leverage with out-of-the-money (OTM) put options and in-the-money (ITM) calls.

I discussed shorting the $275.00 strike price put option expiring Friday for a 1.764% yield in a Nov. 11 Barchart article ("Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued").

As GOOGL closed above this strike price, the short-put investors would not have had their account assigned to buy 100 shares of GOOGL at $275.00. So, this was a successful short play with good income.

However, when the play was initiated on Nov. 11, GOOGL was at $289.58. So, it's up +6.8% over the last month. That's better than the OTM short-put return of 1.764%.

So, why not use the income from shorting OTM GOOGL puts to participate in GOOGL's upside using in-the-money (ITM) calls? This article will show how to do this.

First, let's review the upside price target in GOOGL stock.

GOOGL Price Targets (PT)

In my last article, I showed that based on Alphabet's strong free cash flow (FCF) margins, it could be worth over $408 over the next 12 months.

For example, last quarter its FCF margin (i.e., FCF/revenue) rose to 23.9% from 19.98% a year earlier. Its average over the last year was 19.08% but that included one quarter with a low outlier.

Therefore, assuming Alphabet generates 22% of revenue as FCF, it could generate about $100 billion in FCF in 2026. But, just to be conservative, let's assume it might make as low as $90 billion in FCF.

Therefore, using a 2.0% FCF yield, i.e., 50x FCF, GOOGL stock could be worth between $4.5 trillion and $5 trillion over the next year:

50 x $90b FCF = $4,500 b; 50 x $100b FCF = $5,000 billion

Today, Alphabet's market cap is just $3.746 trillion, according to Yahoo! Finance. In other words, Alphabet could be worth about $1 trillion or +26.8% more($4.75 trillion/$3.746 trillion = 1.268).

That implies that the price target (PT) is 26.8% higher:

$309.29 x 1.268 = $392.18.

And the peak PT could be as high as 33.5% above the current market value (i.e., $5tr/$3.736tr), or $412.90 per share.

So, on average, we could expect a PT of over $400 per share (i.e.,$402.54 per share).

Moreover, 33 analysts surveyed by AnaChart show that the average price target (PT) is $343.47. The bottom line is that GOOGL stock looks undervalued.

Shorting OTM Puts

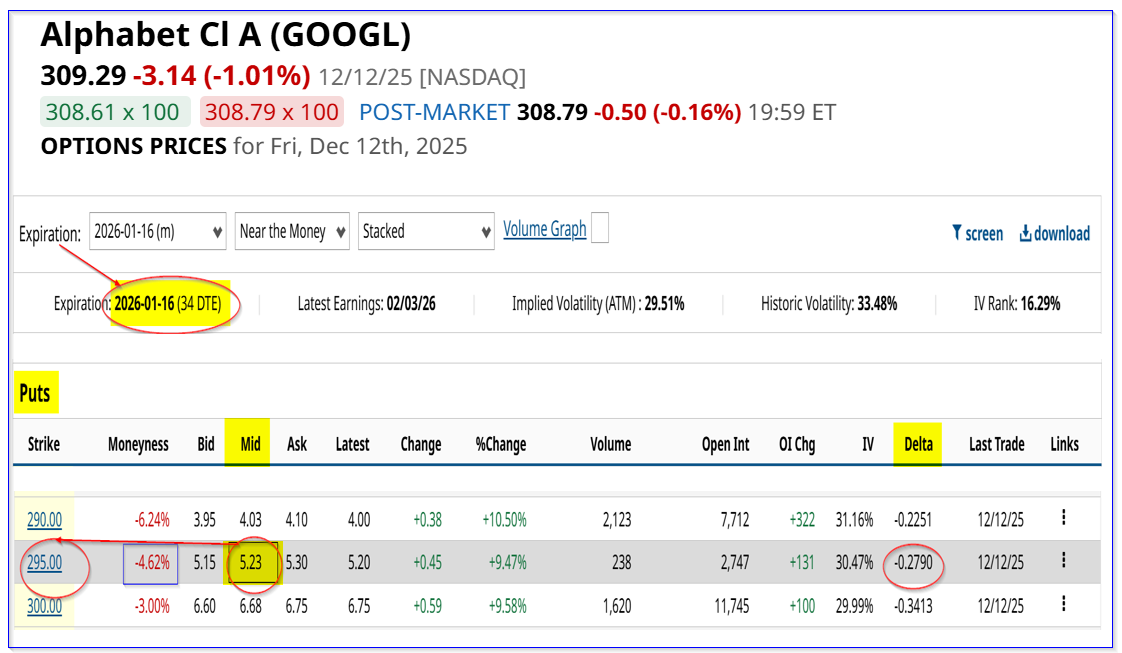

One way to play this, as discussed earlier, is to sell short out-of-the-money (OTM) puts in near-term expiry periods. For example, the Jan. 16, 2026, expiry period shows that $295.00 strike price put option has a premium of $5.23 per put contract.

