Vulcan Materials Company (VMC) is a construction materials firm headquartered in Birmingham, Alabama. The company has grown to become the leading producer in the United States of construction aggregates such as crushed stone, sand, and gravel and also supplies asphalt mix and ready-mixed concrete for infrastructure, housing, and commercial construction projects. Vulcan Materials has a market cap of around $38.6 billion.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and VMC perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the building materials industry. Vulcan Materials leverages its unparalleled scale and strategic geographic footprint to maintain a competitive edge.

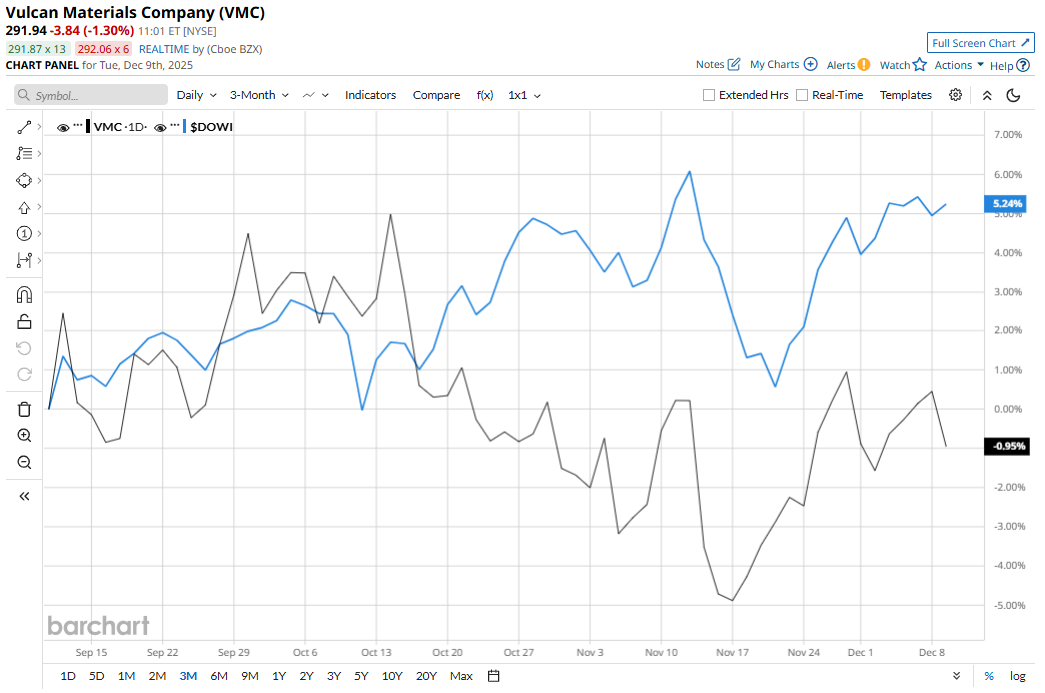

VMC slipped 6.1% from its 52-week high of $311.74, achieved on Oct. 15. Over the past three months, VMC stock has gained marginally, underperforming the Dow Jones Industrials Average’s ($DOWI) 4.7% gains during the same time frame.

In the longer term, shares rose 13.8% on a YTD basis and climbed 4.1% over the past 52 weeks, outperforming DOWI’s YTD gains of 12.5% but underperforming 7.8% returns over the past year.

The stock has been trading above the 200-day moving average since late June. However, it has been mostly trading below the 50-day moving average since mid-October.

The stock is rising in 2025 primarily due to strong operational performance, significant pricing power in construction aggregates, and a favorable market position that benefits from increased public infrastructure spending. In Q3 2025, Vulcan Materials’ total revenue reached $2.3 billion, up about 14.4% year-over-year (YOY). In its core aggregates business, shipments increased 12% YOY, while cash gross profit per ton climbed to $11.84, marking the eleventh straight quarter of double-digit gain in unit profitability.

In the competitive arena, Martin Marietta Materials, Inc. (MLM) has taken the lead over VMC, with an 18.5% return YTD and 6.5% gains over the past year.

However, the stock has a consensus “Strong Buy” rating from the 22 analysts covering it, and the mean price target of $324.19 suggests a potential upside of 9.6% from current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)