With Global X’s launch of a new gold mining ETF, I can’t help but notice that the wars in the industry just keep building. Sometimes it is over price, other times a tilt or nuance in how an ETF is structured versus its established peers.

To be crystal clear, this is not a knock against the product makers and the researchers who devise, construct, and maintain those passive indexes. Or the ones who have added actively managed ETFs to the marketplace, in greater numbers than ever over the past few years. The creation, development, and expansion of the ETF business is in my view, the most investor-friendly innovation of the 21st century so far.

My concerns as someone who has been there since the first ETF launch in 1993, and as someone who has written several hundred articles on ETFs, is that newer, self-directed “retail” investors need more resources to succeed.

In the same way that if you showed me 20 different types of floor coverings, my reaction would be something like “I dunno,” DIY investors can be forgiven for concluding that ETF investing is too complicated. Not because they don’t understand the basics. But because there are so many bells and whistles across the ETF landscape, that “paralysis by analysis” is the name of the game for many retail investors.

Let’s face it, the folks who tend to gravitate toward full control over their own portfolios are more likely to dig in to find ETFs with an edge. And that’s why, when something like Global X’s latest gold mining ETF hits the market, it gets me thinking again about how to help investors sift through the details and make confident decisions. Not only at their portfolio-wide level, but step by step and piece by piece. Where ETFs are the pieces.

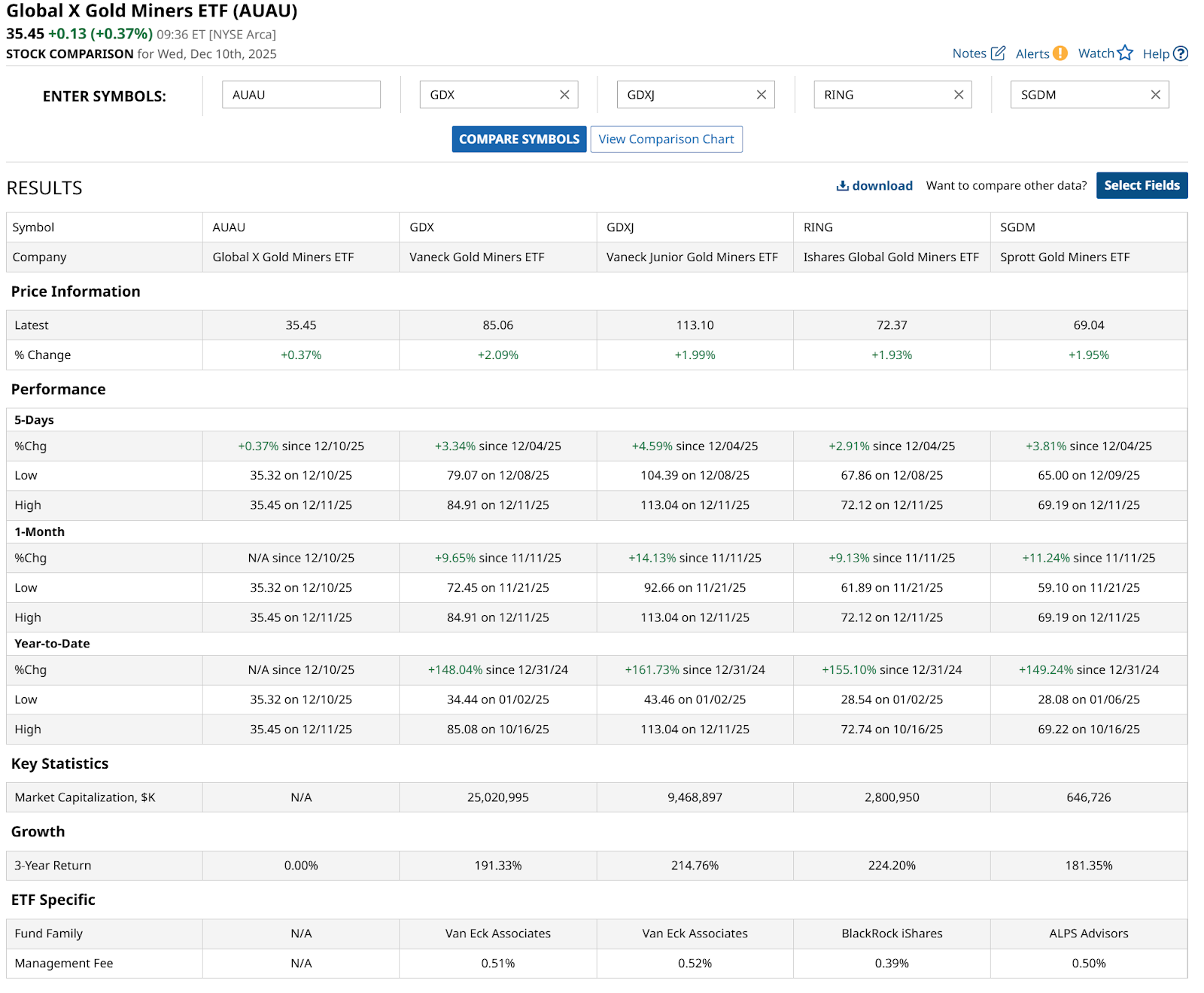

The new Global X Gold Miners ETF (AUAU) brought us the industry’s latest edition of “expense ratio limbo” by launching with a fee of 0.35%. That compares favorably to the four existing alternatives shown beside it in the table below. For institutional investors, 10 or 15 basis points of cost can be significant. For retail investors, maybe not so much. Especially if they are trading it, since those expense ratios are annual.

