Stock splits are a powerful tool for investors that provide portfolio leverage. While a stock split does nothing to alter the fundamental quality of the business of the stock value, companies that split are a rare breed whose stocks have been trending higher and tend to continue trending higher over time. Their qualities include growth, cash flow, and robust market support, sufficient to drive their stock prices to elevated levels and sustain the rallies over the long term.

It is the elevated price points that matter in this scenario. The primary reason for a stock to split is that its price is too high for “average” investors to buy regularly, and there is an expectation for it to continue rising. Three stocks are positioned as strong candidates for a split in 2026, based on current share prices, recent momentum, and expected gains over the next year.

Meta Platforms: The Stock Most Likely to Split in 2026

Meta Platforms' (NASDAQ: META) stock is among the most likely to split in 2026 because its bent on AI is driving growth, sustaining robust cash flow, and powering a strong capital return. The stock price entered a consolidation in 2025 but remains in an uptrend, likely to continue in 2026. Among the concerns is a forecast of increased tech investment; however, the takeaway is that when Meta invests in AI, it pays off. That’s why the stock is trending higher today and has risen 550% over the past three to four years.

Coincidentally, Meta Platforms is the only Magnificent Seven stock that hasn’t split. Analysts believe that increases the odds for a 2026 split, as does their price target trend. The trend includes increased coverage, a firm Moderate Buy rating, and an expectation for 25% upside from critical support levels. They align with the December price bottom, a likely launch pad for 2026’s rally. Regarding 2026’s forecasts, analysts expect Meta to sustain a high-single-digit growth pace and to widen its margin incrementally.

Ulta Beauty: Gains Share, Outpacing Competitors, Widening Margins

Ulta Beauty’s (NASDAQ: ULTA) stock price got a boost following its fiscal Q3 (FQ3) earnings report and is likely to head higher. As it stands, the stock is trading at record highs, near $600, and is on track for a 2026 stock split. Analysts' forecasts are improving and point to another 25% upside, likely achieved well before the end of 2026, and results will likely sustain the bullish trend. While 2025 has been a good year for the business, the forecast for 2026 includes substantial margin improvement, and it is likely to be low. Ulta is gaining market share from competitors and expanding its store count, providing a dual tailwind for growth.

Like Meta Platforms, Ulta Beauty focuses some of its cash flow on share buybacks. Unlike Meta, which reduces the count incrementally, Ulta Beauty aggressively buys its share. Activity in FQ3 reduced the count by more than 4.5% on average, and there is sufficient authorization to sustain the pace for years, which is why institutions like it. Institutional support is solid, with institutions owning about 90% of the stock, and the group is accumulating in Q4 2025.

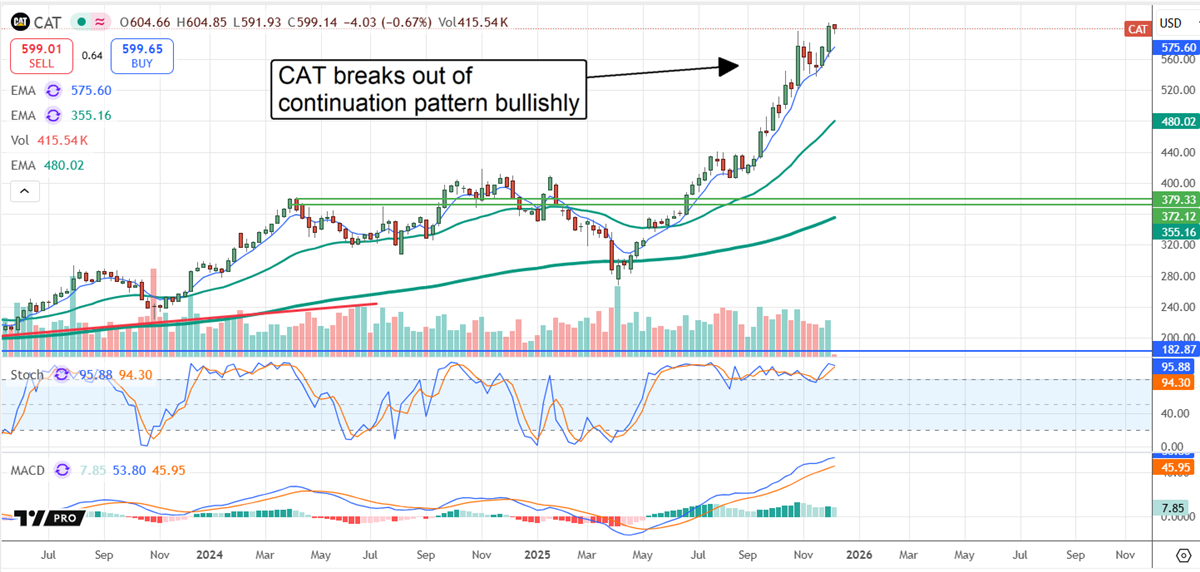

Caterpillar: Blue Chip Stock Accelerates Rally With Robust Support

Caterpillar’s (NYSE: CAT) stock price is near $600 in late 2025 and heading higher in 2026. Business strength, compounded by less-than-expected tariff impacts, sustains the rally, and 2026 is forecast to be another good year. Strength is tied to activity globally, including the surge in datacenter construction, and underpins an outlook for accelerating top-line results and margin improvement. Margin is critical for this Dividend Aristocrat as it pays approximately 30% of its earnings to investors and has been increasing at a semi-aggressive 7% pace over the last few years.

The analyst trends are supporting the CAT price action. Coverage is not only increasing rapidly, but sentiment has firmed from Hold to Moderate Buy over the last year, and price targets are trending higher. While the consensus offers limited upside in late 2025, it is up 60% in the past 12 months, with the high-end offering a 40% upside.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

The article "3 Stocks Most Likely to Split in 2026" first appeared on MarketBeat.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)