The 2025 airline sector is tightening fast as the Federal Aviation Administration (FAA) ordered a 10% cut in flight capacity across 40 major U.S. airports in early November. That reduction hit right as peak holiday shipping builds, squeezing domestic air cargo space and forcing carriers and logistics firms to rethink routes and timelines. The restrictions have since been eased, but the FAA is now investigating potential violators, and air traffic controller shortages persist.

Citigroup, however, is looking past the immediate turbulence and talking about a potential “Supermajors Super-Cycle” in airline stocks. This supercycle essentially means several years when demand, pricing, and margins tilt in favor of the largest carriers.

Citi expects 2026 to be a pivotal year for American (AAL), Delta (DAL), and United (UAL) as these super‑majors lean into scale and loyalty economics. Within this group, Delta Air Lines is the stock under the spotlight here, as it recently projected about a $200 million hit from government shutdown-related schedule disruptions.

Even so, the company says core travel demand remains healthy, giving the supercycle thesis firmer footing. So the real debate is whether investors should treat DAL as a short‑term airline trade or a mispriced compounder into Citi’s envisioned supercycle. Let’s find out.

Why DAL Stands Out Financially

Delta Air Lines is a U.S.-based global carrier that connects passengers and cargo across an extensive domestic and international route network. The company currently pays an annual forward dividend of $0.75 per share, translating to a yield of about 1.15%.

DAL changes hands at $67.68 today, with the stock up 12% year-to-date (YTD) and 9% over the past 52 weeks.

Its equity is valued at roughly $44 billion in market cap, while its forward price-to-earnings multiple sits at 10.96x compared with a sector median of 20.52x.

This combination suggests investors are paying a discount multiple for earnings that are expected to grow at least in line with, if not better than, the broader group.

DAL’s most recent quarter, reported on Oct. 9, shows how that valuation is being backed by real performance. This period saw September sales of $16.673 billion, a slight 0.15% increase that shows revenue has largely stabilized at a high base even as the company fine-tunes capacity and mix.

It delivered net income of $1.417 billion, though that figure represented a 33.47% decline year-over-year (YoY), a reminder that higher fuel, labor, and operational investments are still flowing through the income statement. DAL nonetheless reported earnings per share of $1.71 versus a $1.52 consensus estimate, a $0.19 beat that translated into a 12.50% positive surprise.

This outperformance becomes even more compelling when viewed through the cash-flow lens, as the quarter’s operating cash flow reached $6.082 billion. That’s a jump of 43.61%, while net cash flow climbed to $550 million, representing a striking 409.26% improvement.

Strategic Growth Moves Powering DAL

Delta Air Lines is not just waiting for Citi’s projected 2026 airline “supercycle” to arrive. One of the more under‑the‑radar but important moves is a new strategic partnership between Delta Cargo and Trackonomy, a logistics technology firm that is expanding its global aviation solution suite and network through this collaboration. This deal is designed to modernize and scale Delta’s cargo operations, with better service quality, sharper operational visibility, and stronger capacity utilization across its freight network.

On the passenger side, Delta is laying out an aggressive but targeted growth map. The carrier will launch its first‑ever U.S. carrier nonstop service from New York‑JFK to Porto, Portugal, in May 2026, tapping into a rising leisure and VFR (visiting friends and relatives) market that also feeds broader European connectivity. It will further expand its transpacific footprint with a new Hong Kong route from Los Angeles starting June 2026, adding nonstop access to one of the world’s top business travel and cargo hubs.

Analysts See Room for DAL in the Supercycle

Delta’s near‑term earnings estimate may look a bit restrained at first glance, but they line up well with a setup where 2026 becomes the real acceleration year. For the current quarter ending 12/2025, Wall Street is looking for EPS of $1.68, compared with $1.85 in the same period a year ago, implying a modest -9.19% YoY decline.

For the full fiscal year 12/2025, the average earnings estimate sits at $5.96 versus $6.16 last year, which works out to an expected -3.25% drop. Management’s own guidance supports this framing, as Delta is calling for an operating margin between 10.5% and 12%, paired with adjusted EPS in a range of $1.60 to $1.90 for this current quarter. That range brackets the Street’s $1.68 target nicely.

