Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 74%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Watch List Favorites

This week the Newsletter contains 22 stocks and ETFs across 9 sectors. 2 of the stocks on the Watch List are detailed below:

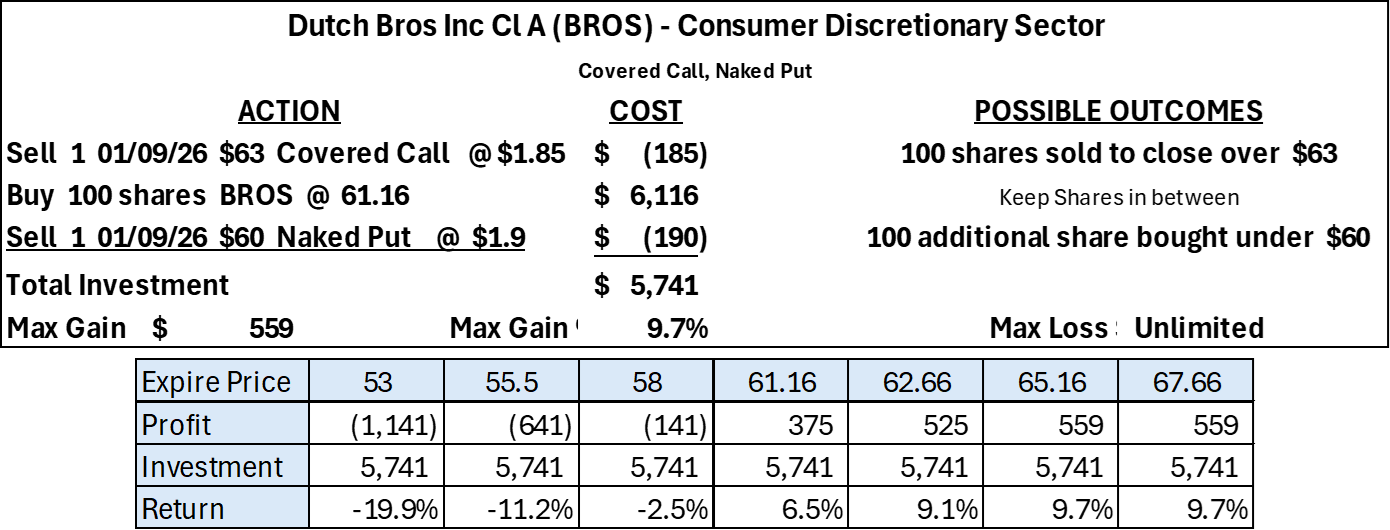

Dutch Bros Inc

- PDutch Bros Inc., together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments.

Dutch Bros Inc crossed the 100-day MA this week and now sits comfortably above 3 moving average.

