I asked if silver prices had reached a peak in a November 20, 2025, Barchart article, where I concluded with the following:

While I remain bullish on silver prices, buying and accumulating silver or silver-related products during corrections, leaving room to add on further declines has been optimal, and I expect that trend to continue. The bottom line is that I expect the price to rise far above the October 2025 record high, but the road to higher prices could be extremely volatile.

It did not take long for silver to eclipse the October 2025 record high, as the precious metals rose to higher highs in November and again in December.

Silver continues to reach new highs

On December 9, nearby COMEX silver futures rose to another new high at $61.11 per ounce as the price blew through the $60 level.

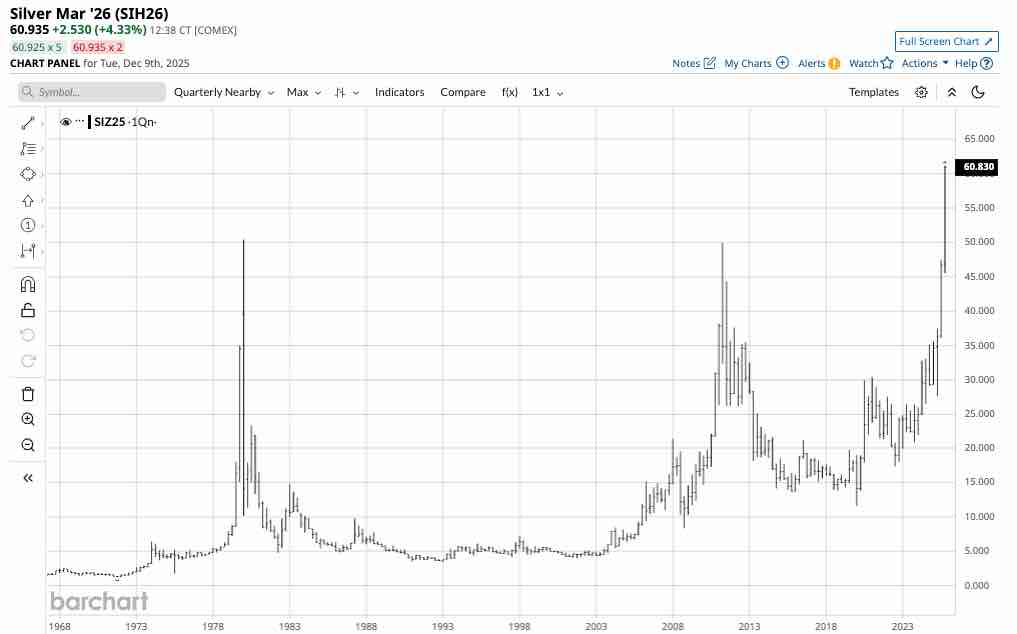

The long-term quarterly continuous contract chart shows silver’s ascent, which rallied through $50 per ounce in November 2025 like a hot knife through butter. Silver traded to a higher high in December as the bullish trend continues to charge higher.

$65 looks likely before the end of 2025

The following factors favor higher highs in the silver futures market over the coming days, weeks, and months:

- The silver market is on track for its fifth straight year in which demand exceeds supply.

- The trend since the 2020 low of $11.64 per ounce remains higher, with the rally turning parabolic in 2025.

- Gold, silver’s precious sibling, has posted new record highs over the past nine consecutive quarters.

- Silver is a highly speculative metal that attracts herds of investors and speculators when significant bullish trends develop, and the trend tends to be silver traders’ best friend.

While the silver market is in a structural deficit amid rising industrial demand, investment demand is booming in late 2025, with the price heading toward a challenge of the $65 per ounce level.

How high can silver rise in 2026

Gold prices found a bottom in 1999 at around $252.50 per ounce when the Bank of England sold half of the U.K.’s reserves, establishing a significant price bottom. Gold’s bull market is now moving into its twenty-seventh year.

Silver had lagged gold’s dramatic rally, but it is catching up in late 2025 as the price moved above the $60 level. Silver’s ability to rally depends on investment and speculative demand over the coming months. Silver is less rare than gold, but it is still a precious metal. The 1980 high attracted significant silver back to the market, as the high price caused holders to sell their metal for processing into silver bars. It is challenging to speculate on the price level that will attract silver to the market for processing that could add to supplies and narrow the deficit. However, in late 2025, silver remains in a parabolic rally. It is virtually impossible to pick tops in markets as aggressive rallies often defy technical levels and supply/demand fundamentals. While $100 silver is undoubtedly possible, commodity markets tend to rise to levels where cyclicality causes production to increase, inventories to build, and consumers to seek alternatives.

The higher the price goes, the greater the potential for a significant correction

One reason for the silver rally could be that it is an alternative to gold, with the price above $4,200 per ounce. Meanwhile, even the most aggressive rallies experience price corrections. In silver’s case, the metal’s history of high volatility could cause dramatic two-way price action over the coming weeks and months.

Trading silver with bullish and bearish leveraged ETF/ETN products- AGQ and ZSL

Even though gold no longer backs currencies, governments, central banks, and monetary authorities hold it as a reserve asset, validating its role in the global financial system. Central banks have added to reserves over the past years, making gold a leading reserve asset. It has been many decades since silver played a similar role, as governments have shunned silver reserves because of its high price volatility.

Therefore, we should expect intense two-way price action in silver over the coming months, now that the price is over $60 per ounce. While investing in silver on price weakness has been optimal since the low in 2020, trading silver in 2026 could offer optimal results.

While the physical market for bars and coins is the most direct route for investment, COMEX silver futures and options are highly liquid, leveraged instruments for trading. While many ETFs track silver prices, the most liquid silver ETF is the iShares Silver Trust (SLV). At $54.78 per share, SLV had over $28.397 billion in assets under management. SLV trades an average of over 34 million shares daily and charges a 0.50% management fee.

The Ultra Silver 2X ETF (AGQ) reflects twice the daily performance of silver bullion as measured by the U.S. dollar price for delivery in London. At $121.52 on December 9, AGQ had over $1.472 billion in assets under management. AGQ trades an average of over 2.72 million shares daily and charges a 0.95% management fee.

A leveraged bearish ETF to consider is the Ultrashort Silver -2X ETF (ZSL). ZSL reflects twice the inverse daily performance of silver bullion as measured by the U.S. dollar price for delivery in London. At $8.22 per share, ZSL had nearly $27.90 million in assets under management. ZSL trades an average of over 4.11 million shares daily and charges a 0.95% management fee.

Trading silver could be optimal after the recent rise to record highs. However, leveraged futures and ETF products require careful attention to risk-reward dynamics. Price and time stops will protect capital when approaching the market with leveraged ETFs that can suffer from time decay if silver’s price moves contrary to expectations or remains stable.

I am bullish on silver as the current trend is our friend. However, silver will likely enter a choppy period, during which price swings could favor trading over investing.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)