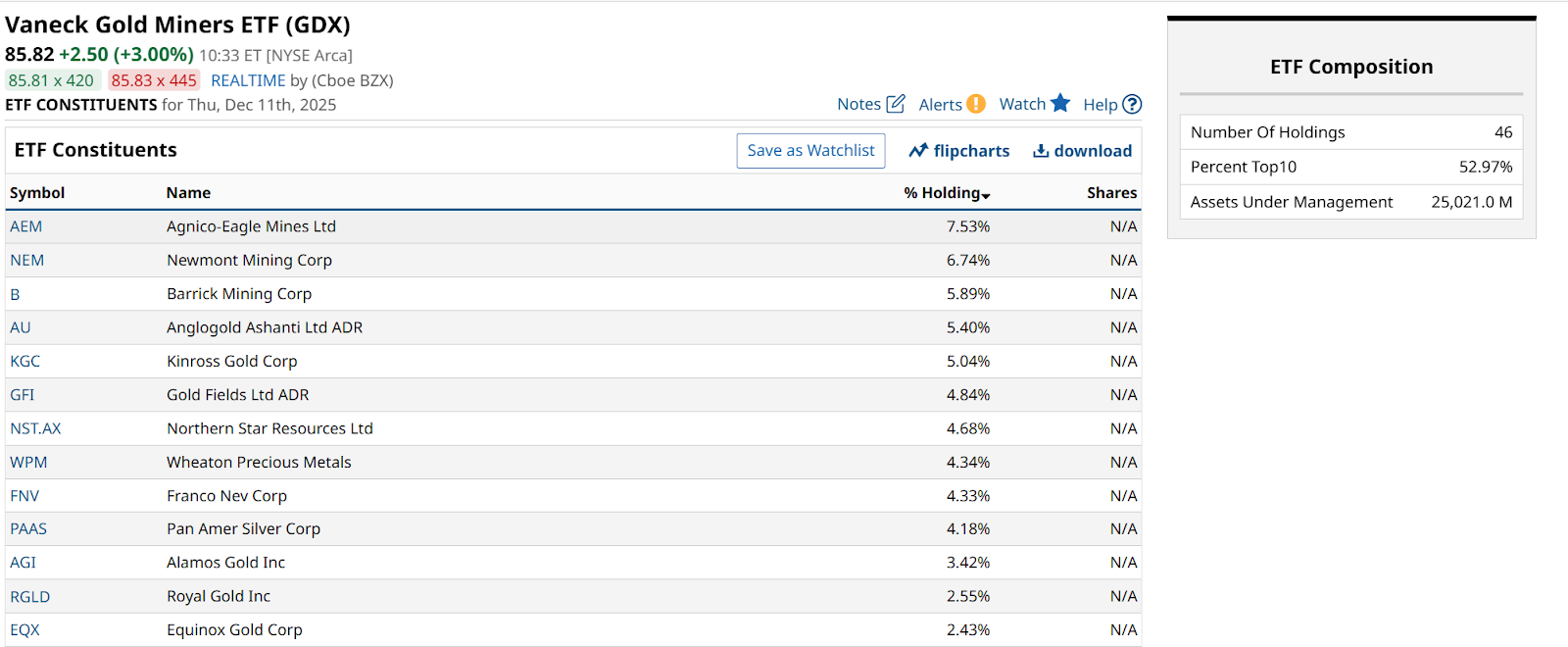

AUAU tracks an 80-stock index, the NYSE Arca Gold Miners Index. The others cover anywhere from 39 to 96 names. But as we can see in examining the holdings of the Vaneck Gold Miners ETF (GDX), which is by far the largest of the group, when market capitalization weighting is involved, many industries tend to be concentrated among a small number of stocks.

