For decades, Visa (V) and American Express (Amex) (AXP) have stood at the center of the global payments revolution. Visa’s vast, asset-light payments ecosystem and Amex’s premium, closed-loop model have allowed them to capture huge market share amid the fierce competition in the fintech space. However, this year, uncertainty around interest rates, economic growth, consumer spending, and global macro factors has kept the stock momentum subdued compared to last year's performance.

Let’s find out which fintech giant is poised for a comeback in 2026.

Visa Appears Positioned for a Strong 2026

Founded in 1958, Visa is a global digital payments company that enables electronic money transfers between consumers, merchants, banks, and financial institutions. It runs one of the world's largest payment networks, handling billions of transactions safely and quickly. However, it does not issue credit cards or lend money.

Valued at $633.4 billion, Visa stock has gained 3.4% year-to-date (YTD) and 4.6% over the past 52 weeks.

Visa ended fiscal 2025 on a high note, laying the groundwork for a stronger 2026. Net revenue rose 11% year-over-year (YoY) to $40 billion, with adjusted earnings rising 14% to $11.47 per share. Processed transactions increased by 10%, payment volume by 8%, and cross-border volumes, particularly travel and ecommerce, increased by 13% YoY.

The U.S. saw stable 8% growth in credit and debit volumes, online transactions outpaced face-to-face payments, and Asia-Pacific reported modest growth. Travel and ecommerce, both high-value categories for Visa, remained resilient. In the fourth quarter, Visa expanded to 12 billion endpoints across cards, bank accounts, and wallets. It added support for multiple stablecoins and blockchains and deployed a cloud-ready, microservices-based VisaNet, much of which was designed with generative AI.

Visa highlighted that its comeback is built on the transformation of its operating model into a multi-layered “Visa-as-a-Service” stack, which includes a foundation layer, services layer, solutions layer, and access layer. As a top sponsor of both the FIFA World Cup 2026 and the Olympic & Paralympic Winter Games, Visa anticipates an increase in client activation and consumer engagement in 2026. Management expects marketing spend to peak in Q2 and Q3, but the revenue benefit to spread throughout 2026 as value-added services support client promotions connected to these events. Visa expects adjusted net revenue and adjusted EPS growth in the low double digits in 2026. Visa also plans a 14% dividend increase in 2026.

Analysts expect an 11.7% increase in earnings in fiscal 2026 and 13% in fiscal 2027. Trading at 25 times forward 2026 earnings, Visa is a reasonable buy now.

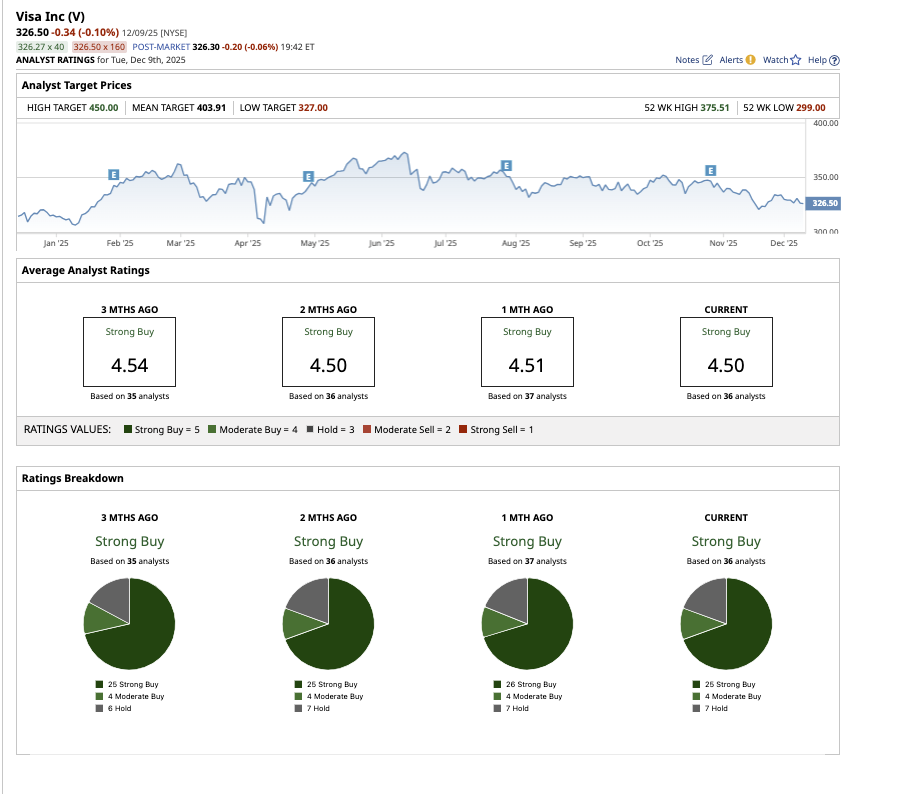

Overall, Wall Street rates Visa stock as a “Strong Buy.” Out of the 36 analysts covering the stock, 25 rate the stock a “Strong Buy,” while four rate it a “Moderate Buy,” and seven rate it a “Hold.” The average target price for V stock is $403.91, which implies an upside potential of 24%. Plus, the high target price of $450 implies potential upside of 38% in the next 12 months.

