/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Before markets gear up for another major earnings cycle, all eyes are turning to Micron Technology (MU). With its next quarterly results scheduled for Wednesday, Dec. 17, after the market close, investors and analysts alike are debating whether now could be a strategic entry point. In recent weeks, several top Wall Street firms have turned bullish, citing surging demand for memory chips driven by the artificial-intelligence (AI) boom, tightening supply dynamics, and renewed pricing power in DRAM and high-bandwidth memory (HBM).

Deutsche Bank reiterated its “Buy” rating and raised its price target to $280, citing tightening supply, recent price increases, and stronger-than-expected industry dynamics. The bank also lifted its FY26 EPS forecast, arguing Micron is uniquely positioned to prioritize profitability during this memory upcycle. HSBC also joined the bullish camp, initiating coverage with a “Buy."

Is this your cue to scoop up Micron shares?

About Micron Technology Stock

Semiconductor company Micron Technology designs, develops, manufactures, and sells memory and storage products globally, including DRAM, NAND flash memory, HBM, solid-state drives (SSDs), and other memory modules. Headquartered in Boise, Idaho, Micron operates multiple business units serving cloud/data center, mobile and client, automotive/embedded, and enterprise segments worldwide. Micron’s market cap stands around $296.4 billion, putting it among the largest and most valuable players in the global semiconductor industry.