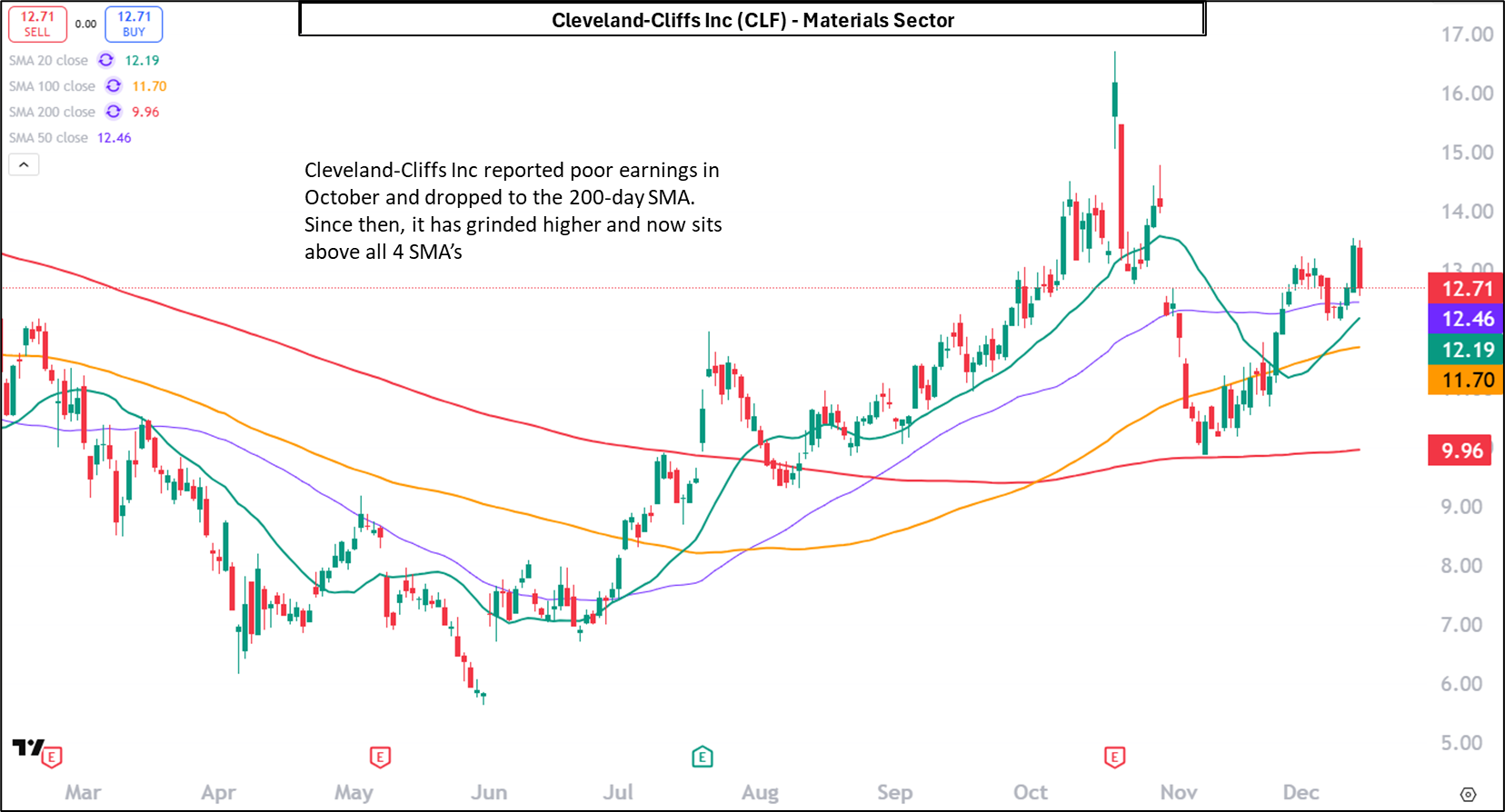

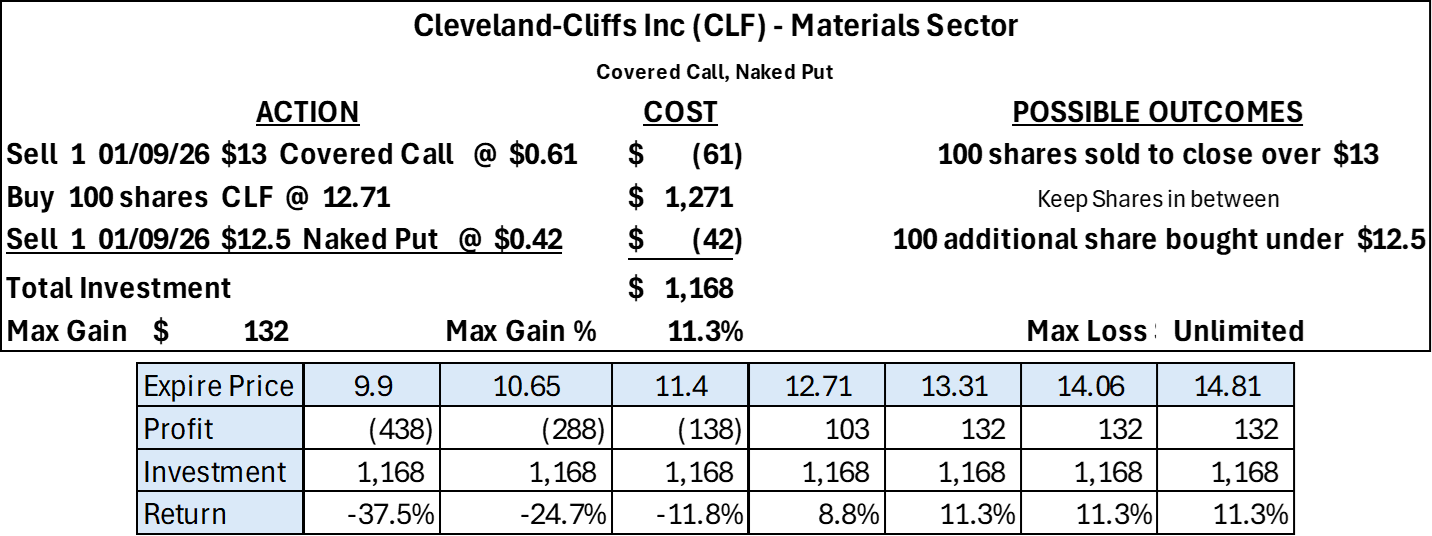

Cleveland-Cliffs Inc

- Cleveland-Cliffs Inc. operates as a flat-rolled steel producer in the United States, Canada, and internationally. The company offers hot-rolled, cold-rolled, electrogalvanized, hot-dip galvanized and galvannealed, aluminized, galvalume, enameling, and advanced high-strength steel products; austenitic, martensitic, duplex, precipitation hardening, and ferritic stainless-steel products; steel plates; and grain oriented and non-oriented electrical steel products, as well as slab, rail, scrap, iron ore, coal, coke, and tool and die, stamped components.

Cleveland-Cliffs Inc reported poor earnings in October and dropped to the 200-day SMA. Since then, it has grinded higher and now sits above all 4 SMA’s

Past Performance

Each week the Newsletter contains around 20 stocks / ETF's on the Watch List to be opened the following Monday for expiration 4 Fridays later. Since the expiration cycle on May 23, the average stock gain on the Watch List has outperformed the S&P 500 23 of 29 weeks. The average Watch List to S&P 500 ratio currently sits at 2.55 : 1 in favor of the Watch List.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)