/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Marvell Technology (MRVL) stock is a highly rated growth stock with strong analyst ratings.

One bad thing about MRVL stock is that it has a low dividend yield of just 0.26%.

But what if we could use options to manufacture our own dividend?

Does MRVL Pay a Dividend?

Let's say I have $9,000 to invest into MRVL stock, I could simply buy 100 shares and hope the stock rises.

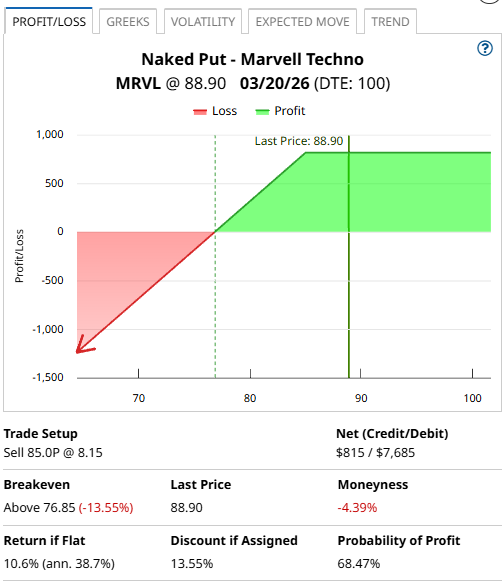

But, if I want a more conservative play, I could sell a March 20, 2026, 2025 put with a strike price of $85 and set aside the $8,500 in case I am assigned on the short put.

That $85-strike put generates around $815 in option premium in around three months.

So, my $8,500 investment into MRVL is giving me a 38.7% annualized "dividend".

Risks of the Trade:

Much like owning MRVL shares, if the stock drops, I'm going to lose money in the short-term.

If MRVL is below $85 in March, then I will be forced to buy 100 shares at $85.

The breakeven price is equal to the strike price less the premium received, which in this case would be $76.85.

So if MRVL is below $76.85, at expiration the trade loses money.

But, if MRVL stays above $85 then I achieve a 39% per annum return when the put expires worthless.

Cash secured puts are a bullish strategy but are considered slightly less bullish than owning MRVL stock because the potential gains are limited to the premium received.

The second risk with the trade is that if MRVL stock goes on a huge rally, we miss out on any upside. The most we can make is the $815 from the option premium.

Greeks and Equivalent Exposure Level

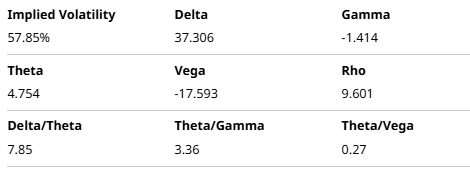

The $85-strike put currently has a delta of 37, so selling this put gives an exposure roughly equivalent to owning 37 shares of MRVL stock, although this will change as the stock moves up and down.

It also means the put has a roughly 63% chance of expiring worthless.

One method which can help cut the risk is to turn the trade into a spread and buy a $75-strike put. This turns the trade into a bull put spread and cuts the risk from $7,685 to around $600.

There are lots of interesting scenarios you can create with options.

Company Details

Marvell Technology is a fabless designer, developer and marketer of analog, mixed-signal and digital signal processing integrated circuits.

The company operates in Bermuda, China, Germany, Japan, Korea, Taiwan, the United Kingdom, and the United States.

Marvell specializes in highly integrated System-on-a-Chip (SoC) and System-in-a-Package (SiP) devices based primarily on ARM designs and sells to both enterprise and consumer customers.

It has a significant number of patents in design, software and reference platforms to its credit.

The company's product line includes application processors, controllers, switches, communications and networking processors and technologies, as well as other SoCs for printers and smart home products.

These serve two broad end markets - data center and enterprise networking.

Implied volatility is currently 53.42% compared to a twelve month low of 36.28% and a twelve month high of 103.68%.

Of the 35 analysts covering MRVL, 24 have a Strong Buy rating, 2 have a Moderate Buy rating and 9 have a Hold rating.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)