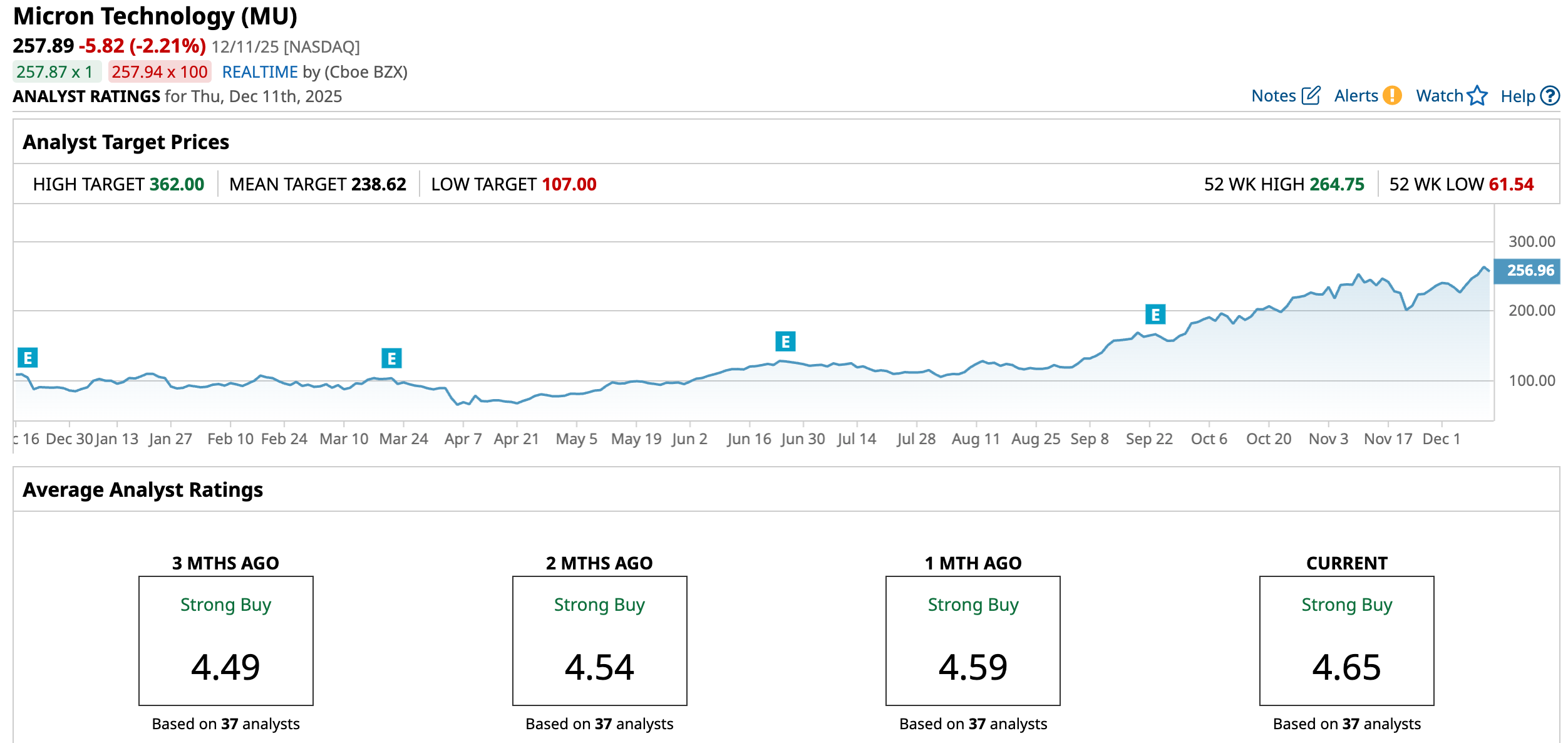

MU has posted an extraordinary run in 2025. It is up 206.43% year-to-date (YTD), easily putting it among the top-performing tech names this year. Over the past 52 weeks, shares have soared 152.7%. The stock is just trading marginally down from its 52-week peak of $264.75 reached on Dec. 10. The immediate trigger for the surge was a rally across the tech and semiconductor sector following the Federal Reserve interest-rate cut, which boosted investor confidence.

Meanwhile, the stock has seen a meteoric rise this year largely driven by a boom in demand for memory products, especially HBM and server DRAM, fueled by surging investment in AI, cloud infrastructure, and data center expansion.

Tight supply conditions in the global memory-chip market, combined with sharply rising DRAM and HBM prices, have boosted revenue and profit expectations for Micron.

In spite of the surge, the stock still seems to be trading at a discount compared to industry peers at 15.07 times forward earnings.

Better-than-expected Q4 Performance

Micron Technology delivered its latest quarterly and full-year results on Sept. 23. In the fourth quarter of fiscal 2025, Micron posted revenue of about $11.3 billion, up 46.1% compared with the same quarter a year earlier and beating analysts’ expectations. On a non-GAAP basis, earnings were $3.5 billion, or $3.03 per share, a substantial increase from $1.18 per share a year ago and higher than the consensus estimate. Non-GAAP gross margin expanded to 45.7% from 36.5%.

For the full fiscal 2025, Micron’s revenue reached $37.4 billion, up from $25.1 billion in fiscal 2024, a jump of about 48.9% year-over-year (YOY). On a non-GAAP basis, full-year net income came in at $9.5 billion, or $8.29 per share, up sharply from $1.5 billion and $1.30 per share the prior year.

Also, Micron provided guidance for the fiscal first quarter of 2026. The company expects revenue of $12.5 billion ± $300 million, and non-GAAP EPS of $3.75 ± $0.15.

In addition, Deutsche Bank raised its full-year fiscal 2026 outlook for Micron, boosting its EPS forecast by nearly 26% to $20.63 from the earlier estimate of $16.41. The firm likewise lifted its revenue projection by about 12%, now expecting Micron to generate $59.7 billion for the year compared with its previous estimate of $53.2 billion.

For Q1, which ended in November, analysts expect EPS to grow 121% YOY to $3.58. Also, the consensus EPS estimate of $16.75 for fiscal 2026 reflects an increase of 118.1%, while the EPS estimate of $21.33 for fiscal 2027 indicates a 27.3% rise YOY.

What Do Analysts Expect for Micron Stock?

In addition to Deutsche Bank, several other analysts have shown optimism toward Micron Technology.

HSBC has recently initiated coverage on Micron with a “Buy” rating and a $330 price target, arguing that the market is still underestimating the company’s growth trajectory even after its massive YTD surge. The firm sees concerns about neo-CSP exposure and the Stargate Project as overstated and views current levels as an attractive entry point.