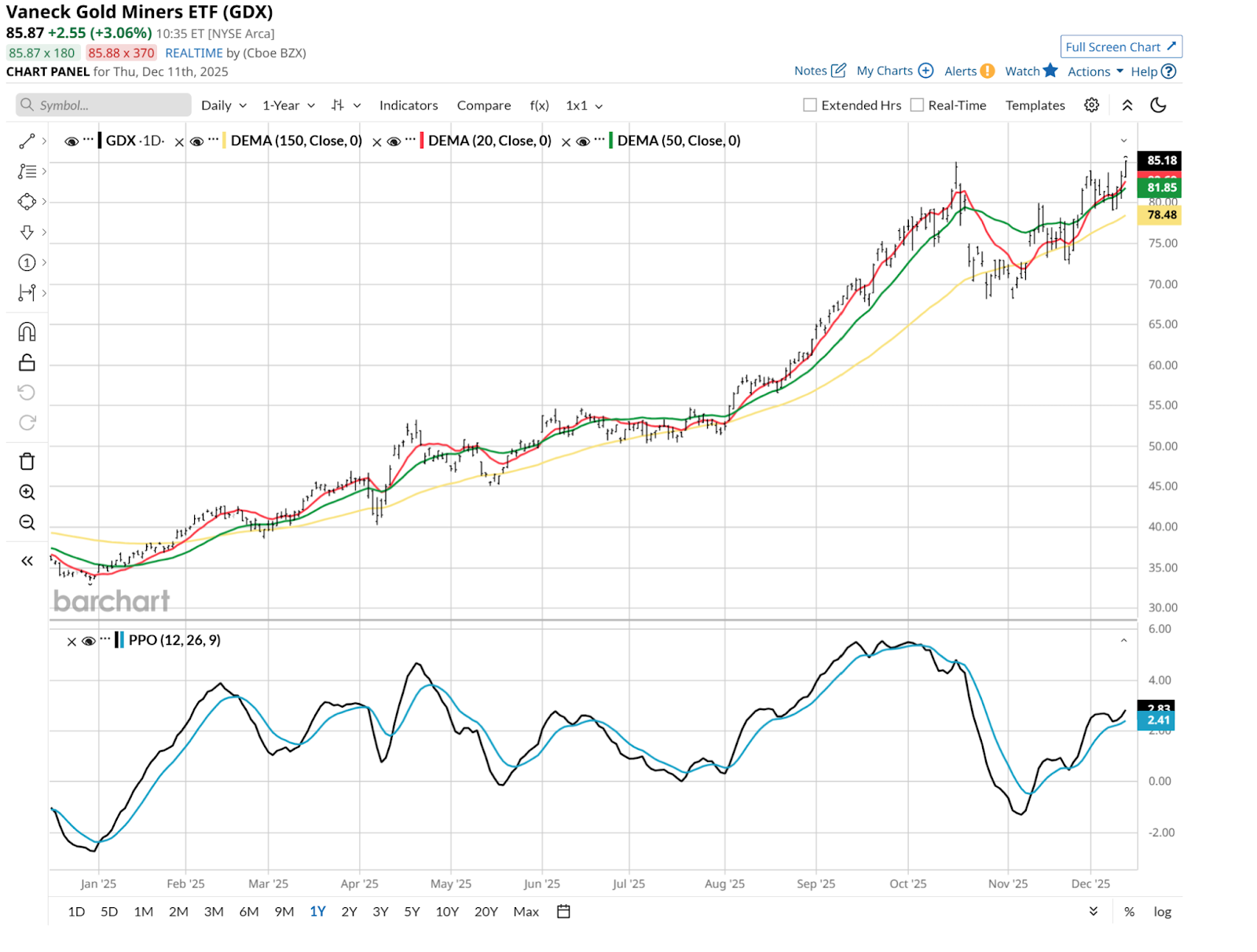

Gold miners, using GDX as a proxy, look pretty good technically. After years of minimal returns, they rallied with gold metal (GCG26), as they often do. And after a pullback, they appear poised for another run higher, at least in a trader’s time frame. Importantly, gold stocks go through periods in which they track gold, and others where they track stocks. So investors should not assume AUAU or its peer ETFs will simply move up and down with gold. Miners are more volatile.

Should You Own Gold Mining ETFs?

That is the question at the heart of the ETF dilemma for so many retail investors who make their own decisions. Sure, ETFs are great tools to build wealth over time, to trade sub-sections of the markets, and hedge within a portfolio. But how do you figure out which ones to own, even after you decide, for instance, that you consider gold mining stocks a good fit for your portfolio?

And while it is a much bigger discussion than this one article can address, here are some short cuts. When investing in ETFs:

- How important is fund size, years of operation and the sponsor firm behind the ETF? Remember, in most cases, ETFs track indexes, and track them very closely. That’s their job.

- How much depth do you want in your ETF portfolio? There are broad market stock ETFs, sector funds, industry ETFs like gold mining, and a wide range of other classifications and tilts. Do you feel the need to target smaller market segments, and if so, to what degree?

- Do you care about the past performance of an ETF? I personally care very little, as I’m a chartist, focused solely on where it is going, and how much risk is attached to that view, but that’s just me.

- What is it about you as an investor… and a human being… that you want reflected in your ETF choices? That includes risk attitude, willingness to explore unfamiliar areas of the markets, social factors, and more.

The ETF industry has done a fantastic job of presenting us with no shortage of choices. That’s a double-edged sword. Lots to choose from, but the easier we wish to make it, and the less time we want to spend thinking about our portfolio, the more that freedom of choice creates a tug-of-war between simplicity and complexity.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)