2026 Could Be a Pivotal Comeback Year for Amex

Founded in 1850, Amex is a global payments and financial services company best known for its credit cards, charge cards, and travel-related services. It focuses heavily on premium customers and offers rewards, lifestyle benefits, and business payment solutions.

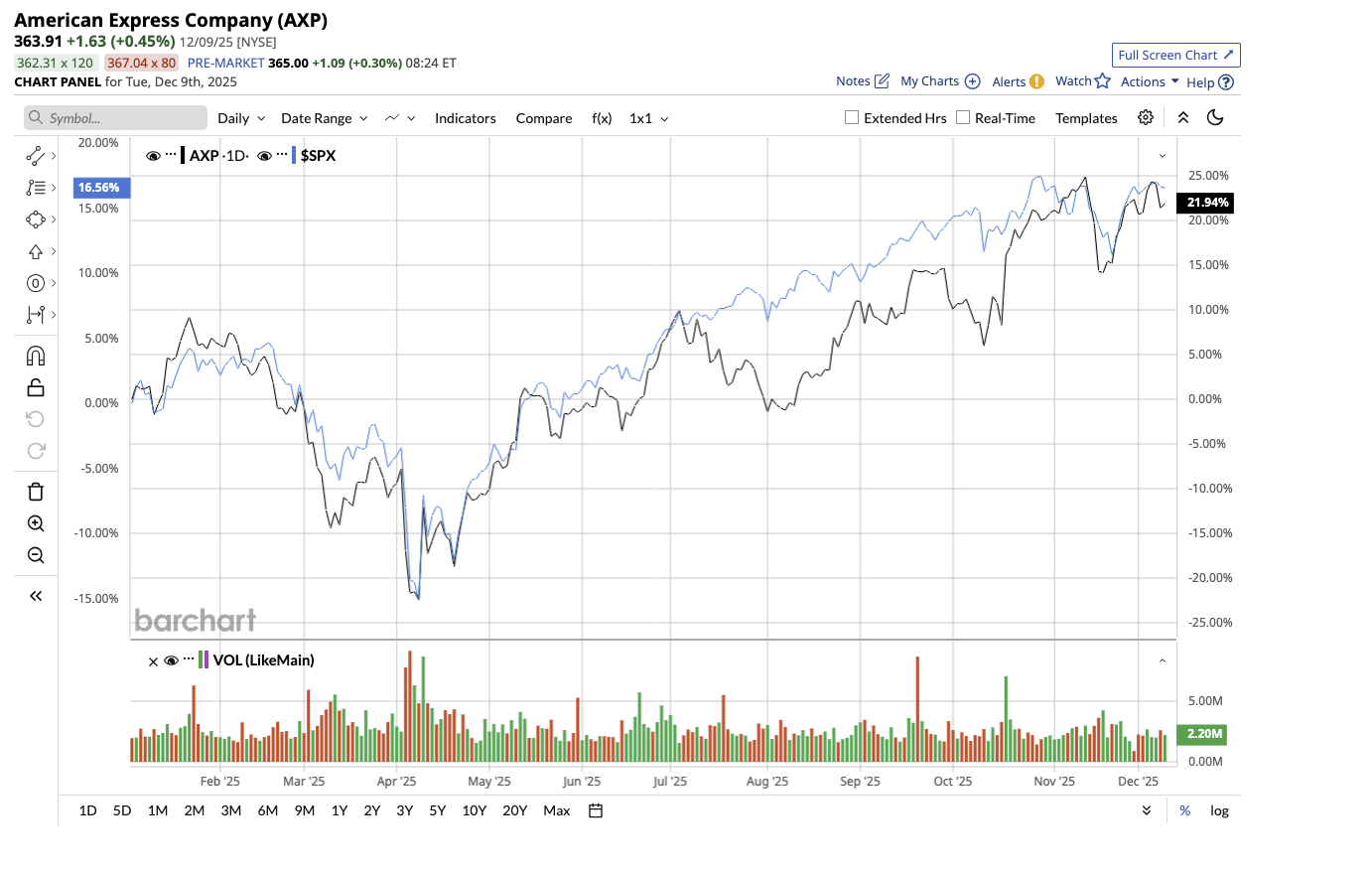

Valued at $258.1 billion, AXP stock has surged 27% YTD, outperforming the broader market.