HSBC believes investors have yet to fully price in the strength of the ongoing DRAM rally or Micron’s potential eSSD market-share gains. The bank forecasts exceptionally strong earnings momentum, projecting a 125% CAGR in operating profit from fiscal 2025 to 2027.

Also, UBS reaffirmed its “Buy” rating and $275 price target on Micron ahead of its upcoming earnings, maintaining a bullish stance. The firm believes Micron’s comments about tightening supply through 2026 signal a stronger-than-guided quarter.

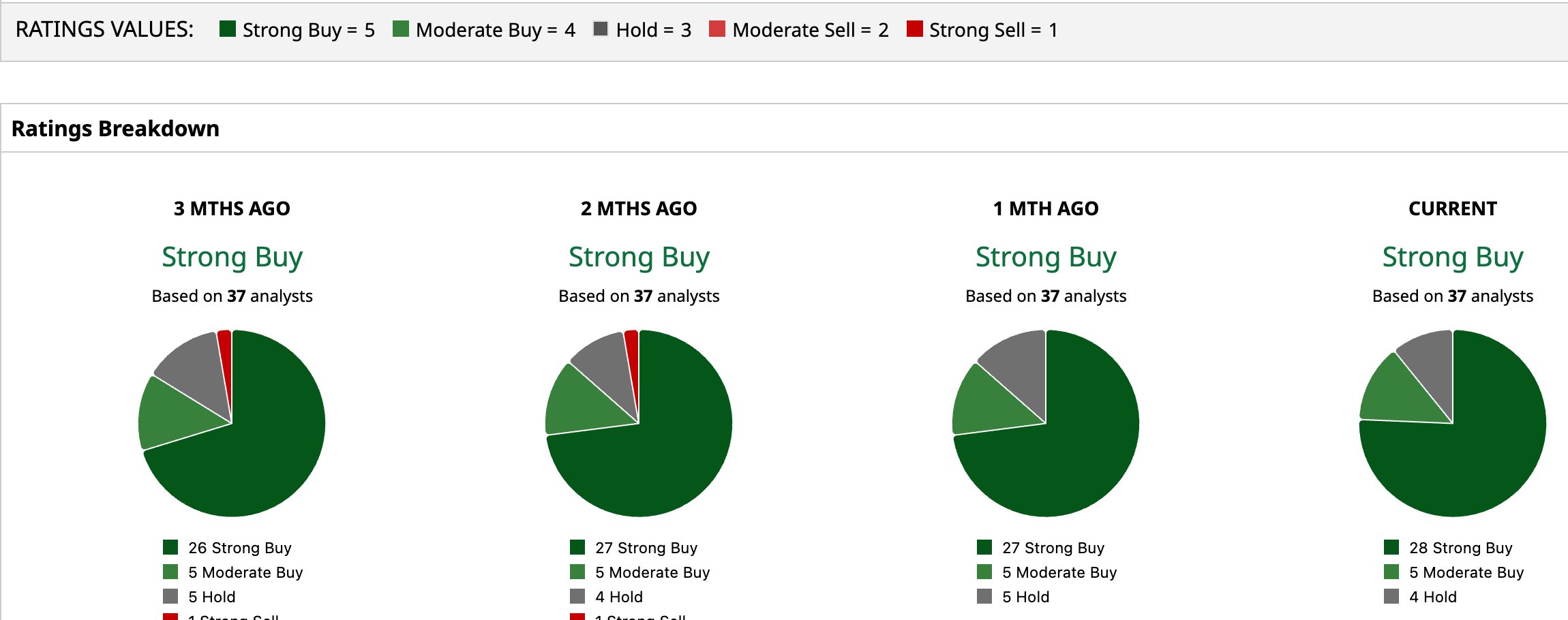

Wall Street is majorly bullish on MU. Overall, MU has a consensus “Strong Buy” rating. Of the 37 analysts covering the stock, 28 advise a “Strong Buy,” five suggest a “Moderate Buy,” and four analysts are on the sidelines, giving it a “Hold” rating.

While MU has already surged past the average analyst price target of $238.62, the Street-high target price of $362 suggests that the stock could rally as much as 40.4%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)