China spent decades tightening its grip on global critical-minerals supply chains, especially the 17 rare earths that power high-performance magnets in vehicles, electronics, energy systems, and defense technology. As tariff tensions continue, the United States is accelerating its push to rebuild domestic mining and processing, aiming to chip away at China’s commanding 90% share of rare-earth refining.

This step positions rare earths at the heart of the Trump administration’s push to expand domestic production, highlighting companies crucial to long-term supply security. USA Rare Earth (USAR) now sits squarely in that spotlight.

The market is reacting meaningfully to USAR’s rising relevance. Shares climbed 2.7% on Nov. 26 and jumped another 8.2% the next day after the company announced it would join major FTSE Russell indexes. The move becomes official on Dec. 22, when USAR enters both the Russell 2000® and the broader Russell 3000®.

The inclusion carries real weight. Russell indexes serve as essential benchmarks for institutional investors, guiding billions in index-linked assets. For USAR, the addition would boost visibility, deepen liquidity, and validate its growing role just as America races to reclaim strategic control of its rare-earth future.

About USA Rare Earth Stock

The Stillwater, Oklahoma-based USA Rare Earth supplies sintered neo magnets and a range of rare-earth metals. The company is building an NdFeB magnet manufacturing plant in Stillwater and aims to establish fully domestic extraction, processing, and supply capabilities to support its own production needs while selling surplus materials to third-party customers.

With a market cap of nearly $2.3 billion, USAR stock has delivered compelling momentum. Shares climbed 20.78% over the past 52 weeks and accelerated further with a 30.78% gain across the last six months.

USAR stock gained another 19.4% over the last five trading sessions, lifted by a 24.7% spike on Dec. 5 after its subsidiary, Less Common Metals (LCM), secured a supply deal with Solvay and Arnold Magnetic Technologies. The deal leverages LCM’s alloy expertise to strengthen USAR’s credibility and secure steady demand as a reliable ex-China supplier of rare-earth materials.

A Closer Look at USA Rare Earth’s Q3 Earnings

On Nov. 6, USA Rare Earth released its fiscal 2025 third-quarter results, reporting a net loss of $156.7 million, a significant increase from the $1.9 million loss in Q3 2024, as the pre-revenue company continues to invest aggressively in long-term strategic assets. Meanwhile, loss per share came in at $1.64, missing the Street’s estimate of a $0.10 loss.

Operational expenses rose to $15.9 million, reflecting higher selling, general, and administrative spending, along with increased research and development costs. These investments remain central to USAR’s progress as it advances its magnet-manufacturing facility and moves to integrate Less Common Metals Ltd. into its operations.

Despite the heavy spending, USAR marked several key milestones. It identified a flow sheet for its Round Top development project, solidifying a critical step toward future production. The Stillwater, Oklahoma magnet facility also remains on track for commissioning in early 2026, positioning the company to become a meaningful domestic source of NdFeB magnets.

USAR ended the quarter with $258 million in cash and no meaningful debt, supported by a $125 million equity investment. Subsequent warrant exercises pushed its cash balance above $400 million, giving the company considerable financial flexibility as it advances capital-intensive projects.

Analysts expect near-term losses to persist with Q4 fiscal 2025 loss per share widening 100% year-over-year (YOY) to $0.06 and a full-year loss of $0.65 per share, also up 100% YOY. However, they anticipate improvement in fiscal 2026, with losses narrowing by 36.9% to an estimated $0.41 per share.

What Do Analysts Expect for USA Rare Earth Stock?