That provides a short-seller of this strike price, which is 4.62% below the closing trading price, provides a short-seller an immediate yield of 1.77% (i.e., $5.23/$295.00 = 0.0177).

This means that an investor who secures $29,500 with their brokerage firm can immediately make $523.00 (i.e., 1.77%).

As long as GOOGL stays over $295.00 for the next month, the $29.5K collateral will not be assigned to buy 100 shares of GOOGL at $295.00.

Moreover, as discussed earlier, this income can be used to partially fund buying in-the-money (calls) at a later expiry period. That way, an investor can gain leveraged exposure, in a relatively safe manner, to any upside in GOOGL stock.

Buying ITM GOOGL Calls

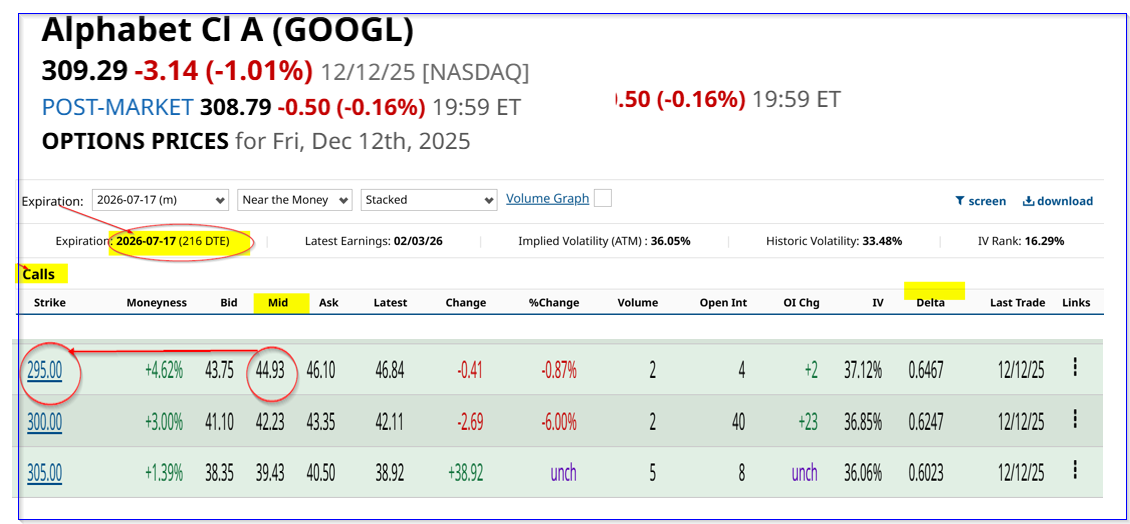

For example, the $295.00 call option expiring on July 17, 2026, shows that the midpoint premium is $44.93. Note that this strike price is in-the-money (ITM) by $14.29 (i.e., $309.29-$295).

That provides some downside protection for an investor, in case GOOGL stock stays flat or falls.

Moreover, if the investor can repeat this one-month OTM short-put play 7 times until July 17, the potential income is $36.61 (i.e., 7x $5.23 received each month, including Jan. 17).

That covers much of the $44.93 price paid for the $295.00 July 17, 2026, call option:

$44.93 call price - $36.61 put income received = $8.32 net cost

Just to be conservative, let's assume the net income received is just $29.93 over the next 7 months:

$44.93 call price - $29.93 put income = $15.00 net cost

And if GOOGL stock rises to just $370 over the next 7 months, the intrinsic value of the $295.00 calls will be:

$370-$295 = $75.00 per call

That implies that the net return will be

$75/15 -1 = 5-1 = 4 = 400% upside

Moreover, just to be conservative, let's say that GOOGL stays flat in 7 months at $310 per share. The intrinsic value of the call option is just $15 (i.e., $310-$295).

So, the investor paid $44.93 for the OTM calls, received income of $29.93 from OTM puts, but could potentially sell the 7/17/26 call at $15.00 in 7 months. Here is the net result:

$44.93-$29.93 = $15.00 ITM call option cost; $15.00 received from call at its intrinsic value = $0 profit.

In other words, there is no loss, and this play has good downside protection. Any net price increase over $309.29 could result in a potential profit.

That shows that shorting OTM GOOGL puts and also buying ITM calls may be an attractive leveraged way to play Alphabet.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)