With a market cap of around $16 billion, Invitation Homes Inc. (INVH) is the nation’s leading provider of single-family home leasing and management. The company meets evolving lifestyle needs by offering high-quality homes in desirable locations near jobs and top schools.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Invitation Homes fits this criterion perfectly. Guided by its purpose, Unlock the Power of Home, Invitation Homes is committed to delivering flexible living solutions and Genuine CARE to the growing number of people who choose to lease.

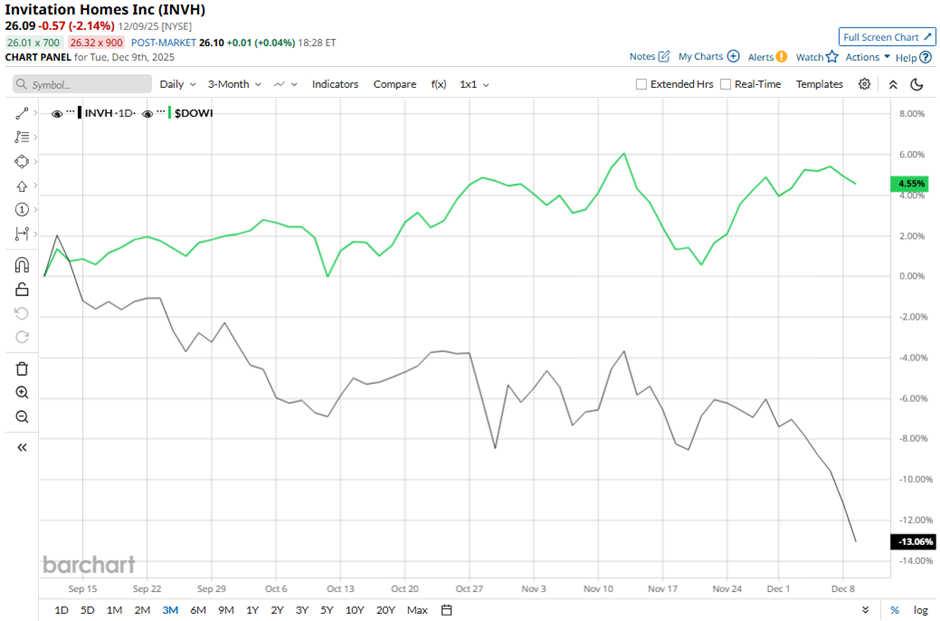

Shares of the Dallas, Texas-based company have decreased 27.1% from its 52-week high of $35.80. Over the past three months, its shares have declined 13.9%, lagging behind the broader Dow Jones Industrials Average's ($DOWI) over 4% rise during the same period.

Longer term, INVH stock is down 18.4% on a YTD basis, lagging behind DOWI's 11.8% gain. Moreover, shares of the company have dipped 22.5% over the past 52 weeks, compared to DOWI’s 7.1% increase over the same time frame.

The stock has been in a bearish trend, consistently trading below its 50-day and 200-day moving averages since late May.

Shares of Invitation Homes rose 3.4% following its Q3 2025 results on Oct. 29 due to revenue of $688.17 million, surpassing analysts’ estimates, driven by strong demand for single-family rental homes. The company reported same-store renewal rent growth of 4.5%, indicating healthy rental increases for renewing tenants. Additionally, its core FFO of $0.47 per share met expectations, and the 2025 core FFO guidance of $1.90 per share - $1.94 per share aligned with estimates, reassuring investors.

In comparison, rival Equity Residential (EQR) has shown a less pronounced decline than INVH stock. EQR stock has dropped 16.3% YTD and 18.5% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. INVH stock has a consensus rating of “Moderate Buy” from 24 analysts in coverage, and the mean price target of $34.50 is a premium of 32.2% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)