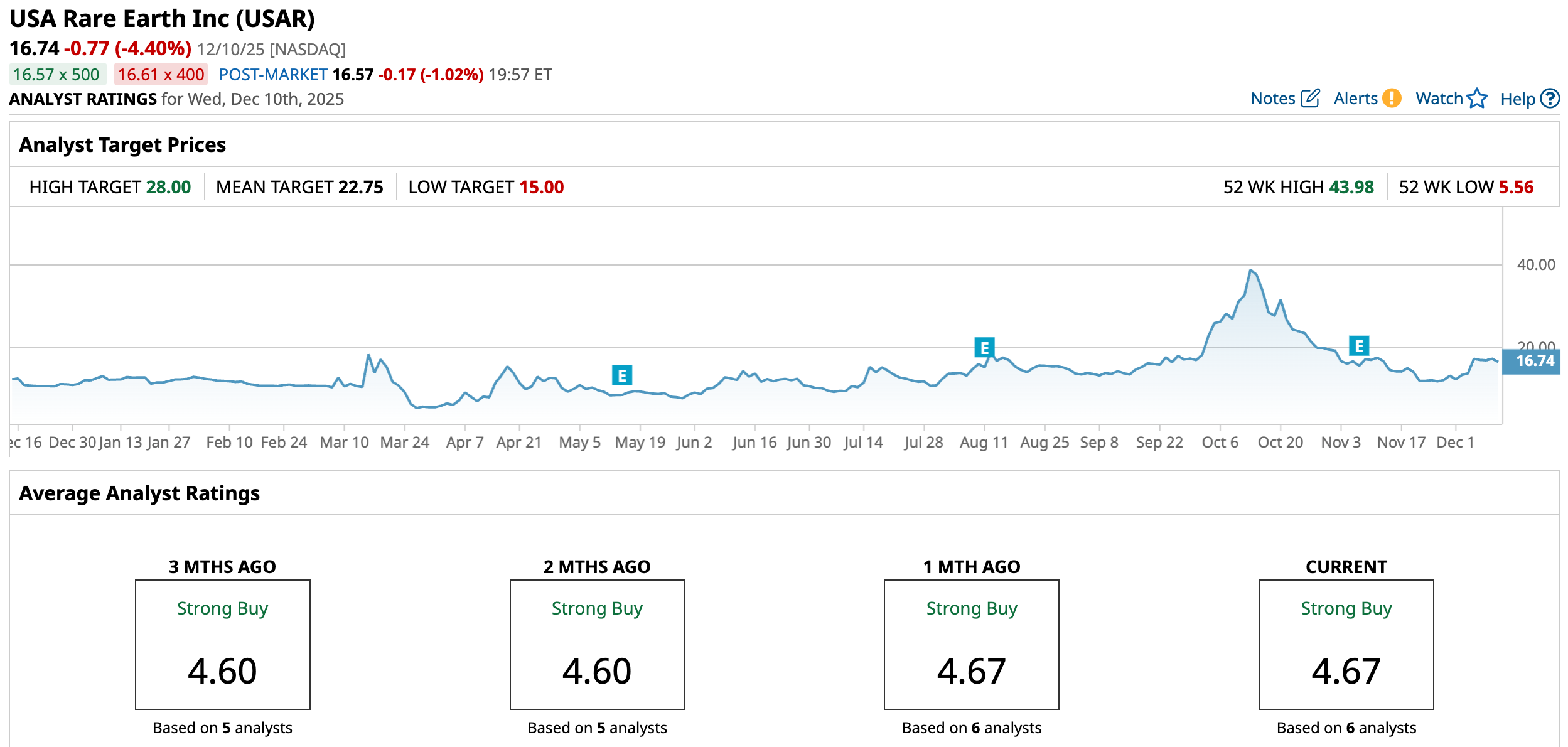

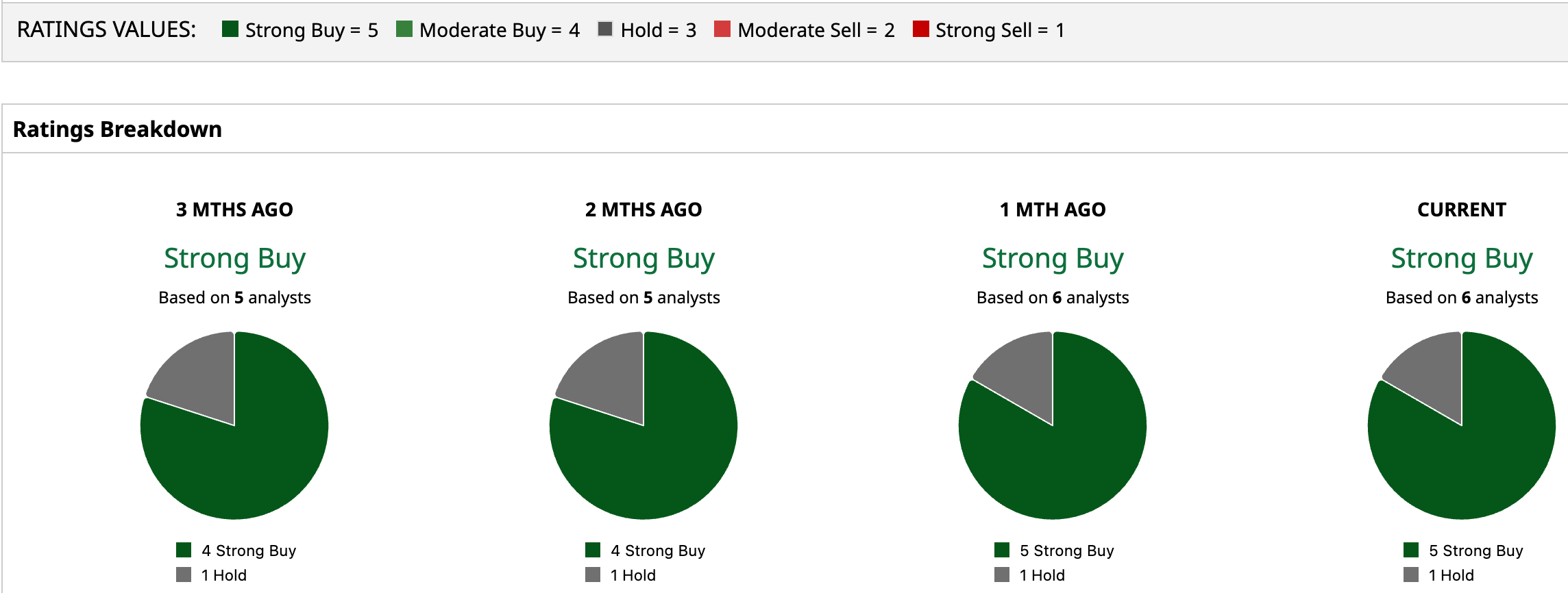

Despite its early-stage losses, USAR continues to attract strong analyst support, earning an overall “Strong Buy” rating. Of the six analysts covering the stock, five recommend a “Strong Buy,” while one rates it a “Hold,” reflecting confidence in the company’s long-term potential.

USAR’s average price target of $22.75 suggests potential upside of 35.9%. Meanwhile, the Street-high target of $28 represents potential gain of 67.2% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)