/A%20concept%20image%20showing%20binary%20code%20with%20the%20ERROR%20message_%20Image%20by%20Danich%20Marmai%20via%20Shutterstock_.jpg)

Among the most magnificent of the “Magnificent Seven” stocks, Meta Platforms (META) has been a top pick of mine for some time. Most of my own personal bullish thesis has to do with Meta's strong underlying cash flow-generating core business (its social media empire), which has allowed Meta to invest aggressively in new technologies and grow its time share among basically all age groups in the economy (and almost every country around the world).

With the majority of the world visiting one of Meta's sites or apps every day, Meta has done an incredible job of monetizing these eyeballs, creating a world-class moat rivaled by only a few companies out there.

Meta's core business has been complemented nicely by a growing AI business, its metaverse ambitions, and other bets that may or may not pan out. But one of the most exciting potential catalysts on the horizon is a highly anticipated rollout of a new large-language model (LLM) next year, which analysts believe could be called “Avocado.”

Let's dive into what this potential release means for the company and its outlook.

What's This New LLM Going to Do?

Meta's new AI project, code-named Avocado, is the company's latest big bet on growing its market share and remaining a leader in the world of large-language model development. Having released Llama years ago (which has come with mixed reviews), this latest model could showcase the work behind the scenes Meta and its management team have made on improving their core offerings in the technology of the future.

The company's goal, according to sources who are following this AI model release, is to have Avocado released as a proprietary model and thus not open-sourced. This would provide a bigger moat around this model and allow the company to develop an ecosystem of AI products that may be able to be more monetizable and profitable over time.

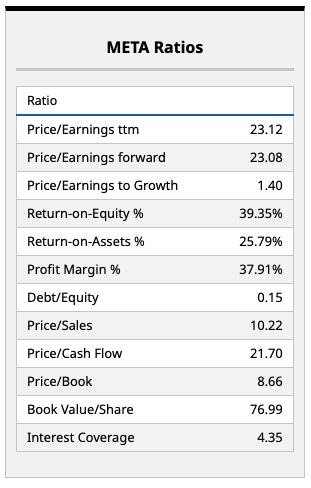

Looking at Meta's fundamentals, it's clear that this is a company with an incredible amount of profitability and growth underpinning its financials. And at 23 times forward earnings, I'd argue Meta remains among the cheapest names in this sector.

The company is clearly viewing the AI race as just that—a race for market share. Indeed, given Meta CEO Mark Zuckerberg's willingness to go “all-in” on certain bets, this is a company that's going to be heavily invested in improving its own AI offerings not only for the public and billions of users around the world but also to improve its own operations. If the company can do that, forget about its existing underlying metrics and assign some new ones.

Ultimately, I think a lot will be riding on Avocado if the company de-prioritizes its Llama LLM (and its spending on its metaverse ambitions), as Zuckerberg has indicated may be the case. Thus, the company's investment in its new LLM (and how profitable this investment turns out to be) could shape a great deal of this stock's future performance.

Given the company's recent talent acquisitions and strategic thinking around securing a dominant position in the AI race, I'm taking a bullish position on these investments. But that's going to be what market participants will collectively need to judge in the months and years to come.

Where Do Analysts Think Meta Stock Is Headed From Here?

I'm just one investor with my own opinion. And while I like to think that my opinion matters, I'm not so jaded as to think that it matters more than any of the 55 analysts currently covering META stock.

Currently, Meta has a juicy $842.31 price target on this stock, implying upside of around 30% from here. That's a very reasonable return for any investor over a one-year or 18-month time horizon.

I do think Wall Street analysts are likely correct on Meta. Despite my concerns around AI spending more broadly and the macro environment right now, I also believe that Meta is one of the greatest companies of our time and should be bought and held accordingly.

Avocado is simply the latest catalyst for investors to latch onto.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)