With a market cap of $25 billion, Boston, Massachusetts-based Iron Mountain Incorporated (IRM) is a global leader in information management, specializing in secure storage, data protection, and digital transformation services. The company operates a vast network of facilities that store physical records, tapes, and other assets for enterprises across industries, while its growing data center business supports demand for cloud and colocation services.

Companies valued $10 billion or more are generally considered “large-cap” stocks, and Iron Mountain fits this criterion perfectly. Known for its recurring-revenue model and strong client retention, Iron Mountain combines legacy records management with expanding digital infrastructure capabilities, positioning itself as a hybrid physical-digital information steward for large organizations.

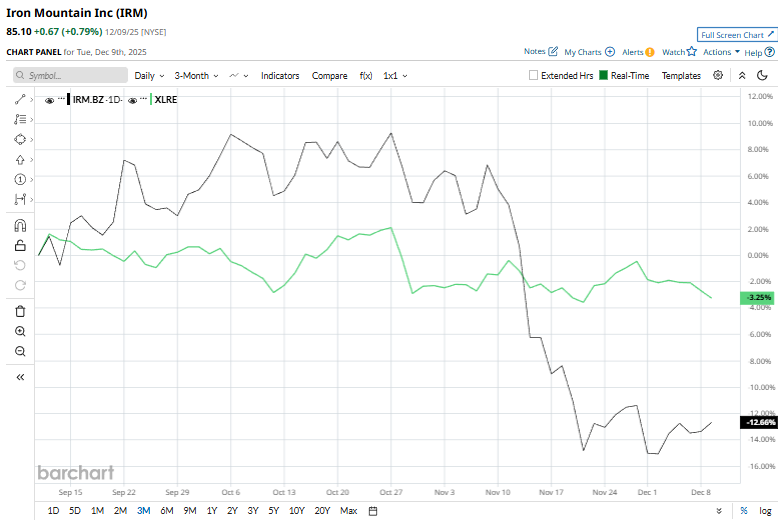

Despite this, shares of the company have dipped nearly 25.9% from its 52-week high of $114.88. IRM stock has decreased 12% over the past three months, lagging behind the Real Estate Select Sector SPDR Fund’s (XLRE) over 3.3% dip during the same period.

Longer term, Iron Mountain’s shares have fallen 19% on a YTD basis, underperforming XLRE's marginal plunge. Moreover, the stock has declined 25.6% over the past 52 weeks, compared to XLRE's 7.7% drop over the same time frame.

IRM stock has been trading below its 50-day and 200-day moving averages since early mid-November, establishing a downtrend.

On Nov. 19, shares of Iron Mountain fell more than 2% after short-seller Gotham City Research disclosed a short position and released a bearish thesis on the company. In its report, Gotham alleged that IRM’s valuation is significantly inflated relative to its fundamentals and argued that the shares are worth no more than 22 to 40 dollars each, far below the current market price. The firm questioned the sustainability of Iron Mountain’s growth strategy and raised concerns about its leverage and cash-flow quality, prompting heightened investor caution and adding pressure to the stock.

In contrast, its rival SBA Communications Corporation (SBAC) has shown less pronounced decline than IRM stock on a YTD basis, falling 7.1% and decreasing 15.2% over the past 52 weeks.

Despite the stock’s underperformance, analysts are moderately optimistic, confirmed by a consensus rating of "Moderate Buy" from 11 analysts. The mean price target of $117.20 represents a premium of 37.7% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)