/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Oracle (ORCL) delivered mixed second-quarter fiscal 2026 financial results that rattled investors even as the company continues to see significant demand, driven by investments in artificial intelligence (AI) infrastructure. Earnings came in ahead of expectations, but revenue fell short, sending Oracle shares tumbling 14.7% in morning trading on Thursday.

Oracle’s Big Investment Cycle Meets Investor Skepticism

The second-quarter revenue miss stings because it arrives in the middle of one of the company’s most aggressive investment cycles. Oracle has been spending heavily to expand its cloud footprint and build out AI infrastructure. Those efforts showed up clearly in the quarter’s cash flow profile. Its free cash flow was negative $10 billion, driven by a hefty $12 billion in capital expenditures.

Oracle is betting that heavy spending will secure long-term growth. However, the size of these outlays has investors questioning how long it will take for those investments to pay off. The broader market narrative hasn’t helped. Investors are growing more cautious about the enormous sums being funneled into AI development. With companies promising transformative long-term returns, the market is becoming more sensitive to any signs of slowing momentum or delayed payoffs.

This anxiety isn’t unique to Oracle. Across the tech sector, investors are becoming more cautious about the pace and payoff of the industry’s AI spending boom. After months of hearing about transformative potential, markets are now demanding clearer evidence that the returns will materialize on schedule.

Oracle’s Growth Engine Is Running Hot

Even so, Oracle’s underlying fundamentals remain strong. Demand for its cloud services and AI-focused infrastructure continues to accelerate, and the company’s forward-looking metrics highlight that strength and momentum. Remaining performance obligations (RPO), which are contracted future revenue, surged to $523 billion, up 433% from a year ago and rising $68 billion since August. A meaningful share of this jump came from major deals with customers such as Meta (META) and Nvidia (NVDA), implying that its customer base is expanding. Notably, the portion of RPO expected to convert into revenue within the next 12 months grew 40% year over year, a sharp acceleration from recent quarters.

Momentum in cloud revenue was equally strong. Total cloud sales climbed 33% to $8 billion, an acceleration from last year’s pace and now accounting for half of Oracle’s total revenue. Infrastructure-as-a-service remained a standout, soaring 66%, powered by a 177% spike in GPU-related revenue. Cloud database services rose 30%, with Autonomous Database up 43% and multicloud consumption seeing explosive 817% growth. These are signs that Oracle’s strategy of integrated, enterprise-focused cloud services is resonating.

The company also offered an update on what its massive RPO gains mean for future growth. As most of the newly signed contracts are tied to the capacity Oracle already has available, the company expects to convert them into revenue more quickly. As a result, Oracle now forecasts an additional $4 billion in revenue for fiscal 2027. While its full-year fiscal 2026 revenue outlook remains unchanged at $67 billion, the company’s confidence in next year’s growth trajectory has strengthened.

Overall, Oracle’s quarter reflects the concerns shaping the broader AI investment narrative, which includes heavy spending today, uncertainty about timing, and enormous demand waiting to be captured. The revenue shortfall and pressure on cash flow may have rattled investors in the short term, but record backlog and accelerating cloud growth position it well to deliver strong growth.

On concerns about debt and funding growth, Oracle’s management emphasized diversified funding channels, including customer- and supplier-driven financing structures. This diversification will enable Oracle to align payments with cash receipts. This reduces the need for incremental borrowing and counters bearish assumptions about balance-sheet strain.

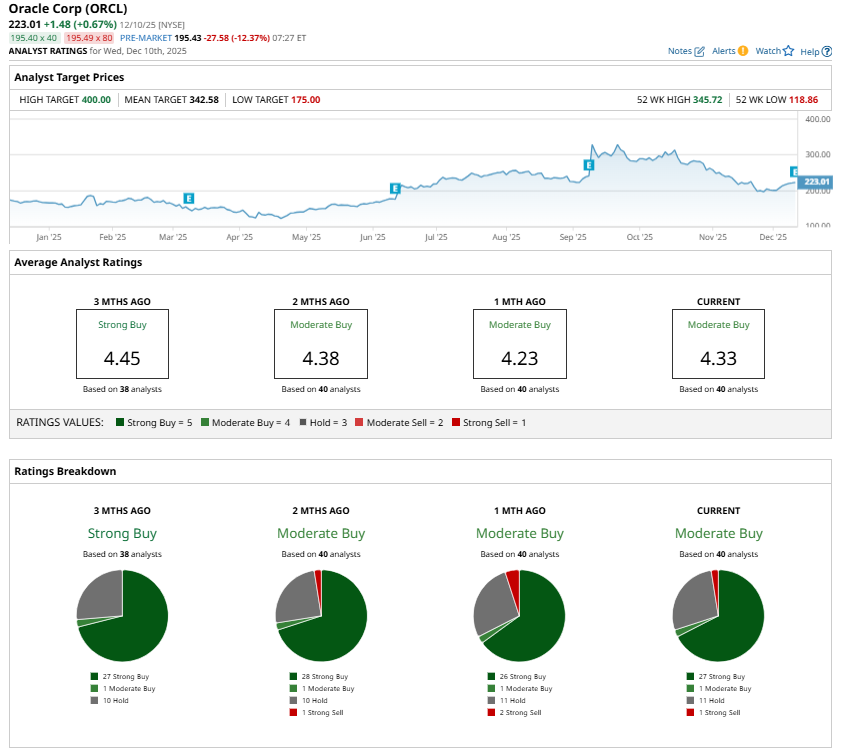

Is ORCL Stock a Buy, Sell, or Hold?

Notably, the heavy capital spending will continue to pressure Oracle’s cash flow in the near term. These concerns have kept a few analysts from endorsing ORCL stock.

However, Record RPO growth, accelerating cloud revenue, and a surge in GPU-driven infrastructure demand reveal that Oracle’s offerings are resonating with large, high-value enterprise customers. Moreover, a greater share of these commitments is expected to convert into revenue within the next year, indicating that Oracle’s capital investments may begin to translate into tangible returns sooner.

In the short term, cash flow pressure and investment fatigue may keep the stock volatile. Over the long term, the company’s robust backlog, strengthening cloud momentum, and growing leadership in AI-ready infrastructure provide a solid foundation for growth.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)