In the most recent third quarter, total revenue increased 11% YoY to $18.4 billion. Earnings per share increased 19% to $4.14. Cardmember spending increased 9%, driven by retail and a rebound in travel. For the full year, management now anticipates 9% to 10% revenue growth and EPS of $15.20 to $15.50, highlighting the company's solid trend into 2026.

Notably, platinum card spending outside the U.S. grew 24% in Q3, continuing a trend that began two years ago. Transaction growth of 10% indicates great client involvement. Amex added 3.2 million new cards in the quarter, with more than 70% on fee-paying products, indicating a strong interest in premium offers. The launch of Amex's refreshed U.S. Consumer and Business Platinum Cards was a key driver in the quarter. Management stressed that this was the best start to a U.S. Platinum refresh that the company has ever experienced. Since 2019, Amex has completed over 200 product refreshes worldwide, each designed to keep benefits in line with changing consumer behavior. The Platinum refresh is the most recent example of how Amex builds loyalty and attracts new high-value customers.

Annual card fees are approaching $10 billion, having increased at double-digit rates for 29 straight quarters. While fee growth is expected to slow before picking up again in 2026, the Platinum refresh is a significant catalyst. The company also returned $2.9 billion to shareholders through dividends and share repurchases.

With rising fee revenue, increased Platinum engagement, robust spending trends, and sustained credit strength, the company enters 2026 with multiple growth tailwinds already in place. Analysts predict Amex earnings will rise by 16% in 2025 and another 12.6% in 2026. Currently, AXP stock is trading at a reasonable 20x forward 2026 earnings.

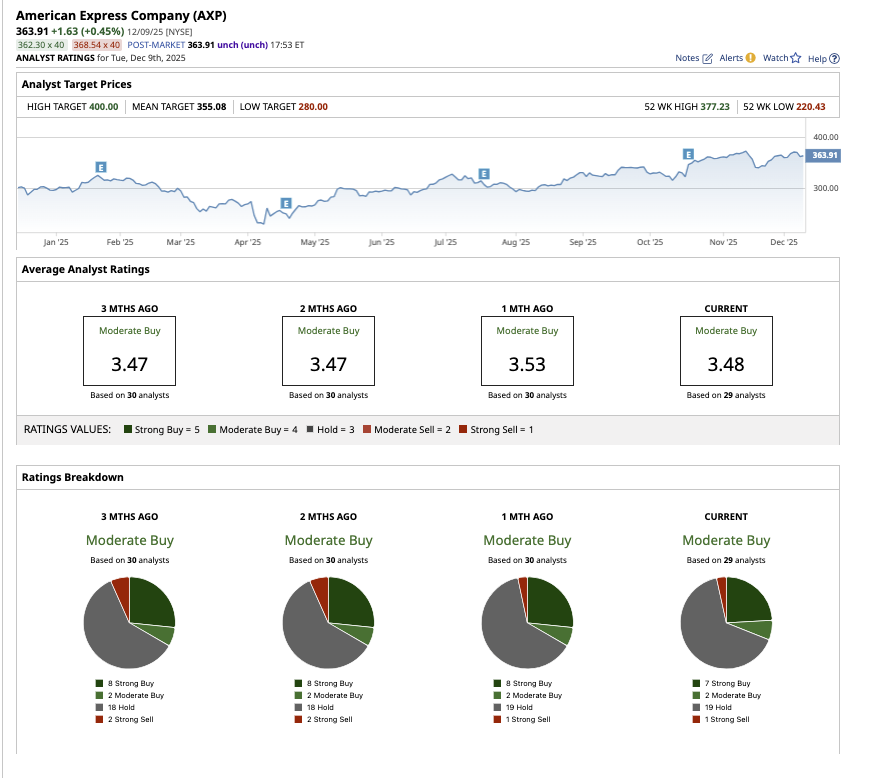

Overall, Wall Street remains moderately bullish on AXP stock. Out of the 30 analysts who cover the stock, six rate it a “Strong Buy,” two say it is a “Moderate Buy,” 18 rate it a “Hold,” and two recommend a “Strong Sell.” The stock has surpassed its average price target of $355.08. However, its high target price of $400 implies potential upside of 10% in the next 12 months.

Which Is the Better Buy for 2026?

While both Amex and Visa are great long-term fintech investments, Visa appears to be the better choice now. Its massive global network, compelling catalysts like the FIFA World Cup, financial strength, deep investment in a modern “Visa-as-a-Service” stack, expansion into stablecoins and digital payments infrastructure, and reliance on thousands of partners all point to a broad and diverse way forward.

All these factors create a powerful setup for Visa’s renewed performance in 2026, making Visa the better blue-chip fintech stock to buy for 2026.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)