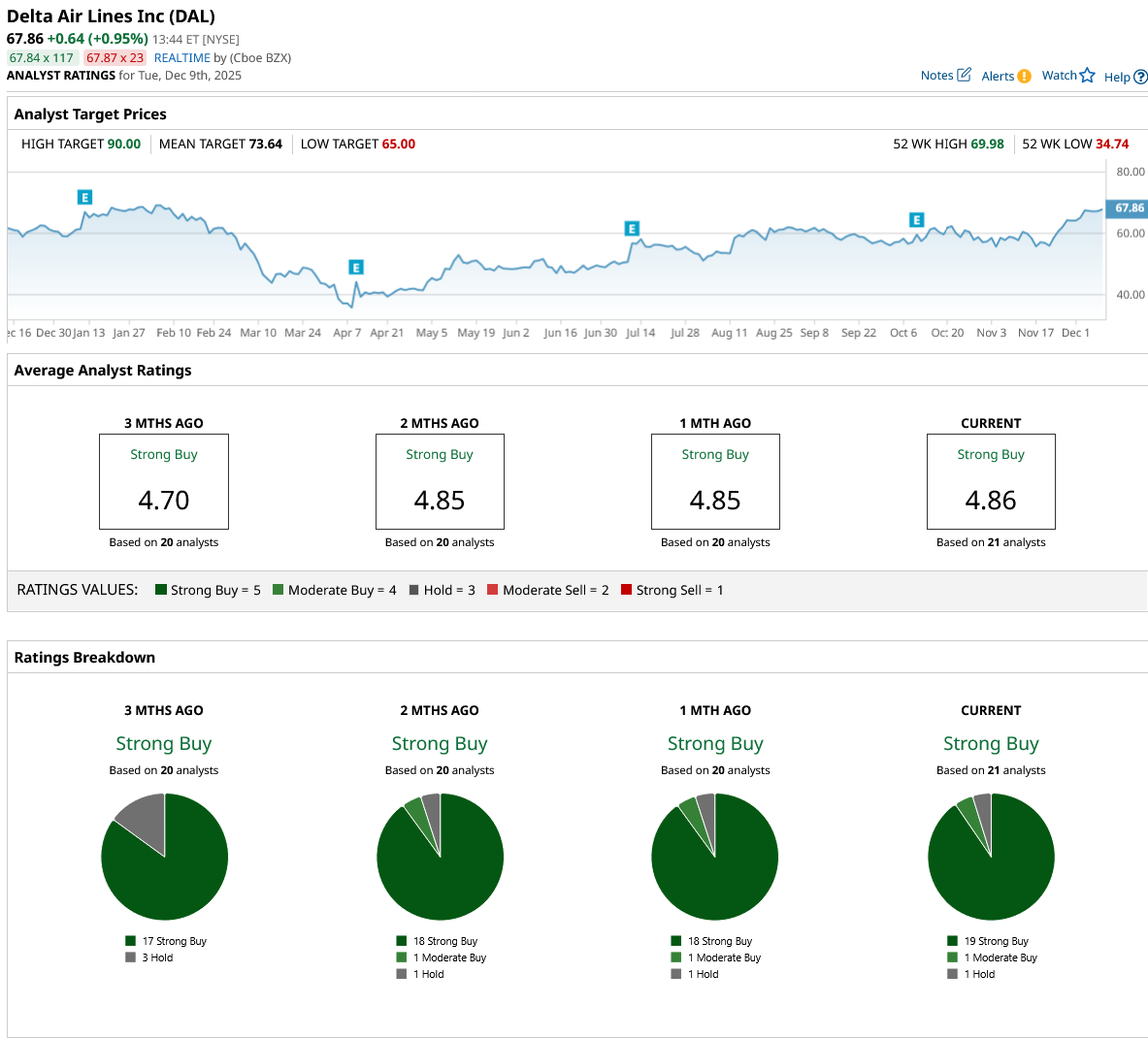

Wall Street’s stance on the stock reflects that mindset straightforwardly. Across 20 surveyed analysts, DAL carries a consensus “Strong Buy” rating. The average 12‑month price target sits at $73.64, implying roughly 8.5% upside from here.

Conclusion

Delta doesn’t need a wild bull case to work from here. It just needs the market to start valuing a durable 10%+ margin business like this one. With a reasonable multiple, a still‑modest dividend, a “Strong Buy” consensus, and a route map wired into higher‑yield demand, the bias over the next couple of years looks gently upward rather than sharply sideways. If Citi’s “supercycle” call even half‑lands, DAL feels less like a trade and more like a core position that quietly grinds higher as earnings catch up to the story.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)