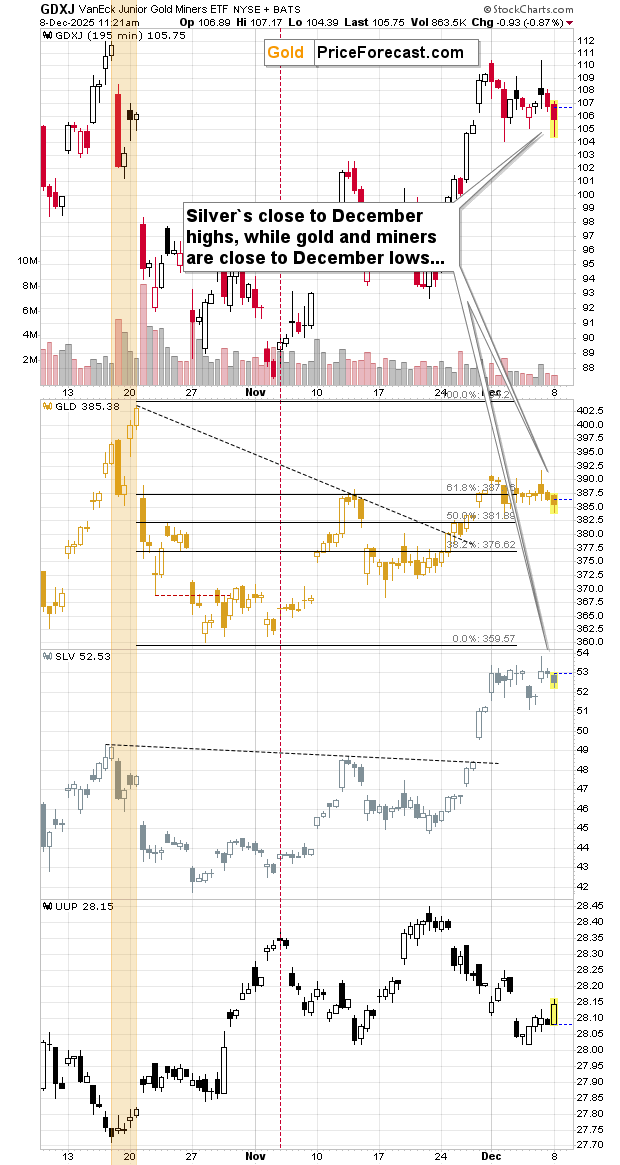

I might have ended today’s article at the title as it pretty much covers most of what we can see on the charts today.

The USD Index broke above its declining resistance line, and this might have marked the end of the short-term decline, and the beginning of a much bigger upswing.

Is this the case? We’ll know shortly. The breakout is encouraging, but it’s prudent to wait for confirmations before saying that something has indeed changed.

But what is already very interesting is the way in which different parts of the precious metals market reacted to the above.

The GDXJ just tested its December lows and gold moved close to its December lows as well.

The white metal moved a bit lower, but overall, it continues to trade close to this month’s high, and the consolidation just below $60 simply continues.

When (not really ‘if’) the USD Index moves higher, it seems that gold and miners will react with declines, but this might be the case with silver only to a limited degree.

Technically, it looks like a flag pattern, but we’ll know for sure, when silver breaks above it (and the $60 level).

At this point, the theory about the silver’s disconnection from the rest of the precious metals market remains intact.

Thank you for reading today’s free analysis. We recently made major shifts in all parts of the portfolio. If you’d like to read more and stay up-to-date with the quick trades, intraday Alerts, and all the key details (trading position details, profit-take levels) that my subscribers are getting, I invite you to sign up for my Gold Trading Alerts or the Diamond Package that includes them. Alternatively, if you’re not ready to subscribe yet, I encourage you to sign up for my free silver newsletter today.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)